A CryptoCompare report published on July 6 has closely analyzed monthly trends in the cryptocurrency exchange market and found that crypto derivatives volumes have begun to taper off after peaking this May. Crypto derivatives volumes dropped 35.7% in June to $393 billion.

Historical Monthly Derivatives Volumes. Source: CryptoCompare

The overall trend which was also observed in the spot markets can be partially explained by the lack of volatility currently seen in Bitcoin and the majority of crypto assets within the market. There are a few exceptions like DeFi tokens, which have outperformed Bitcoin (BTC) considerably in the last month.

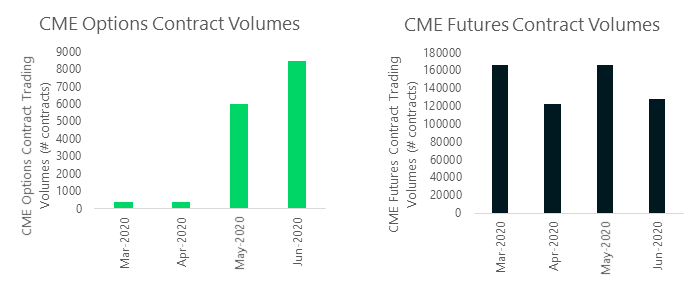

Despite the drop in overall volumes for the derivatives markets, regulated options seem to be gaining popularity. In June, the total volume for Bitcoin options on the Chicago Mercantile Exchange (CME) rose by 41% to reach another all-time monthly high with 8,444 contracts traded. Meanwhile, BTC futures traded on CME decreased by 23% in June which was still the second biggest month in 2020.

CME Options and Futures Contract Volumes. Source: CryptoCompare

Other signs of institutionalization

While the soaring volumes in the CME are a pleasant sign for those who are patiently awaiting institutionalization as the catalyst which will bring Bitcoin and other cryptocurrencies to new heights, there are other factors pointing to this change.

These trends are already observed in funds like GBTC which boast an institutional investor demographic of over 80% and is currently managing $4.1 billion dollars worth of digital assets. Barry Silbert, CEO at GBTC’s Digital Currency Group, tweeted that the fund has recently gone through its biggest raise yet, although no details are yet known.

Companies that cater to institutional needs are also jumping on the crypto bandwagon, further cementing this trend. For example, KPMG, one of the UK’s big four accounting firms, launched a cryptocurrency management platform called Chain Fusion. In a recent report by the firm, KPMG said:

“Institutionalization is the at scale participation in the market by small and large entities within the global financial ecosystem, including banks, broker dealers, exchanges, payment providers, fintechs and service providers.”

How institutions can change crypto

As institutions continue to hop into Bitcoin, it’s possible that this trend will continue which in turn can bring many advantages to the overall market.

Institutional investors require safe, transparent trading venues whereas a number of cryptocurrency exchanges are known for falsified trading volumes, wash trading, and worse.

Philip Gradwell, chief economist of Chainalysis, recently said:

“If you want to get serious money into crypto, you have got to build up their confidence that there are actually good trading venues […] If you’re an exchange and you have good incentives to report real volume, you may actually get institutional money coming in, but if you don’t have those incentives, they’ll stay away.”

The shift from retail to institutional investors, or at least the substantial increase in the engagement of the latter, may be a clear sign to exchanges that they must behave accordingly or be phased out.

These improvements may open the doors for the creation of the much-awaited Bitcoin Exchange Traded Fund (ETF) and other instruments which will lure institutional investors into the crypto sector.