On Friday, Tether announced that it had entered into a subscription agreement with Bitdeer to buy up to $150 million worth of shares in a private placement.

The agreement includes 18,587,360 Class A ordinary shares and a warrant to purchase up to 5,000,000 additional shares at $10.00 per share, per the press release. Bitdeer shares are currently trading between $6 to $7 a share.

On Thursday, the private placement transaction yielded $100 million in gross proceeds from the share issuance, with the chance to raise an additional $50 million if the warrant is fully exercised.

“We regard Bitdeer as one of the strongest vertically integrated operators in the Bitcoin mining industry, differentiated by its cutting-edge technologies, and a robust R&D organization,” said Paolo Ardoino, CEO of Tether, in the press release. “Bitdeer’s proven track record and world-class management team are perfectly aligned with Tether’s long-term strategic vision. We anticipate close collaboration with Bitdeer across several key infrastructure areas moving forward.”

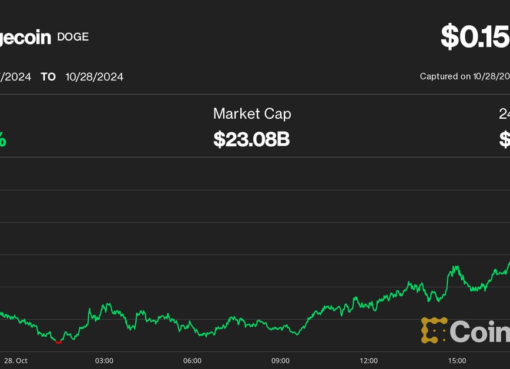

Bitdeer’s stock (BTDR) is up over 13% in intraday trading at the time of writing, indicating the market’s positive response to Tether’s investment.

Tether’s interest in BTC mining

This investment marks a significant step from Tether, the developer of the world’s largest stablecoin, USDT. It shows that Tether is willing to invest in Bitcoin (BTC) mining, reflecting its wider interest in developing the crypto economy. Tether secures a critical aspect of the crypto ecosystem by supporting Bitcoin mining.

This move aligns with Tether’s broader strategy of diversifying its portfolio and reinforcing the stability and reliability of its USDT token by investing in blockchain technology, like the technology provided by Bitdeer.