Bitcoin has come a long way since bottoming out below $4,000 in March. The cryptocurrency clocked a record high above $19,900 early Tuesday and is up nearly 170% this year.

While institutional participation has increased, a large part of the retail crowd may have stayed away from the market. For that group, the fear of missing out (FOMO) on the opportunity to make triple-digit gains may have set in over the past few weeks.

Yet, investing now while the cryptocurrency is trading near lifetime highs may seem risky because there is always a possibility of significant price pullback. Bitcoin has seen several pullbacks of over 20% during the previous bull markets.

As such, investors looking to buy bitcoin now should consider implementing a dollar-cost averaging (DCA) strategy, according to leading traders in the cryptocurrency space.

“It is a good way to build exposure to both bitcoin as well as other asset classes such as global equity indices, as both look set to perform well against a backdrop of negative real rates for the next few years,” Scott Weatherill, chief dealer at the over-the-counter liquidity provider B2C2 Japan, told CryptoX.

How dollar-cost averaging saves money

DCA, also known as the constant dollar plan, involves buying smaller amounts of an asset at regular intervals, regardless of price gyrations, instead of investing the entire amount at one time. The strategy helps investors take the emotion out of their trades and can result in a lower average purchase cost because markets seldom move higher without pullbacks.

“Dollar-cost averaging in bitcoin has historically been a very profitable strategy that lowers drawdown risk,” Weatherill said.

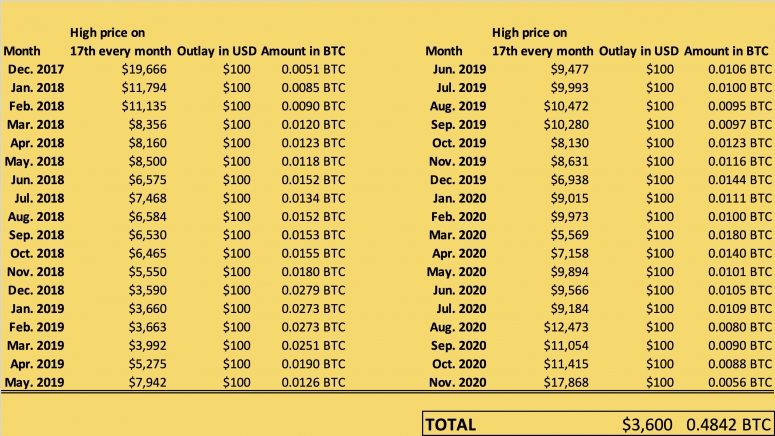

To illustrate, let’s say an investor has been accumulating $100 worth of bitcoin at the highest price observed on the 17th of every month, starting from Dec. 17, 2017, when bitcoin peaked at $19,783. As of press time, that investor would own roughly 0.48 BTC at an average cost of around $8,660. It also means the investor would be making a nearly 120% gain at the current market price of $18,850.

However, if the investor made a lump-sum investment at the record price of $19,783 on Dec. 17, 2017, the investment would currently suffer a loss of 4.7%. Over a long period, that loss could be more significant when adjusted for inflation.

In the former case, the investor spread out $3,600 over 36 months, buying fewer bitcoin when prices were high and more when prices were low. That helped pull down the average cost and bring in a substantial gain. The strategy has delivered similar results during the previous bull-bear cycles.

“Ideally, one must invest with a hope of selling at higher prices in the long run,” Chris Thomas, head of products at Swissquote Bank, said. “The best way, in my opinion, is to buy each month and build up a position over the longer term.”

The risk of certain option strategies for retail traders

Some investors may think of implementing synthetic strategies through the options market, such as buying a put option against a long position in the spot market. The put would gain value in the event of a sell-off, mitigating the loss (on paper) in the long spot market position.

Yet, such strategies are more suitable for speculators who intend to profit from short-term price volatility and go against the idea of pulling down the average purchase cost via DCA. “I wouldn’t recommend buying puts if you are ‘DCAing,’ as it would crimp returns,” Weatherill said.

A put option is a derivative contract that gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price on or before a specific date. A call option gives the right to buy.

An option buyer needs to pay a premium upfront while taking a long call/put position. A long put position makes money only if the asset settles below the put’s strike price on the day of expiry. Otherwise, the option expires worthless, causing a loss – in this case, the premium paid – for the buyer.

What’s more, those trying to combine DCA with an options hedge may end up hurting their portfolios. For example, if an investor buys puts while DCAing and the market goes up, the options bought to hedge against a potential downturn would bleed money, crimping overall returns from dollar-cost averaging.

“Retail investors should stay away from options trading,” warned Thomas. He added that one particular strategy, selling out-of-the-money calls, is extremely dangerous.

Savvy traders often generate additional income by selling call options well above bitcoin’s current spot price and collecting premiums on hopes the market wouldn’t rally above the level at which the bullish bet is sold. However, with short call positions, holders can theoretically suffer unlimited loss because the sky’s the limit for any asset.

In the case of bitcoin, that’s particularly risky as sentiment remains bullish, with analysts expecting a continued bull run on increased institutional demand. As such, selling call option(s) while DCAing could prove costly.

“While there may be a temptation to optimize through various trading strategies, the new money should stick to sure strategies: 1) stay long, and 2) buy dips,” said Jehan Chu, co-founder and managing partner at Hong Kong-based blockchain investment and trading firm Kenetic Capital.