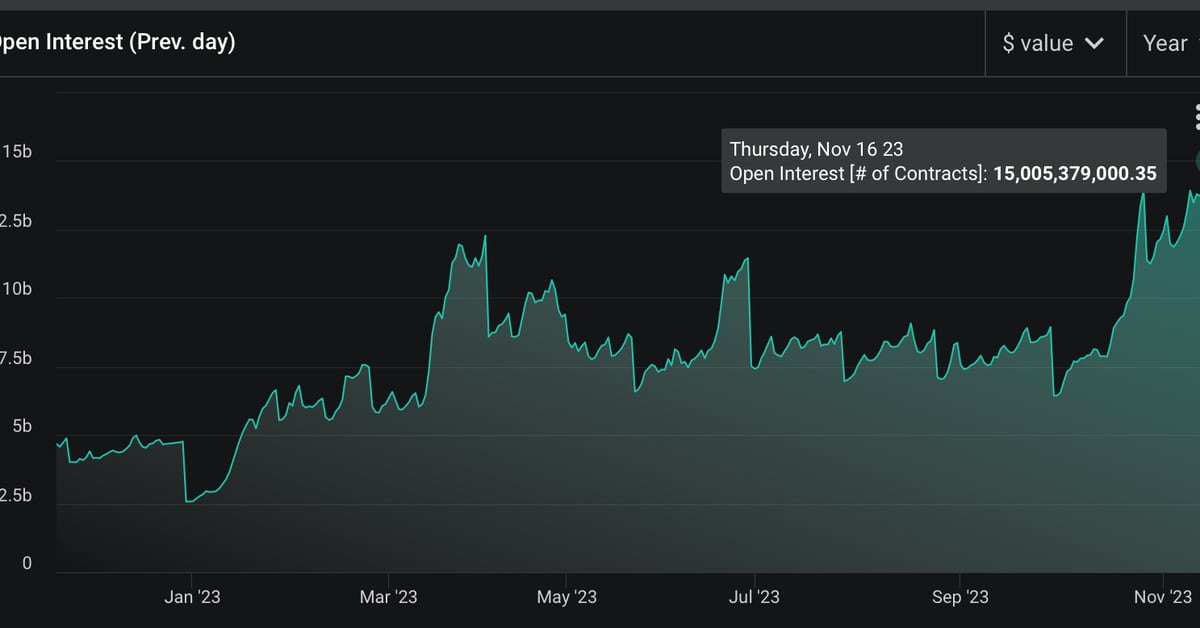

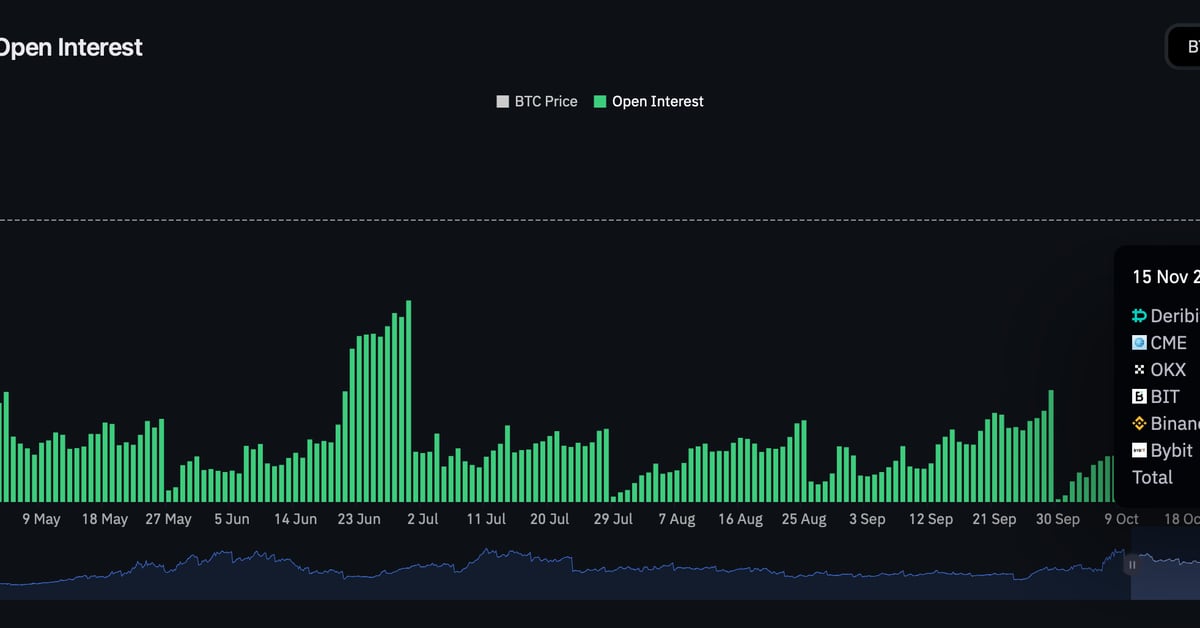

Nearly $6.5b in Bitcoin and Ethereum options are set to expire

Over $6.51 billion in Bitcoin and Ethereum options are due to expire on Nov. 24, potentially indicating heightened trading activity. A vast number of Bitcoin (BTC) and Ethereum (ETH) options are set to expire on Nov. 24, potentially influencing market dynamics. This comes in the wake of the U.S. DOJ’s

Read More