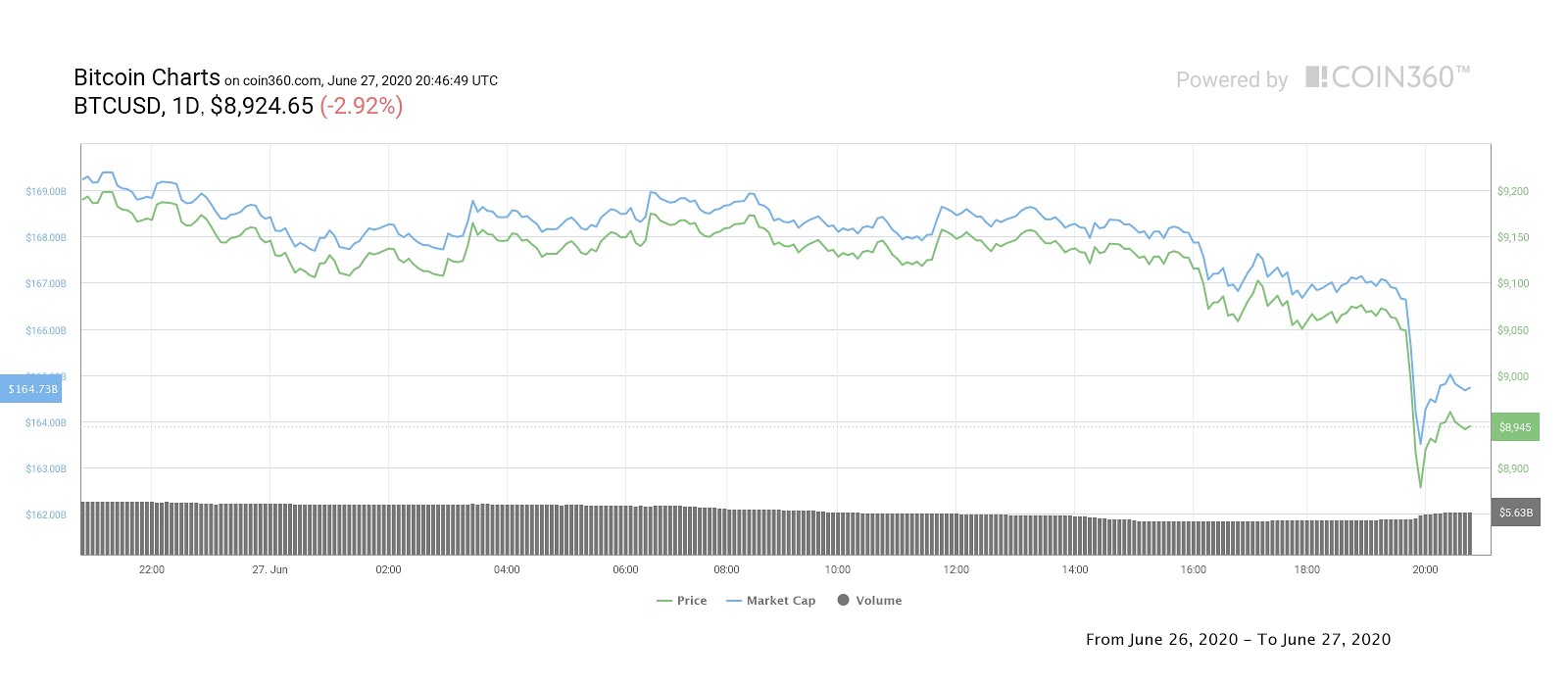

Within the last hour Bitcoin (BTC) price dropped below $9,000 to a daily low at $8,813. Since June 24 Bitcoin price has been losing momentum while pinned below the 20-MA and today’s drop to $8,813 coincided with a surge in sell volume.

Crypto market weekly price chart. Source: Coin360

As discussed in previous analysis, buyers have been keen to purchase every dip below $9,000 and today’s drop brought the price near the edge of a key high volume VPVR node at $8,800.

BTC USDT daily chart. Source: TradingView

If bears succeed in pushing the price below this level, the top-ranked digital asset could drop to the 200-MA at $8,325, but failure to find support at this moving average could see the price sink lower to the $7,400 to $6,800 zone.

Weekend corrections occur on thin trading volume

Investors are accustomed to mild pullbacks over weekends as trading volume tends to thin. It’s also possible that larger size traders are watching from the sidelines after yesterday’s $1.06 billion BTC futures and options expiry and the approaching monthly close next Tuesday.

According to Cryptox contributor Marcel Pechman the market is in a bit of a neutral zone after Friday’s massive options expiry. In private comments Pechman said:

“The options expiry did not have a meaningful impact as most of the call options were aimed at $10K or higher. This event wiped out 67% of the previous day’s $1.7 billion in open interest, including 70% of the Chicago Mercantile Exchange (CME) and 50% at Deribit.

The futures expiry had a slightly different story as CME traders rolled over – reopened at a longer maturing – most of the futures positions on June 25, leaving a mere $38 million for Friday’s expiry. Bitmex and Deribit open interest also remained unchanged after expiry, indicating most positions were rolled over but at OKEx half of the $860 million futures contracts open interest matured.

Overall this indicates traders are unwilling to open new positions ahead of the weekend. Friday’s financial markets’ negative performance might have spooked Bitcoin investors as the correlation between the S&P 500 and BTC remains relatively high.”

Bitcoin daily price chart. Source: Coin360

As Bitcoin price corrected a number of altcoins also suffered heavy losses. Ether (ETH) dropped by 4%, Chainlink (LINK) lost 6.42% and DeFi token Compound (COMP) fell by 13.17%.

According to CoinMarketCap, the overall cryptocurrency market cap now stands at $255.7 billion and Bitcoin’s dominance rate is 65.1%.