Bitcoin (BTC) may be struggling to hit $10,000, but its progress is right on track, new stock-to-flow data confirms.

Adding a new update to his model on July 1, stock-to-flow model creator PlanB showed that Bitcoin is behaving exactly as its bullish history demands.

Bitcoin adds second “red dot”

The BTC S2F Cross Asset Model (S2FX) uses color-coded dots to analyze Bitcoin price action relative to the date of its next block reward halving.

Dots immediately after halving, like at present, are in red, and historically precede a jump in Bitcoin price which PlanB often refers to as being higher by “an order of magnitude.”

Reflected in the model, the next order of magnitude shift is imminent — it should start before the end of 2020. Between then and the next halving in 2024, the model focuses on a price of $288,000 for BTC/USD, with the potential for much higher peaks.

“#Bitcoin S2F chart update .. RED DOT #2,” PlanB summarized on Twitter, referring to June and July’s markings on the chart.

Stock-to-flow remains a steadfast bullish take on long-term Bitcoin price action, despite fielding considerable criticism this year.

PlanB maintains that those critics have yet to produce a viable alternative to his model, which has traditionally tracked price behavior extremely accurately.

Bitcoin S2FX price model as of July 1. Source: PlanB/ Twitter

“Typical” month could spark $12K BTC price

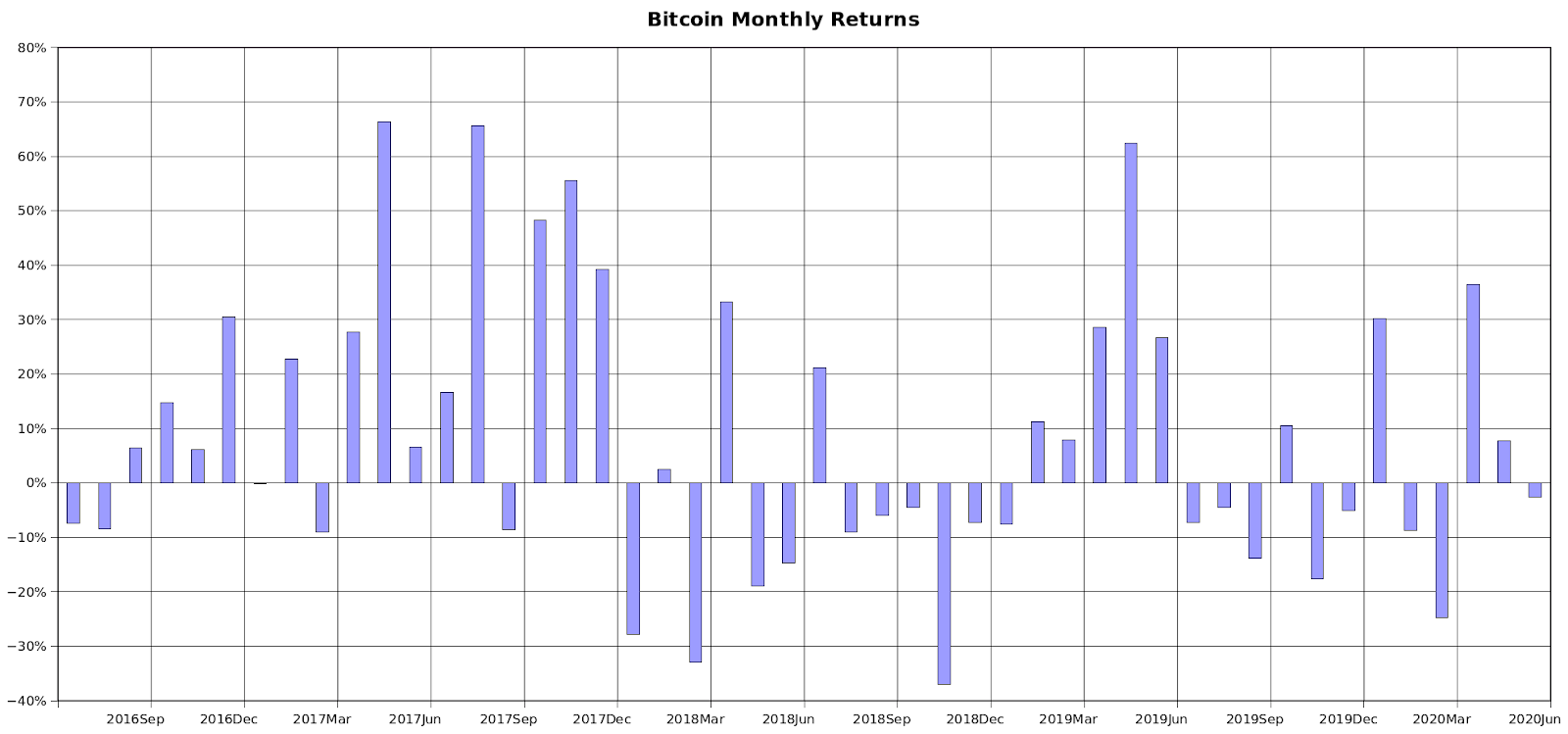

Analyzing monthly returns during the last halving period from 2016 to 2020, PlanB highlighted the “very asymmetrical” nature of Bitcoin price performance.

As such, for BTC/USD to leave its current stagnant levels at around $9,000 and hit $12,000, all that is needed is a “typical” month of solid 30% gains.

Bitcoin monthly returns during the last halving period. Source: PlanB/ Twitter

Nonetheless, Bitcoin’s considerable correlation to the S&P 500 forms a focus for macro factors dictating likely resistance to even $10,000.

Against a backdrop of pressure on stock markets, analysts broadly expect that BTC/USD will continue to act in line with macro swings — no matter how intense these become.

Tone Vays, for example, has stated he does not believe that the pair will go above $10,000 until 2021.