Fed watchdog Michael Barr calls stablecoins risk for economy

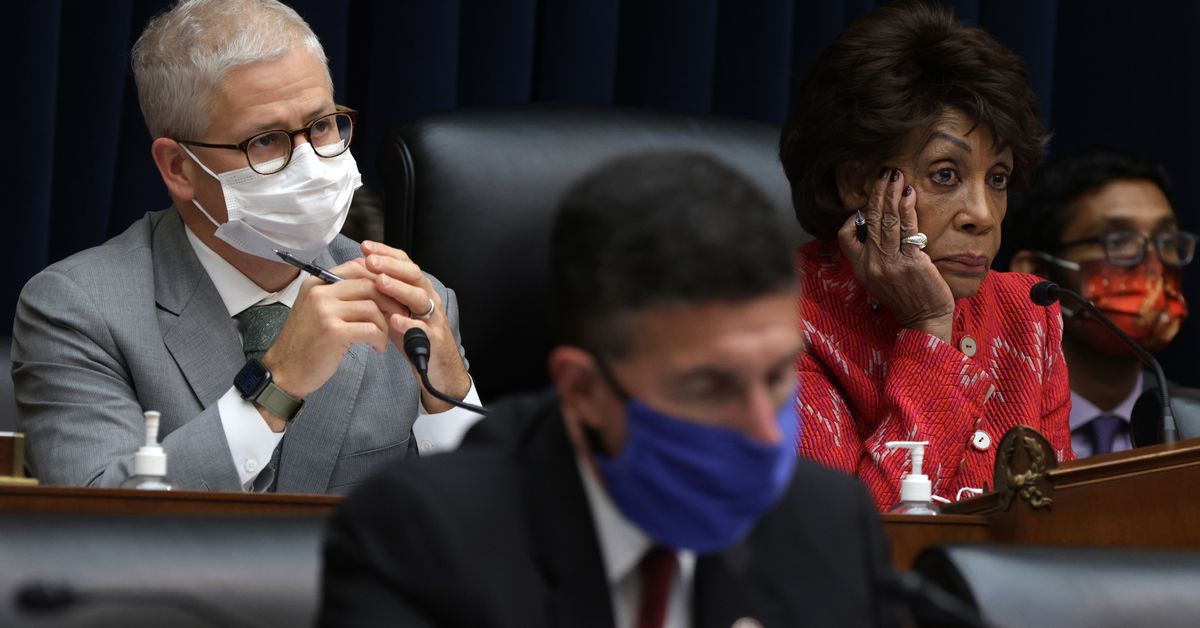

Federal Reserve’s Michael Barr highlights the risks of unregulated stablecoins, emphasizing the need for robust federal oversight in the evolving digital currency landscape. Michael Barr, the Federal Reserve’s leading authority on banking oversight, has voiced robust concerns regarding stablecoins operating outside the oversight of federal regulation. While Federal Reserve officials have articulated

Read More