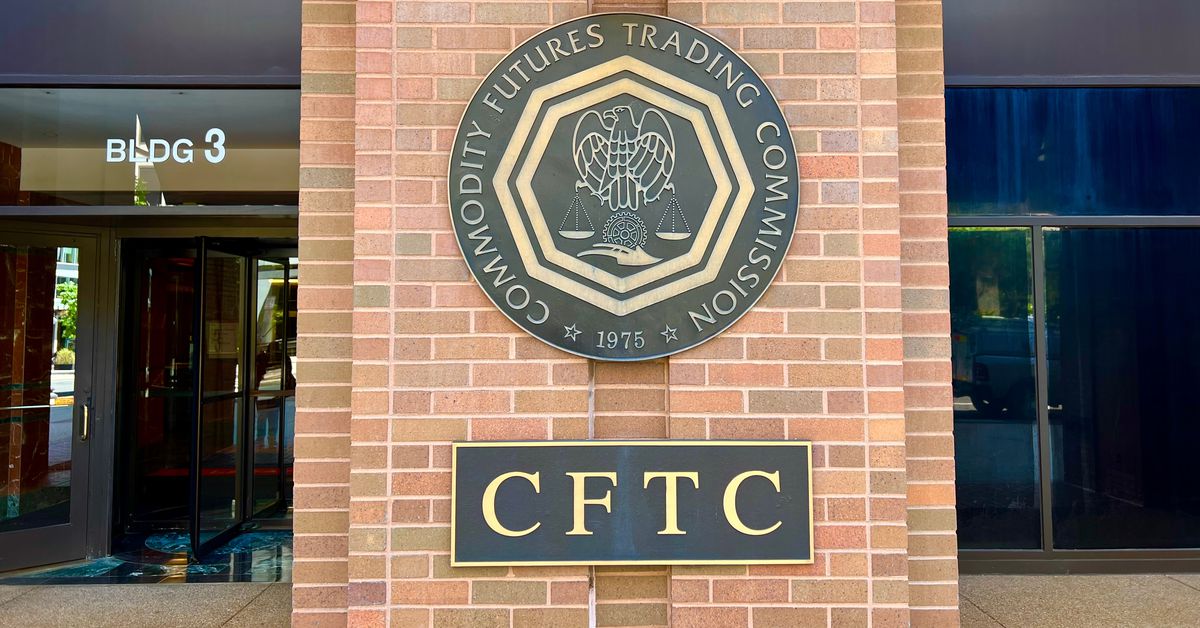

CFTC Wins Lawsuit Against Crypto Derivatives Operator Ooki DAO

A federal judge has sided with the U.S. Commodity Futures Trading Commission (CFTC) in a lawsuit alleging decentralized autonomous organization (DAO) Ooki DAO offered unregistered commodities, quashing an industry-wide perception that decentralized finance (DeFi) actors are immune to regulatory scrutiny. Source

Read More