Coinspeaker

Why Aave Outperforms other DeFi Blue Chips Like Maker and Lido

The DeFi lending protocol Aave

AAVE

$142.2

24h volatility:

-3.3%

Market cap:

$2.13 B

Vol. 24h:

$392.17 M

outperformed its sector peers in Q3. Since mid-June, AAVE’s value has hiked 71% and traded above $140. On the contrary, its rivals were in the red. Maker

MKR

$1 525

24h volatility:

-4.0%

Market cap:

$1.42 B

Vol. 24h:

$65.30 M

, which rebranded to Sky, declined 31%, while Uniswap

UNI

$6.38

24h volatility:

-6.0%

Market cap:

$4.82 B

Vol. 24h:

$121.36 M

dropped 38% over the same period. The staking platform, Lido

LDO

$0.98

24h volatility:

-5.0%

Market cap:

$877.30 M

Vol. 24h:

$78.08 M

, was the worst sector performer, with a whopping 50% decline in Q3.

Photo: TradingView

The trio – MKR, LDO, and UNI, mirrored Ethereum’s ETH broader decline. ETH, considered DeFi’s health barometer, was also down 35% over the same period. In short, based on quarterly returns, investors holding the other top DeFi blue chips were in losses – but not AAVE. So, what’s driving AAVE’s lead and decoupling from ETH’s decline?

What Makes AAVE an Outlier?

According to Kinji Steimetz, an enterprise research analyst at crypto research firm Messari, AAVE’s rally was boosted by macro and crypto-specific factors. Steimerz noted that the declining interest rates in TradFi would make DeFi rates more appealing.

Another crypto-centric catalyst was the potential fee switch announced in July. Pundits have viewed the proposal to adjust protocol fees as a growth catalyst that could benefit AAVE’s value and its holders.

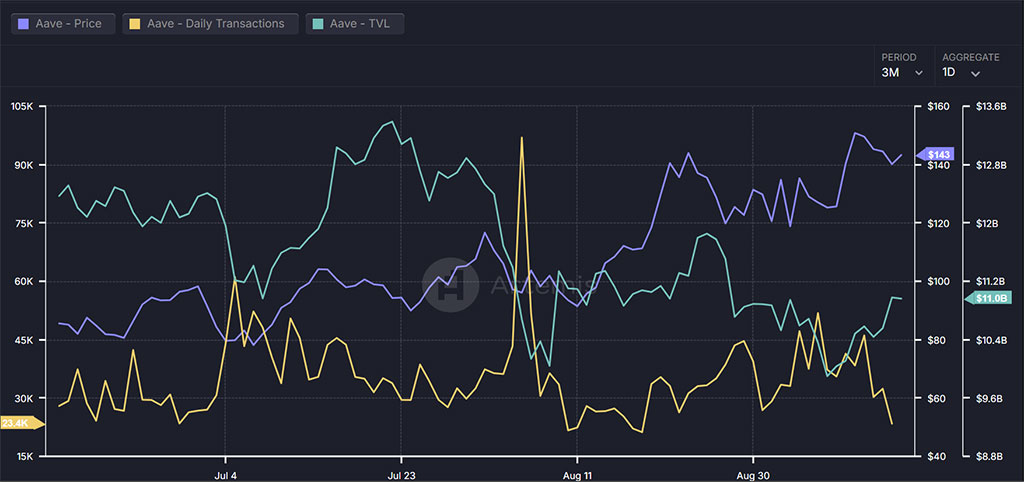

In fact, the fee proposal update exploded AAVE network activity, as seen by a surge in daily active addresses.

Photo: Artemis

Additionally, some top figures, like Ethereum’s founder Vitalik Buterin, recently used the protocol, and Donald Trump plans to partner with it for its new DeFi projects. Collectively, this reinforced confidence in AAVE and fueled wild interest, as seen by the spike in social mindshare by Kaiko data.

Photo: Kaiko

Finally, Steimtz pointed to limited supply pressure as AAVE, as most of its token supply was almost fully unlocked.

“With the token supply (almost) fully unlocked, you can enter a position without worrying about supply overhang,” Steimtz wrote.

According to Token Unlocks data, 92% of AAVE tokens, or about 14.67 million coins, have been unlocked. The total supply was designed to be 16 million tokens, meaning only 1.33 million, or about 8%, was left to be unlocked.

Photo: TradingView

AAVE was above $140 on the price charts and hovered near its March high of $153. This meant it was one of the top tokens to return to its March highs despite the Q3 and Q2 drawdowns. Given the RSI readings of 56, more rally for AAVE was possible because overbought conditions were yet to be hit.

Why Aave Outperforms other DeFi Blue Chips Like Maker and Lido