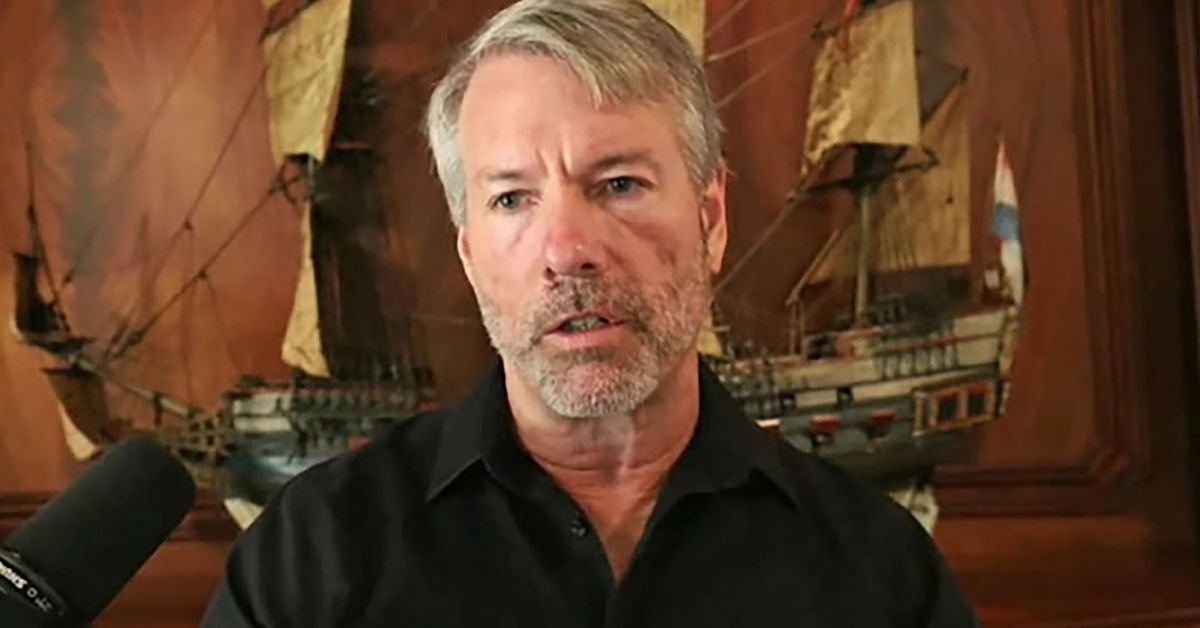

MicroStrategy to Report Bitcoin Holdings Quarterly without Impairment Losses

The decision by the FASB to allow fair-value accounting for digital assets is a huge step forward for companies like MicroStrategy. Software developer MicroStrategy Inc (NASDAQ: MSTR) is set to report its Bitcoin (BTC) holdings quarterly without recognizing impairment losses in case of crypto price declines during the reporting period. This

Read More