In the last 24 hours, the Bitcoin price experienced a significant surge of 2%, touching an intraday high of $27,320 yesterday. As of this writing, the BTC price hovered near the $27,000 mark.

Why Is Bitcoin Price Up Today?

Several analysts have offered insights into the recent upward trajectory. Renowned crypto specialist Skew elucidated on Twitter, “BTC Aggregate CVDs & Delta: Lower timeframe stuff but pretty clear spot absorption around the high, so $27.2K is an important price area to clear for spot buyers. Most of the push up was perp driven with spot trailing price (short liquidations & strong perp bid).”

Skew’s chart unveils that the momentum was predominantly backed by short liquidations and sturdy bids in the perpetual markets. Upon touching the $27,200 threshold, spot market selling began, indicating a potential local zenith for the Bitcoin price.

Complementing the data, on-chain analytics firm Santiment confirmed that open long and short Bitcoin positions surged as Bitcoin’s price enjoyed a bullish Thursday. The chart shared by Santiment correlates Bitcoin’s ascent with the augmented open interest in the futures market.

“After a quick price retrace after those longs & shorts quickly closed yesterday, they have remained high today, allowing prices to maintain their levels,” the on-chain tracker said.

On a bullish note, Santiment commented that Bitcoin sharks and whale addresses, which are defined as 10-10,000 BTC wallets, have now accumulated to their highest amount held in 2023, amounting to 13.03 million BTC. Additionally, Tether sharks and whales are accumulating buying power. “This is generally a bullish combination,” Santiment remarked.

Nonetheless, the analysis firm also sounded a note of caution: “The long-term outlook is bright for Bitcoin with whales accumulating BTC & USDT. However, watch for a short-term correction, with traders profit taking heavily as $27K hit Thursday. When the 7D MVRV gets below 0, that may be ideal for another leg up.”

Their data further highlights that during yesterday’s significant move, Bitcoin showcased its highest on-chain profit/loss mark in the past quarter, which usually hints at an impending short-term correction.

DaanCrypto, another industry pundit, remarked during the price flux, “Bitcoin Price up, Spot Premium up, Funding down. This move has seen a strong sustained spot bid so far which is looking quite healthy as we speak.”

Similarly, renowned crypto analyst Exitpump chimed in during the price crescendo with the observation, “BTC Binance spot orderbook: Noticed chasing bid on the book with big asks stacked slightly above the price, it’s getting interesting. Maybe a spoof buy wall, but I think that it just grinds higher.”

What’s Next For BTC Price?

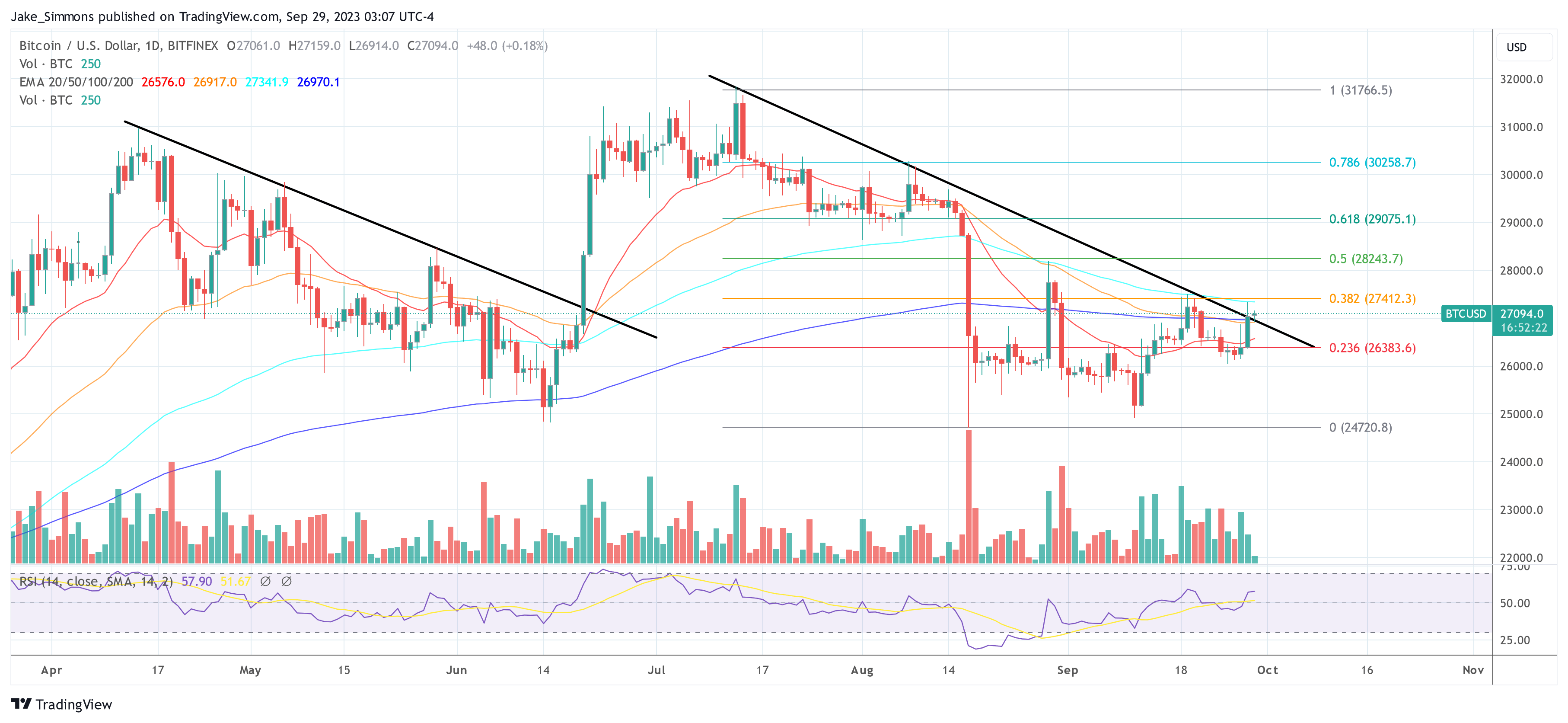

As described in one of our last analyses, the Bitcoin price is facing a crucial monthly close tomorrow, Saturday. Rekt Capital, a seasoned crypto analyst, recently spotlighted the significance of Bitcoin’s approaching monthly candle close.

Via X, he emphasized that Bitcoin is currently treating the $27,000 mark as a resistance. He elaborated, “Bitcoin needs to monthly close above $27,091 for this to be a fake-breakdown. Otherwise, the breakdown will be technically confirmed.” In this case, a fall toward $23,000 could be imminent.

On the 1-day chart, Bitcoin is showing strong bullish momentum today. The BTC price has managed to break the (black) trend line. The task today is to defend the re-test. If it succeeds, a monthly close above $27,100 seems very likely, and a rally similar to June could be possible.

Featured image from Shutterstock, chart from TradingView.com