By Omkar Godbole (All times ET unless indicated otherwise)

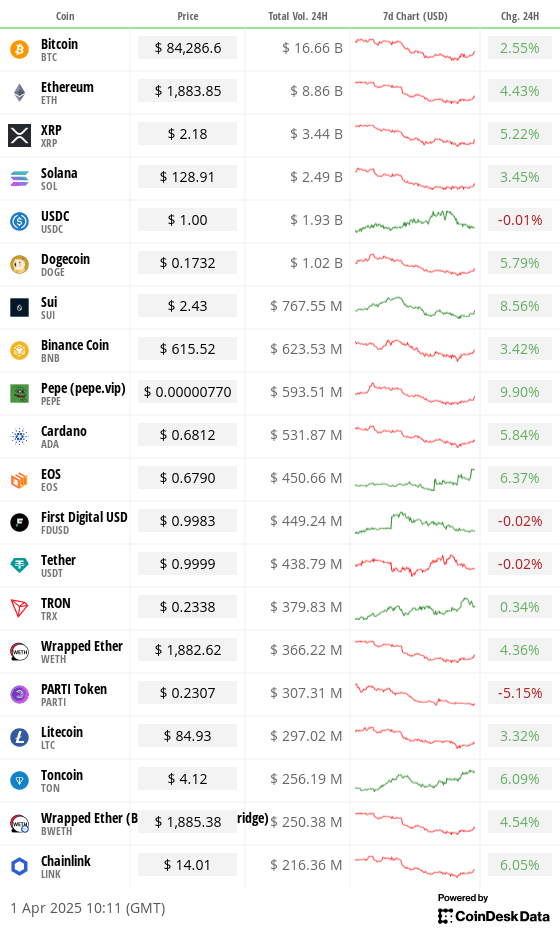

Bitcoin is building momentum, rising over 2% on the day to over $84,000, with memecoins leading the market higher, followed by tokens associated with artificial intelligence and gaming. In traditional markets, gold set another record, surpassing $3,140, and futures linked to major U.S. equity indices are pointing to a positive open.

President Donald Trump pledged a “very kind” yet firm approach toward all trading partners ahead of Wednesday’s planned reciprocal tariffs announcement.

Still, market flows reveal nervousness likely stemming from tariff uncertainty. An aggressive move could ratchet up inflation expectations, which would lower risk asset prices, including cryptocurrencies.

Reports suggest that the Treasury and other federal agencies are expected to disclose their holdings of bitcoin and other tokens on April 5, That’s in accordance with the March 11 document that called for such an action within 30 days of Trump’s March 6 decision to issue an executive order to form a strategic crypto reserve.

Still, some indicators call for caution. For instance, bitcoin’s one-year percentage change is approaching the negative zone, according to crypto research firm Alphractal. “Out of the four times this has happened, three led to bearish movements, while one had no significant effect,” the firm said.

BTC’s apparent demand by 30-day change, derived from the flow of coins into exchanges and adjusted for factors including net outflows, now shows the most negative values in over a year, according to data source CryptoQuant.

Speaking of the broader market, decentralized AI data liquidity network Vana unveiled the VRC-20 data token standard for fair and transparent data token transactions. “For data markets to work, tokens must be reliable, secure, and useful. As a universal standard for data-backed tokens, VRC-20 delivers this by ensuring fair and transparent data token trading,” Vana said on X.

Elsewhere, the MOVE Index, which measures the 30-day implied volatility for the U.S. Treasury notes, is rising. A volatile Treasury market often causes financial tightening worldwide, leading to reduced demand for risk assets. Stay alert!

What to Watch

- Crypto:

- April 1: ONINO (ONI) will have its mainnet launch.

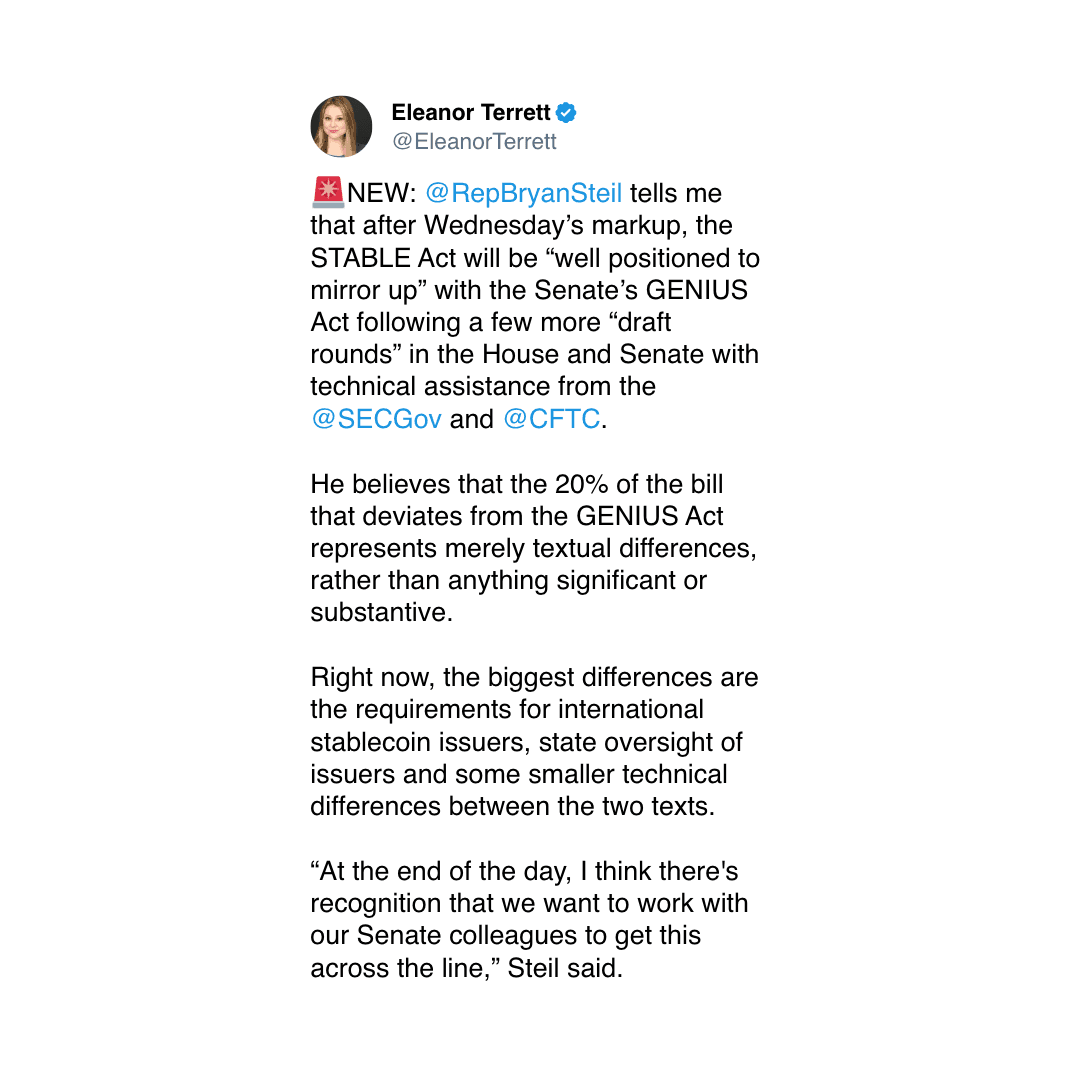

- April 2, 10:00 a.m.: U.S. House Financial Services Committee hearing for marking up various measures, including H.R. 2392, the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act of 2025, and H.R. 1919, the Anti-CBDC Surveillance State Act. Livestream link.

- April 2: XIONMarkets (XION) will have its mainnet launch.

- April 5: The alleged birthday of Satoshi Nakamoto.

- April 9, 10:00 a.m.: U.S. House Financial Services Committee hearing about how the U.S. securities laws could be updated to take into account digital assets. Livestream link.

- Macro

- April 1, 9:00 a.m.: S&P Global releases Brazil March purchasing managers’ index (PMI) data.

- Manufacturing PMI Prev. 53

- April 1, 9:30 a.m.: S&P Global releases Canada March purchasing managers’ index (PMI) data.

- Manufacturing PMI Prev. 47.8

- April 1, 9:45 a.m.: S&P Global releases (Final) U.S. March purchasing managers’ index (PMI) data.

- Manufacturing PMI Est. 49.8 vs. Prev. 52.7

- April 1, 10:00 a.m.: The U.S. Department of Labor releases February JOLTs report (job openings, hires, and separations).

- Job Openings Est. 7.63M vs. Prev. 7.74M

- Job Quits Prev. 3.266M

- April 1, 10:00 a.m.: The Institute for Supply Management (ISM) releases March U.S. manufacturing sector data.

- ISM Manufacturing PMI Est. 49.5 vs. Prev. 50.3

- April 2: Trump administration’s “Liberation Day” reciprocal tariffs will get announced.

- April 2, 4:30 p.m.: Fed Governor Adriana D. Kugler will give a speech titled “Inflation Expectations and Monetary Policymaking.” Livestream link.

- April 3, 12:01 a.m.: The 25% tariff on imported automobiles and certain parts announced March 26 becomes effective.

- April 3, 12:30 p.m.: Fed Vice Chair Philip N. Jefferson will give a speech titled “U.S. Economic Outlook and Central Bank Communications.” Livestream link.

- April 4, 11:25 a.m.: Fed Chair Jerome H. Powell will give a speech titled “Economic Outlook.” Livestream link.

- April 1, 9:00 a.m.: S&P Global releases Brazil March purchasing managers’ index (PMI) data.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on converting 15 million ARB into stablecoins to be managed via a “33/33/33 split among Karpatkey, Avantgarde & Myso, and Gauntlet.” It’s also voting on allocating 10 million ARB into “on-chain strategies designed to generate yield while safeguarding the principal.” Voting ends April 3.

- Sky DAO is discussing increasing the Smart Burn Engine (SBE) rate after a recent executive proposal “resulted in substantial increase to net revenue.”

- Unlocks

- April 1: Sui (SUI) to unlock 2.03% of its circulating supply worth $143.15 million.

- April 1: ZetaChain (ZETA) to unlock 6.05% of its circulating supply worth $12.85 million.

- April 2: Ethena (ENA) to unlock 0.77% of its circulating supply worth $14.07 million.

- April 3: Wormhole (W) to unlock 47.64% of its circulating supply worth $112.67 million.

- April 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $20.23 million.

- Token Listings

- April 1: Bybit to delist CEL, MXM, ZEND, CTT, BONUS, LGX, PLT

Conferences

Token Talk

By Shaurya Malwa

- A hacker involved in February’s multimillion exploit of the zkLend DeFi protocol said they inadvertently sent their stolen funds to a phishing site posing as mixing service Tornado Cash.

- The hacker lost all 2,930 ETH stolen from zkLend to the apparent phishing attack, according to Lookchain and blockchain data.

- They then sent an on-chain message via Etherscan to zkLend apologizing for the “havoc and losses caused,” claimed to no longer hold the stolen funds and urged zkLend to redirect recovery efforts toward the phishing site’s operators.

- Market watchers expressed skepticism, suggesting the alleged phishing site was set up by the hacker in an attempt to shift scrutiny away from the attackers’ known wallets to the address that purportedly ended up thieving the thief.

- zkLend responded by requesting the hacker to return any remaining funds. The protocol has been actively working on fund recovery, having launched a “Recovery Portal” on March 5, to compensate affected users, and is collaborating with security teams, centralized exchanges and authorities to trace the stolen assets.

Derivatives Positioning

- Open interest in futures tied to TON, TRX, HYPE, SHIB and XMR has increased in the past 24 hours while the remaining major coins, including BTC, saw a drop in open bets.

- Perpetual funding rates for BTC, ETH and most other top coins remain below an annualized 5%, indicating cautiously bullish sentiment.

- Deribit’s BTC and ETH options continue to show a bias for short- and near-dated puts with bullishness seen only from July expiry.

Market Movements

- BTC is up 2.19% from 4 p.m. ET Monday at $84,236.71 (24hrs: +2.47%)

- ETH is up 3.34% at $1,880.62(24hrs: +3.34%)

- CoinDesk 20 is up 3.16% at 2,579.16 (24hrs: +5.15%)

- Ether CESR Composite Staking Rate is up 10 bps at 3.03%

- BTC funding rate is at 0.0032% (3.5150% annualized) on Binance

- DXY is unchanged at 104.12

- Gold is up 1.18% at $3,159.80/oz

- Silver is up 0.99% at $34.80/oz

- Nikkei 225 closed unchanged at 35,624.48

- Hang Seng closed +0.38% at 23,206.84

- FTSE is up 0.9% at 8,660.19

- Euro Stoxx 50 is up 1.2% at 5,311.30

- DJIA closed on Monday +1% at 42,001.76

- S&P 500 closed +0.55% at 5,611.85

- Nasdaq closed -0.14% at 17,299.29

- S&P/TSX Composite Index closed +0.64% at 24,917.50

- S&P 40 Latin America closed -0.96% at 2,406.22

- U.S. 10-year Treasury rate is down 3 bps at 4.185%

- E-mini S&P 500 futures are unchanged at 5,656.00

- E-mini Nasdaq-100 futures are up 0.22% at 19,482.25

- E-mini Dow Jones Industrial Average Index futures are down 0.12% at 42,207.00

Bitcoin Stats:

- BTC Dominance: 62.18 (-0.21%)

- Ethereum to bitcoin ratio: 0.02236 (1.31%)

- Hashrate (seven-day moving average): 835.3 EH/s

- Hashprice (spot): $46.93

- Total Fees: 4.9 BTC / $406,290

- CME Futures Open Interest: 135,210 BTC

- BTC priced in gold: 26.8 oz

- BTC vs gold market cap: 7.6%

Technical Analysis

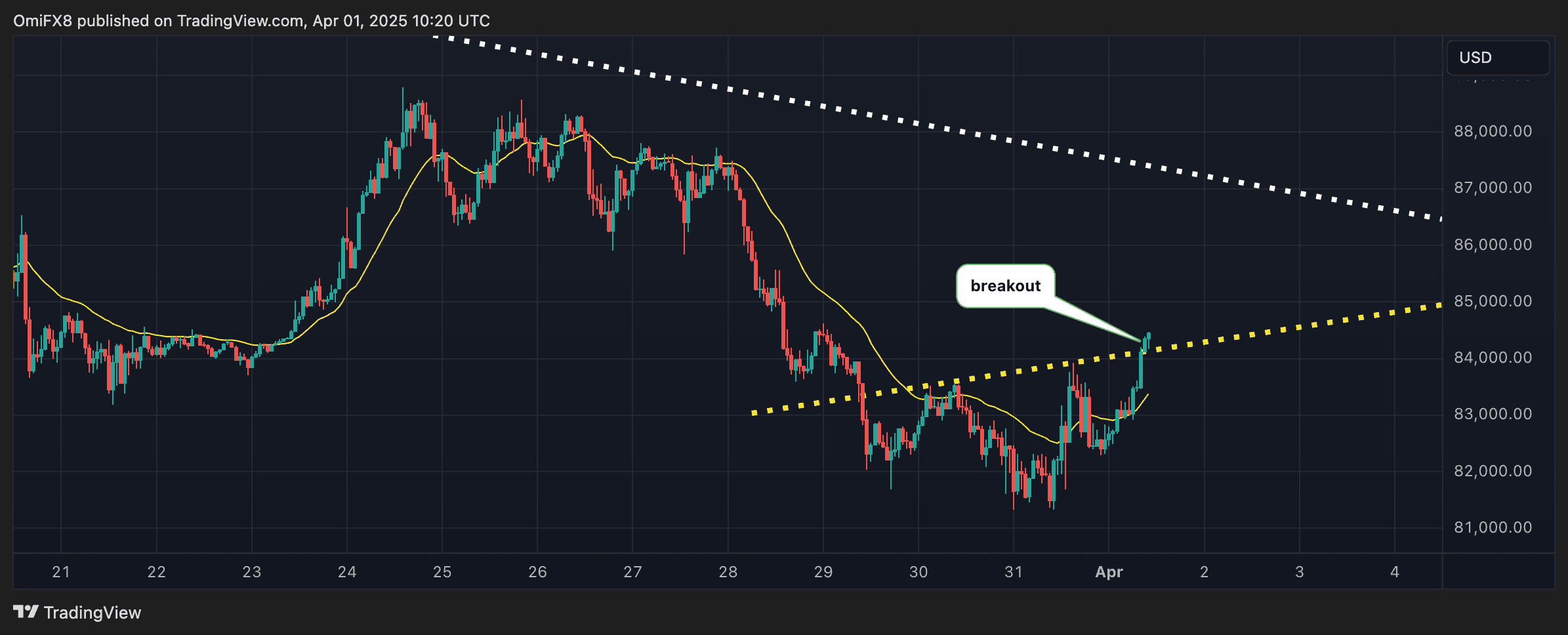

- BTC has moved past the yellow trendline, confirming an inverse head-and-shoulders breakout to suggest the path of least resistance is on the higher side.

- The 24-hour simple moving average is now trending north, indicating a renewed upward momentum.

- Prices could rise toward the descending (white) trendline resistance, currently at $87,200.

Crypto Equities

- Strategy (MSTR): closed on Monday at $288.27 (-0.39%), up 2.54% at $295.60 in pre-market

- Coinbase Global (COIN): closed at $172.23 (-0.98%), up 1.78% at $175.30

- Galaxy Digital Holdings (GLXY): closed at C$15.17 (-7.78%)

- MARA Holdings (MARA): closed at $11.50 (-7.78%), up 2.7% at $11.81

- Riot Platforms (RIOT): closed at $7.12 (-3.91%), up 1.69% at $7.22

- Core Scientific (CORZ): closed at $7.24 (-3.21%), up 0.83% at $7.30

- CleanSpark (CLSK): closed at $6.72 (-6.54%), up 3.13% at $6.93

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.77 (-2.74%), down 2.51% at $12.80

- Semler Scientific (SMLR): closed at $36.20 (-1.79%)

- Exodus Movement (EXOD): closed at $45.74 (-4.39%), up 2.25% at $46.77

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$60.6 million

- Cumulative net flows: $36.27 billion

- Total BTC holdings ~ 1.12 million.

Spot ETH ETFs

- Daily net flow: $6.4 million

- Cumulative net flows: $2.43 billion

- Total ETH holdings ~ 3.41 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

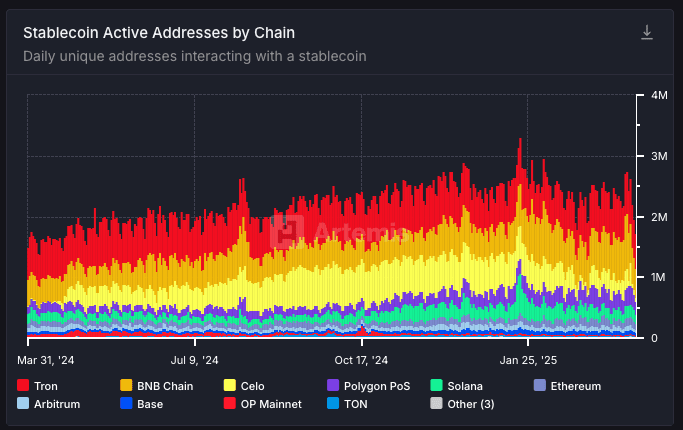

- Tron, BNB Chain and Celo are the past year’s top three blockchains by the number of active stablecoin addresses.

- Ethereum lags even though the stablecoin supply on the smart-contract blockchain recently surged to all-time high over $132 billion.

While You Were Sleeping

- China Kicks Off Military Drills Near Taiwan, Warns Island’s ‘Independence’ Means War (CNBC): China said its military actions were punishment for Taiwan’s leadership, simulating multidirectional encirclement and coordinated strikes on key areas to demonstrate combat readiness.

- Ethereum Reclaims No. 1 Spot as Leading DEX Chain for First Time Since September, Overtakes Solana (CoinDesk): Bearish market sentiment, particularly within the memecoin sector, led to a significant decline in activity on Solana-based platforms Raydium and Pump.fun.

- Democrats Sue Trump Administration Over Election Executive Order (Reuters): The lawsuit says requiring voter citizenship proof and cutting funds for noncompliant states would unlawfully let presidents reshape election rules to protect their own political interests.

- Gold Hits Record as Trump’s Trade Threats Fan Haven Demand (Bloomberg): Spot gold, up 19% in the first quarter, hit $3,149 as investors braced for retaliation over Trump’s reciprocal tariffs plan, which will be unveiled Wednesday.

- RBA Keeps Rates on Hold as It Points to Trade War Threat (The Wall Street Journal): Australia’s central bank warned that stiffer U.S. tariffs and rising geopolitical tensions could drag on global growth by undermining confidence and prompting households and firms to delay spending decisions.

- Metaplanet Ups Bitcoin Holding to Over 4K BTC, Adds Another 696 BTC (CoinDesk): The Japanese firm paid about $97,500 per bitcoin, raising the average cost of its holdings to roughly $86,500 per coin.

In the Ether