Bitcoin price tumbled 8% on March 15 from an all-time high of $73,805 to weekly low of $66,786: market data trends suggest whale investors could trigger an early BTC rebound.

Bitcoin shed over $120 billion of its market capitalization on March 15 after weeks of overheated bull trading. With institutional demand remaining steady, what are the chances of an early BTC price rebound above $80,000?

Why is Bitcoin price down today?

The Bitcoin price dip on March 15 appears to have been triggered by overheated bull trading. Over the last 60-days dating back to the ETFs approval, BTC price has delivered a remarkable 75% rally which peaked at an all-time high of $73,805 on March 15. During that period, bullish traders piled on highly-leveraged positions to amplify gains.

Pointedly, since the start of March, Bitcoin funding rates – perpetual futures contract fees paid by leveraged long traders to short position holders, has averaged 0.05%.

The BTC futures markets overheated as funding rates remained elevated for a prolonged period, exposing bull traders to margin calls and massive liquidations. This set the stage for the rapid 8% price downswing experienced on March 15.

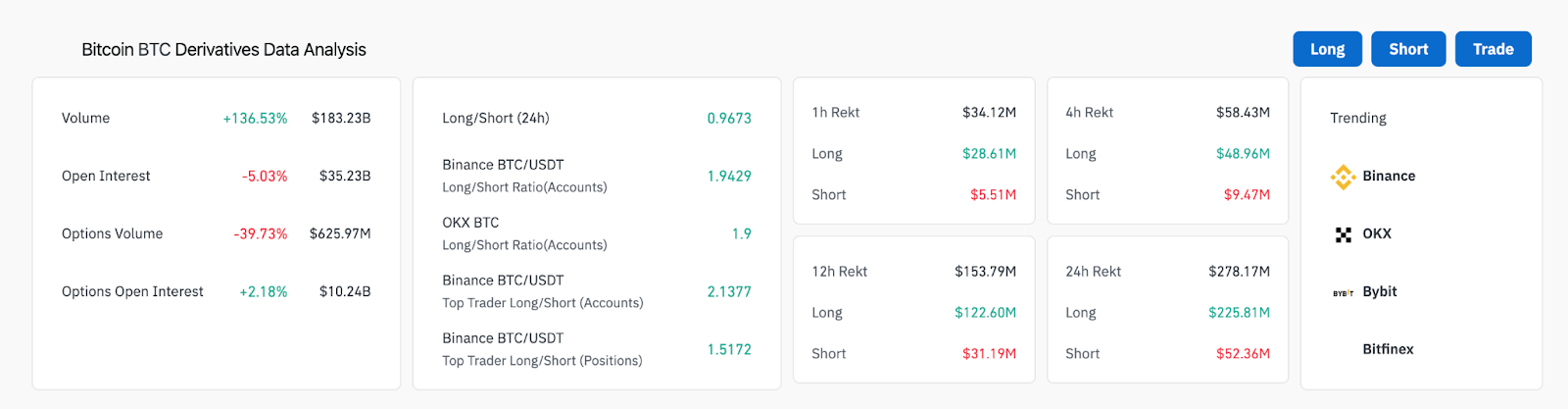

At press time on March 15, over $122 million worth BTC long contracts have been liquidated within the last 24 hours, according to aggregate derivatives market data compiled by Coinglass.

This reflects a cascading wave of forced sale of spot BTC assets deposited as collateral for those liquidated leveraged positions. Unsurprisingly, bitcoin price recorded its largest single-day loss since the start of 2024.

Bitcoin whales are rapidly buying the dip: $27B acquired in two weeks

Overheated bull trading on Bitcoin over the last two months put the pioneer crypto asset at risk of wild price volatility which crystallized into an 8% dip on March 15 as over $120 million long positions were liquidated within 24 hours.

However, a closer look at other vital on-chain data points shows that institutional investors continue to make rapid purchases despite the BTC price dip.

The Santiment chart below shows, in real-time, the cumulative balances in whale wallets that currently hold at least 10 BTC ($700,000).

BTC whales held a total 16.08 million BTC at the start of March 2024. And at the time of writing on March 15, that figure has ballooned to 16.12 million BTC. The whales have acquired 40,000 BTC, worth approximately $27 billion when valued at the current prices.

This holds three notable facts. Firstly, the whales have acquired 40,000 BTC in the first half of March 2024, which is already equal to the total accumulation in the whole of February and January, respectively. Secondly, they now control more than 83% of the total Bitcoin supply in circulation.

And more importantly, as BTC prices tumbled 8% on March 15, led by ETFs accumulations, the whales have firmly maintained their bullish positions.

As observed during a similar price pullback on March 5, if institutional investors keep up the buying trend, it’s only a matter of time before retail investors and speculative swing traders take the cue and set the stage for an early price rebound.

Bitcoin price prediction: Can BTC reach $80k?

Given that the BTC has only recently retreated from the $74,000 area, during the next rally, the bulls could now set their sights on higher targets closer to $80,000.

Drawing inferences from the market data analyzed above, the BTC maintains strong demand. And without any major swings in market sentiment or macroeconomic indices, there’s a fair chance for an early Bitcoin price rebound.

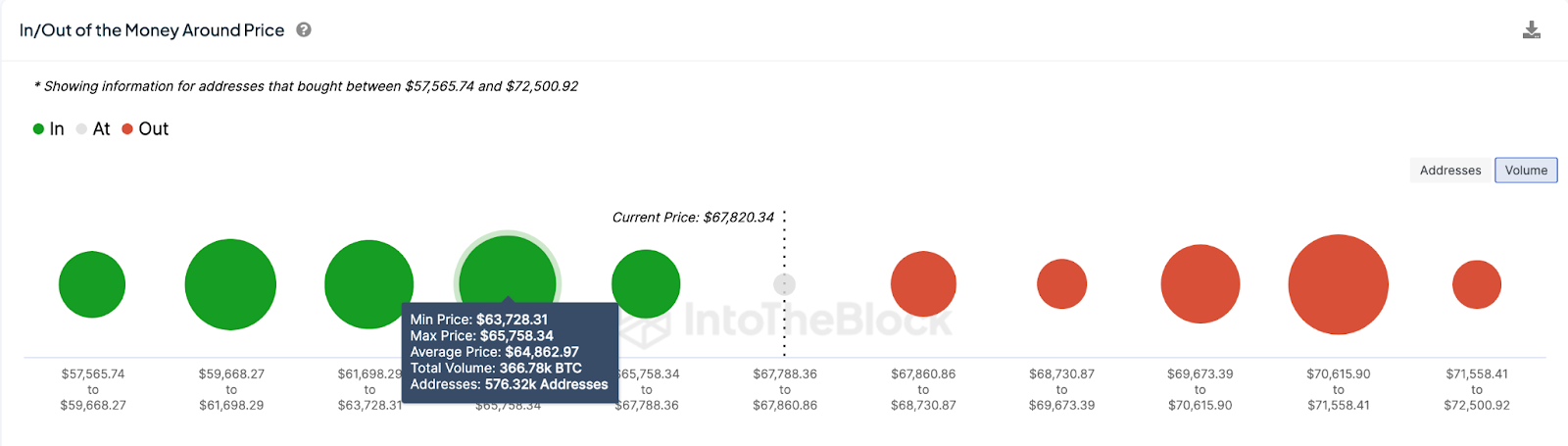

But in the short-term the bulls must avoid a downswing below the $65,000 area. IntoTheBlock’s in/out of the money data shows that 576,320 addresses had acquired 366,780 BTC at the average price of $65,758.

Considering the large cluster of holders that bought BTC at the price range, losing that key $65,000 support level, could trigger another wave of margin calls and cascading liquidations.