For the 14th consecutive month, the total market cap of stablecoins continues to shrink, standing at a modest $130 billion in May – a startlingly low point unseen since September 2021. But, as their numbers dwindle, the crypto market faces a potential headwind.

Financial giants such as JPMorgan and Goldman Sachs have voiced concerns that a sustained recovery in cryptocurrency prices may not materialize until the stablecoin market stabilizes. This shrinkage is seen as a sort of ‘quantitative tightening’ for the crypto market, indicating declining liquidity and leverage.

In this exploration, we navigate the troubled waters of the crypto market, focusing on the shrinking stablecoin market and its impact on crypto prices. Unpack the implications of this 14-month contraction and a glimpse into potential future repercussions.

Deepening crisis: trading volume plummets

A worrying sign accompanying this steady decrease is the plunging trading volume with stablecoins, which has fallen by 40.6% this month, hitting $460 billion – the lowest since December 2022.

This drop comes as significant crypto assets grapple with range-bound activity and fail to break critical support and resistance levels.

Amid the widespread slump, trueUSD (TUSD) stablecoin has emerged as an unexpected beacon, recording an increase in trading volume to $29 billion.

Outperforming competitors like USD coin (USDC) and Binance USD (BUSD), TUSD has become the second most traded stablecoin on centralized exchanges for the first time. This resurgence can be attributed to Binance, the world’s dominant crypto exchange, actively promoting TUSD usage by waiving trading fees.

Tether vs. USDC: a tale of two stablecoins

The dynamics between two primary stablecoins, tether (USDT) and USDC, underpin the intricacies of the broader crypto landscape.

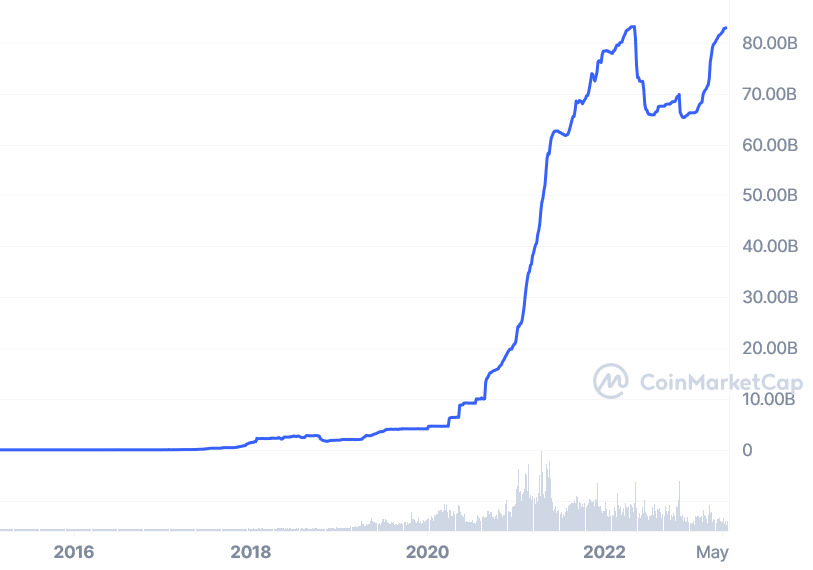

Despite concerns surrounding trading volumes, USDT, the leading player in the stablecoin realm, has steadily grown its market cap.

As of May 25, tether’s market cap stood at a remarkable $83 billion, nearing its historical peak. This figure indicates a sizable rise from the $65 billion mark it held in September 2021.

However, this growth raises some uncertainties, given the stagnant trading volume – an unsettling observation since the primary function of stablecoins is transactional.

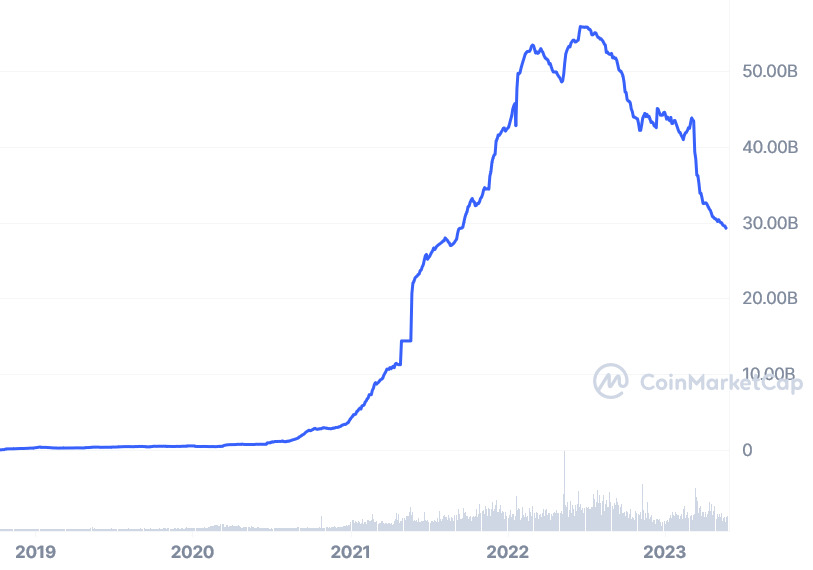

On the flip side, USDC, the stablecoin brainchild of Circle and Coinbase, has experienced a more turbulent journey.

In April 2022, USDC boasted a peak market cap of $55 billion. But since then, it has experienced a considerable downturn, currently valued at $24 billion as of May 2023.

This reduction, amounting to a more than 50% drop over the year, transpired amidst the multibillion-dollar collapse of the Terra ecosystem.

One plausible factor contributing to USDC’s decline could be the amplified regulatory scrutiny faced by Circle in the past year.

Circle’s commitment to morphing into a full-reserve national digital currency bank has intensified regulatory oversight. This development may have prompted some users to gravitate towards less regulated stablecoins, like tether, potentially explaining its sustained dominance.

The road ahead

The contraction of the stablecoin universe suggests that the crypto recovery could be less sustainable than optimists suggest.

Despite impressive gains earlier in the year, bitcoin and ethereum have seen a significant decline from their peaks, impacted by increased regulatory scrutiny and market uncertainty. These price fluctuations exemplify the inherent interdependence between cryptos and stablecoins.

Moreover, as the US navigates a debt-ceiling impasse, the reserves of major stablecoins, mainly consisting of Treasury securities, could face significant challenges maintaining their pegs in an adverse scenario of a US technical default.

As a result, given their critical role in facilitating trading and decentralized finance (DeFi), any issues faced by stablecoins could reverberate throughout the entire crypto ecosystem.