Bitcoin (BTC) challenged $31,000 again after the June 27 Wall Street open as traders hoped for upside continuation.

$31,000 returns amid Fidelity Bitcoin ETF rumor

Data from Cointelegraph Markets Pro and TradingView showed BTC price action edging higher after holding $30,000 support.

The start of U.S. trading saw fresh positive news as asset manager Fidelity Investments reportedly prepared a filing to launch its Bitcoin spot-based exchange-traded fund (ETF).

“First it happens slowly, then all at once,” financial commentator Tedtalksmacro wrote in part of a reaction, referring to existing ETF plans from largest global asset manager BlackRock and others.

Despite not yet repeating the rapid gains seen last week, BTC/USD preserved the majority of its progress, with commentators hopeful that bulls would come through.

“Bitcoin refuses to dip back below $30k,” popular trader Jelle summarized on the day.

“Looks like this will be one of those times where ‘consolidation below resistance is bullish.’ Flip $30-$32k and all bets are off.”

Jelle added that although he was prepared for a dip lower, he was “not very confident” that it would happen.

Fellow trader Crypto Tony queried the strength of the day’s uptick, while nonetheless repeating calls for $32,000 next.

“Consolidation was to be expected here,” trader and analyst Josh Rager added in part of a Twitter post.

“If price can go and test the $32k to $33k level and hold there, a chance we teleport to $38k+ over the coming weeks.”

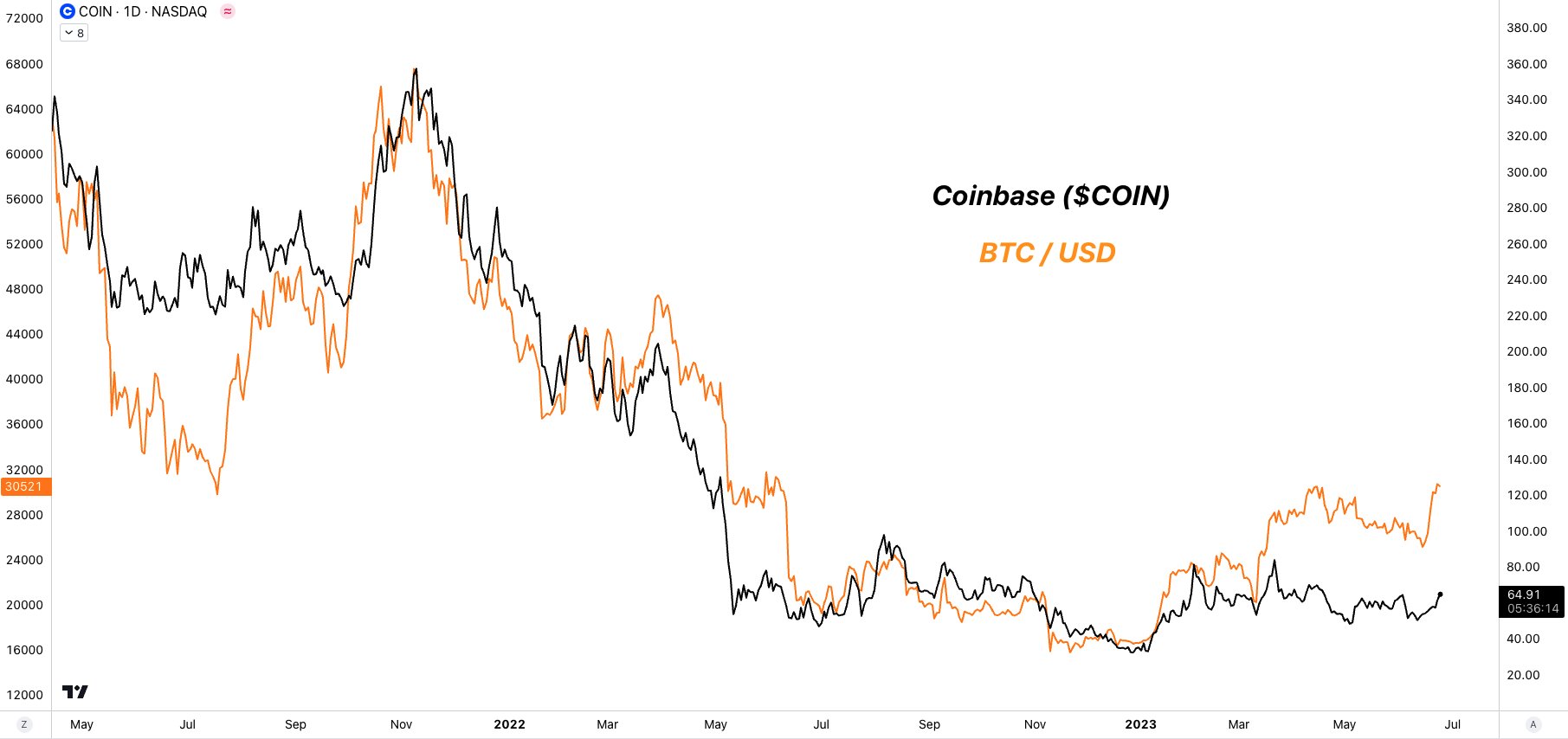

Coinbase stock rebound sets the tone

Bitcoin thus branched out to leave altcoins behind on daily timeframes, with the top ten cryptocurrencies by market cap mostly flat.

Related: BTC price metric warns that Bitcoin speculators may sell past $33K

Another ETF-related success story concerned the stock of U.S. exchange Coinbase, which added 4% at the open to hit one-month highs.

Despite legal pressure from U.S. regulators, Coinbase’s role in the BlackRock ETF continued to reverse its fortunes.

“What’s good for $COIN is good for BTC and vice-versa,” Tedtalksmacro argued the day prior.

“Following news that Coinbase will be the BTC custodian for the world’s largest asset manager, in the case a spot ETF is approved… it’s hard to imagine Coinbase testing anywhere near those lows in the near future.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.