Security Tokens and Tokenized Securities Are Not the Same Thing

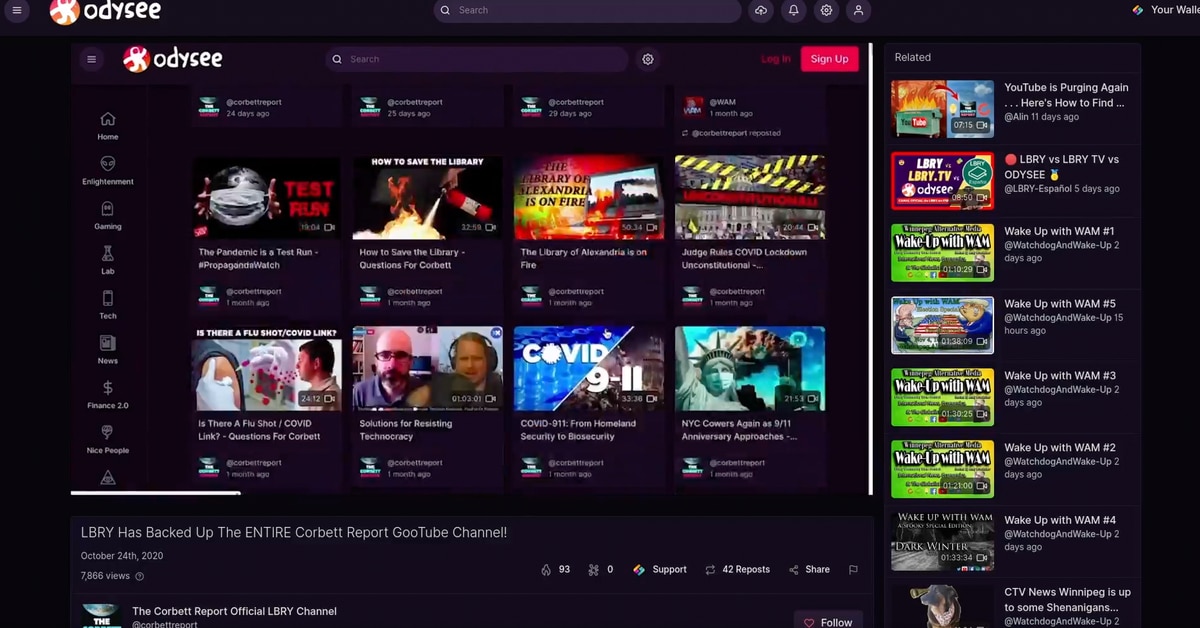

Security tokens, however, are struggling amid a lack of regulatory clarity, and the all-too-familiar regulation-by-enforcement approach of the U.S. Securities and Exchange Commission (SEC). To pick an example, starting in 2016 LBRY – a decentralized storage protocol and media service – financed its development through the issue of LBC tokens,

Read More