While digital currencies like bitcoin and ethereum lost roughly 10% in value during the last seven days, the decentralized finance (defi) economy has weathered the storm better than the top two leading crypto assets. A slew of blockchain games coins, defi tokens, and metaverse assets like gala, crypto.com coin, wax, kadena, wonderland, and avalanche have seen double-digit gains during the last 24 hours.

TVL in Defi Weathers the Crypto Economy Storm

While bitcoin (BTC) has hovered just above the $60K zone in consolidation, the defi economy and a number of other crypto assets have seen decent gains. Statistics from defillama.com show that on November 9, the total value locked (TVL) in defi protocols tapped $275 billion and today it’s only 6.54% lower at $257 billion. The defi protocol Curve commands 8% dominance amid the $257 billion with $20.63 billion TVL.

Curve’s TVL is followed by Makerdao ($18.16B), Aave ($15.59B), Convex Finance ($15.34B), and WBTC ($14.66B), respectively. The top three chains today in terms of TVL in defi include Ethereum (ETH), Binance Smart Chain (BSC), and Solana (SOL). ETH captures $172.22 billion or 66.93% of the aggregate TVL in defi on Wednesday. BSC has $19.56 billion or 7.60% and SOL has $13.32 billion or 5.17%.

7 Tokens See Double-Digit 24 Hour Gains, Cross-Chain Bridge TVL Dips 6.3% in 30 Days, Uniswap Commands Today’s Top Dex Volume

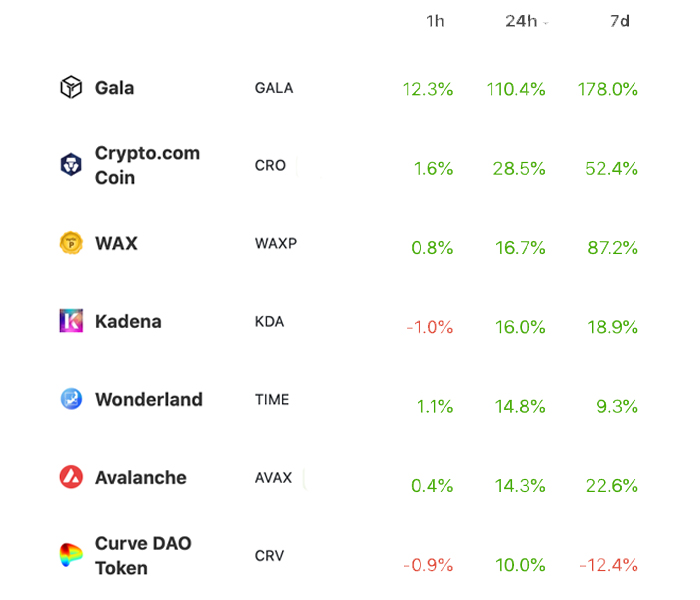

The top gainer during the last 24 hours is the blockchain game coin gala (GALA), up 110.4% today. Crypto.com coin (CRO) has increased 28.5%, wax (WAXP) jumped 16.7%, kadena (KDA) spiked 16.0%, wonderland (TIME) lifted 14.8%, avalanche (AVAX) rose 14.3%, and curve dao token (CRV) increased by 10%. The aforementioned seven tokens are the only coins on Wednesday that saw double-digit gains among the 10,000+ crypto assets.

Other notable gainers include theta fuel (TFUEL) up 8.3%, kucoin token (KCS) jumped 5.2%, nem (XEM) rose 5.2%, polygon (MATIC) increased by 4.8%, and iota (MIOTA) spiked 4.3% during the last 24 hours. Defi cross-chain bridge action is around $23.98 billion total value locked with Ronin Bridge commanding $7.5 billion, according to Dune Analytics metrics. 30-day changes in cross-chain bridge TVL show bridge TVL is down 6.3%.

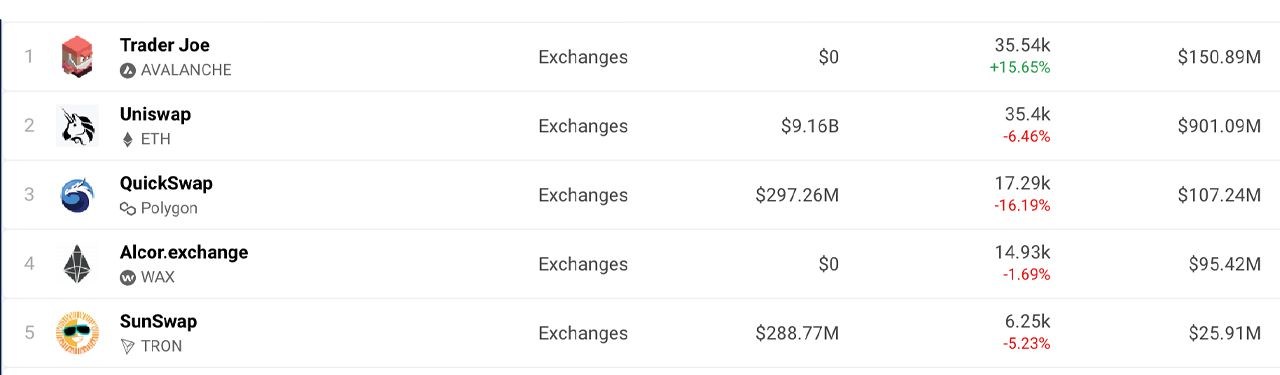

The top five decentralized exchange (dex) platforms today include Uniswap (Ethereum), Trader Joe (Avalanche), Quickswap (Polygon), Alcor.exchange (WAX), and Sunswap (Tron). During the last 24 hours, the Avalanche-based Trader Joe saw $150.89 million in dex swaps, while today’s leader Uniswap processed $901 million, according to dappradar.com’s records on November 17.

What do you think about the blockchain games coins, defi tokens, and metaverse assets rising above the crypto market downturn? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, defillama.com, dappradar.com, coingecko.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.