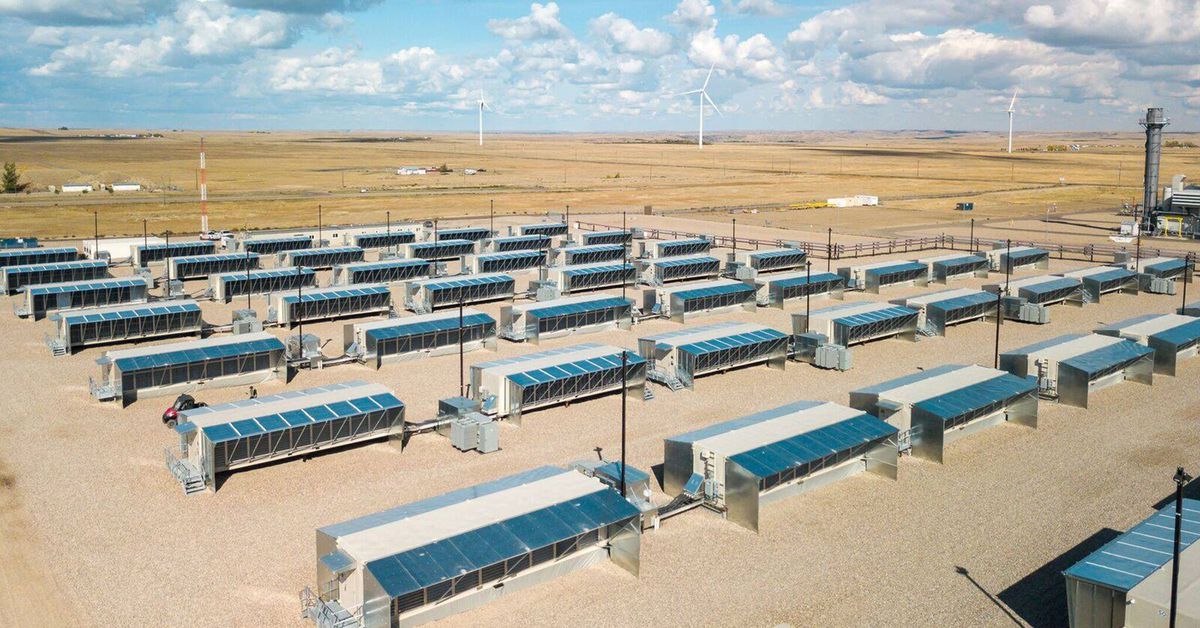

RIOT, MARA,HUT Are Among BTC Miners Likely to Benefit From a Growing Hashrate, Bitcoin Halving: Bernstein

Four – Riot (RIOT), Marathon Digital (MARA), Hut 8 (HUT) and Hive Digital (HIVE) – hold bitcoin on their balance sheet. This allows these firms to wait for higher prices before selling, and make greater realized gains on the crypto they have mined, the note added. Source

Read More