Volume doldrums and December sluggishness caused bitcoin to slip steadily below $19,000; ether options above spot are highest at $1,120 strike price.

- Bitcoin (BTC) trading around $18,705 as of 21:00 UTC (4 p.m. ET). Slipping 1.7% over the previous 24 hours.

- Bitcoin’s 24-hour range: $18,629-$19,299 (CryptoX 20)

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

The price of bitcoin took a tumble again Tuesday, following Monday’s move lower. At around 06:00 UTC (1 a.m. ET), traders started to sell, which culminated in the price going as low as $18,629, according to CryptoX 20 data. The price recovered somewhat and was at $18,705 as of press time.

“Short-term momentum has fallen off,” noted Katie Stockton, a technical analyst for Fairlead Strategies. “Our overbought/oversold measures support another two to three weeks of consolidation before the uptrend resumes.”

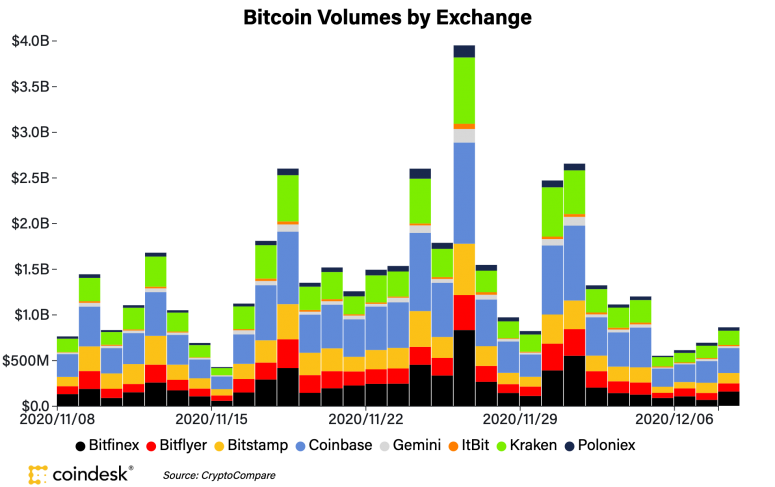

Momentum, in the form of volume, is much lower this week so far than the previous week. Exchanges tracked by CryptoX 20 experienced under $1 billion in daily average spot activity so far this week.

Some uncertainty in the traditional markets may be seeping into the cryptocurrency ecosystem, noted Joel Edgerton, chief operating officer of exchange BitFlyer. “There is no clear market direction short term with the stimulus discussions in (the U.S.) Congress as positive and increased regulatory focus as negative,” Edgerton told CryptoX.

Global equity performances Tuesday are looking meek at best:

“I think we might see bitcoin stay below $19,000 for a couple more weeks as investors take their profits and start to relax before Christmas,” said Michael Gord, chief executive officer for crypto trading firm Global Digital Assets. “I expect to see a surge in demand as enterprises and institutions have new budgets for 2021 and need to decide where to deploy” them.

Some traders are also clearly putting some of their bitcoin holdings into ether. This can be seen by the daily trend in the spot ETH/BTC pair, which continues to be bullish, according to technical analysis standards, after reverting in late November. In other words, some traders are selling BTC to buy ETH.

“A resurgence in looking for alpha across other tokens is likely preventing bitcoin from making further gains as capital is being deployed elsewhere,” noted Denis Vinokourov, head of research at crypto brokerage Bequant.

“Historically the holidays have seen [a] market decline as investors take profits and take time off from the market,” added Global Digital Asset’s chief operating officer, Zachary Friedman. “The sideways trending market may also see a surge in alt coins.”

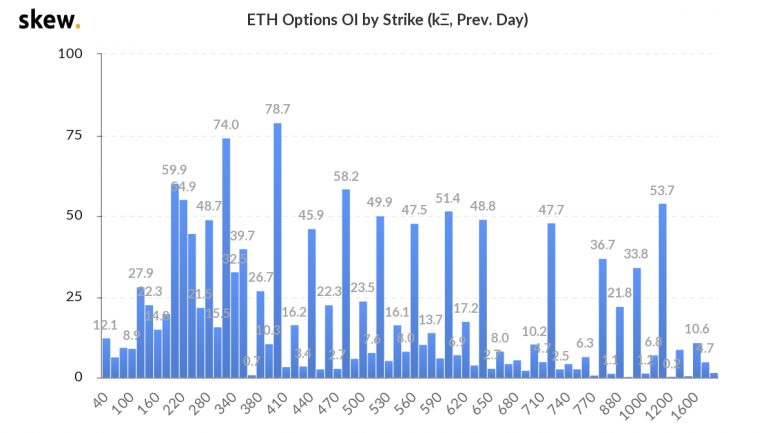

Highest ether options open interest above spot is $1,120

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Tuesday trading around $563 and slipping 4% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

Traders have amassed options at the strike price of $1,120 per 1 ETH. That level now has the highest amount of open interest on strikes above current spot price. However, 60% of strikes are still to the downside of spot, according to data from Skew.

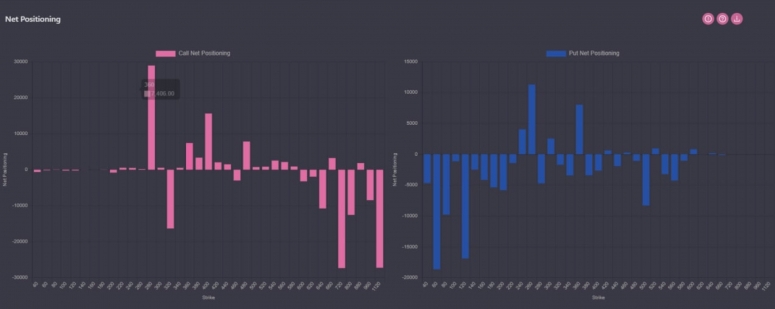

What’s more, the big position at the $1,120 strike isn’t necessarily a bullish one.

“We can see that takers – retail or public investors – are actually net short far out-of-the-money calls at $1,120 ETH,” said Greg Magadini, chief executive officer of data aggregator Genesis Volatility.

Using options exchange Deribit’s data, Magadini showed (in the chart) that the large position at the $1,120 strike is traders who are selling those calls short on Deribit. “Retail has been short selling,” he added.

Other markets

Digital assets on the CryptoX 20 are all red Tuesday. Notable losers as of 21:00 UTC (4:00 p.m. ET):

- Oil was flat, up 0.02%. Price per barrel of West Texas Intermediate crude: $45.63.

- Gold was in the green 0.39% and at $1,869 as of press time.

- The 10-year U.S. Treasury bond yield fell Tuesday dipping to 0.913 and in the red 0.53%.