Bitcoin (BTC) held above $9,000 on Oct. 28 as a weekend of bullish madness continued to captivate markets.

Cryptocurrency market daily overview. Source: Coin360

Bitcoin price mulls next move amid $8.8K warning

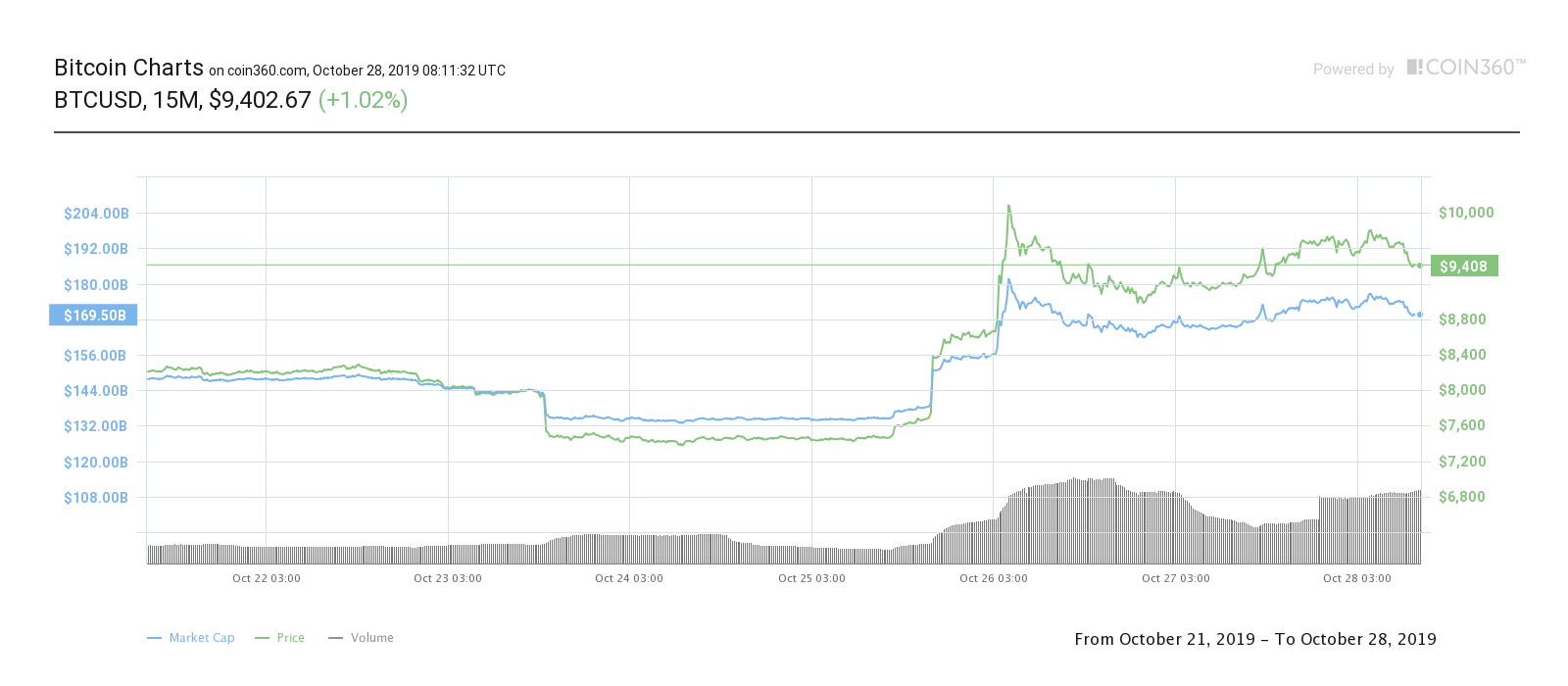

Data from Coin360 showed volatility remaining elevated for Bitcoin on Monday, with swings between $9,100 and $9,900 characterizing the past 24 hours.

On Friday, news that China was officially embracing blockchain technology appeared to reawaken enthusiasm across cryptocurrency markets. After trailing at $7,400 for several days, BTC/USD suddenly exploded, hitting local highs of nearly $10,500 early Saturday morning.

Those levels have since consolidated, with the press time price of $9,400 nonetheless corresponding to 3-day gains of 25%.

Bitcoin seven-day price chart. Source: Coin360

China fuelled the mood once more as the week began, CryptoX reporting on the news a major national bank had sealed an investment deal in a Bitcoin wallet provider.

Despite the excitement being tangible among market participants, however, not everyone was convinced the new highs would endure.

“The chart obviously looks completely ridiculous now and CME are going to open with a gap to the upside if prices remain like this,” CryptoX contributor filbfilb told subscribers of his dedicated Telegram channel over the weekend.

Filbfilb added he expected BTC/USD to return to levels around $8,800.

Altcoin markets show a clear divide

Altcoins likewise maintained higher levels after rising precipitously in line with Bitcoin. However, it was Chinese projects which showed a clear advantage for traders.

Both Tron (TRX) and NEO (NEO) delivered considerably stronger performances than the average top twenty cryptocurrency, both rising around 23% in the past 24 hours. Tezos (XTZ) and Zcash (ZEC) also showed progress with 8% gains.

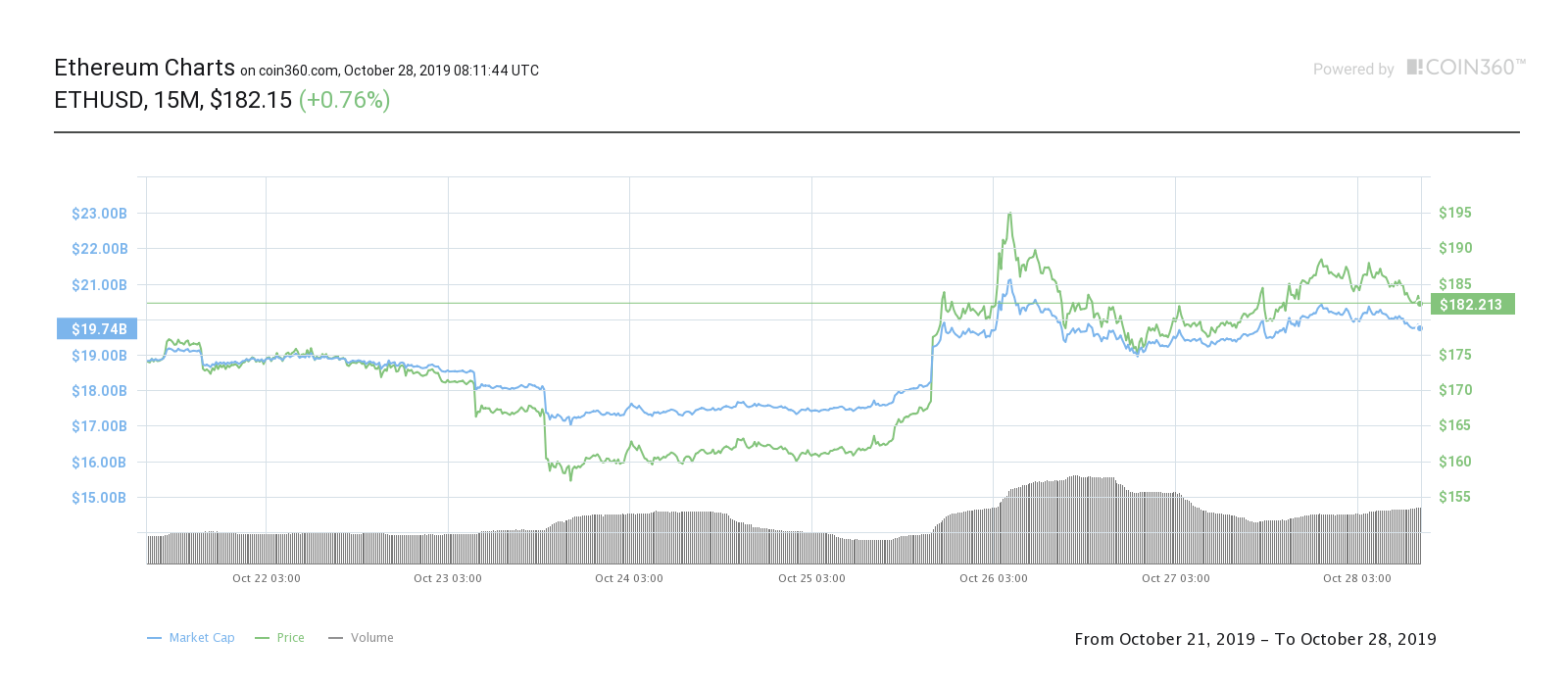

Ether (ETH), the largest altcoin by market cap, meanwhile saw sideways movements on Monday, with daily gains of just 1.5% to $182.

Ether seven-day price chart. Source: Coin360

The overall cryptocurrency market cap hit $250 billion, with Bitcoin’s share at 68%.