Core Scientific Shares Downgraded After SEC Filing Hints at Possible Bankruptcy – Mining Bitcoin News

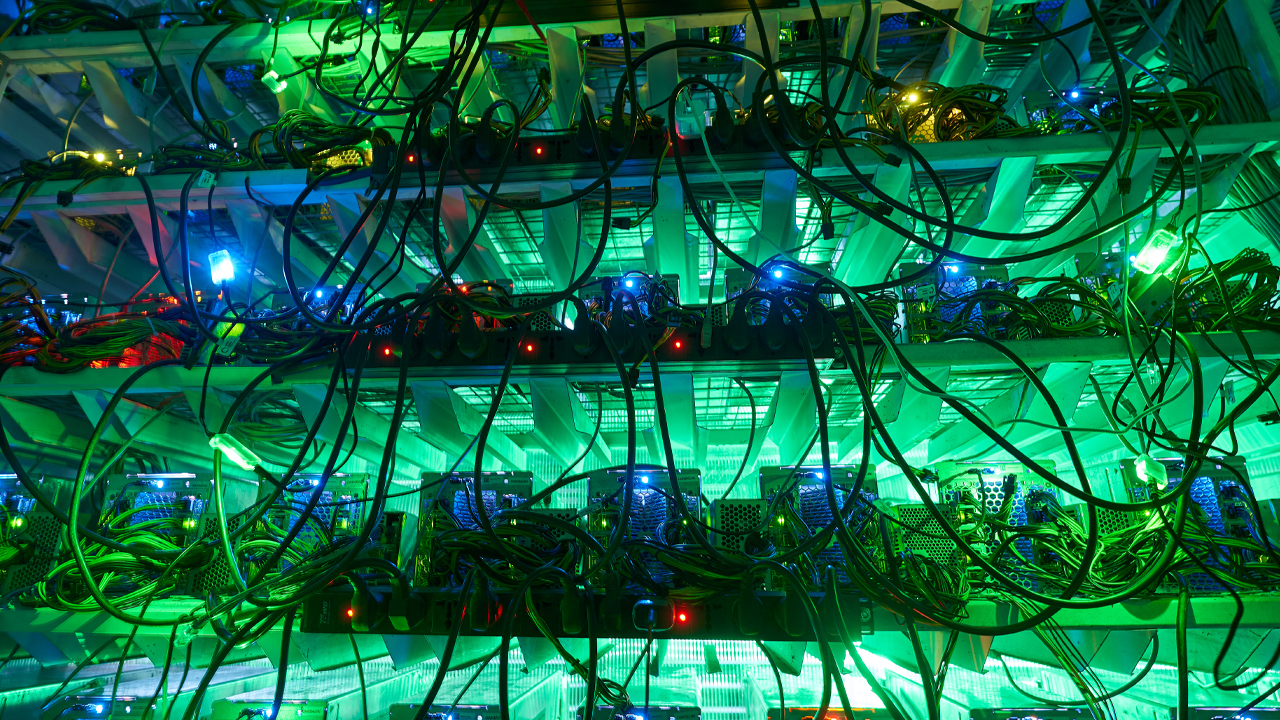

One of the largest publicly listed bitcoin miners, Core Scientific, has shaken investors with a recent filing with the U.S. Securities and Exchange Commission that raises the possibility the company may apply for bankruptcy protection. The filing notes that Core Scientific will be unable to pay down debt payments due

Read More