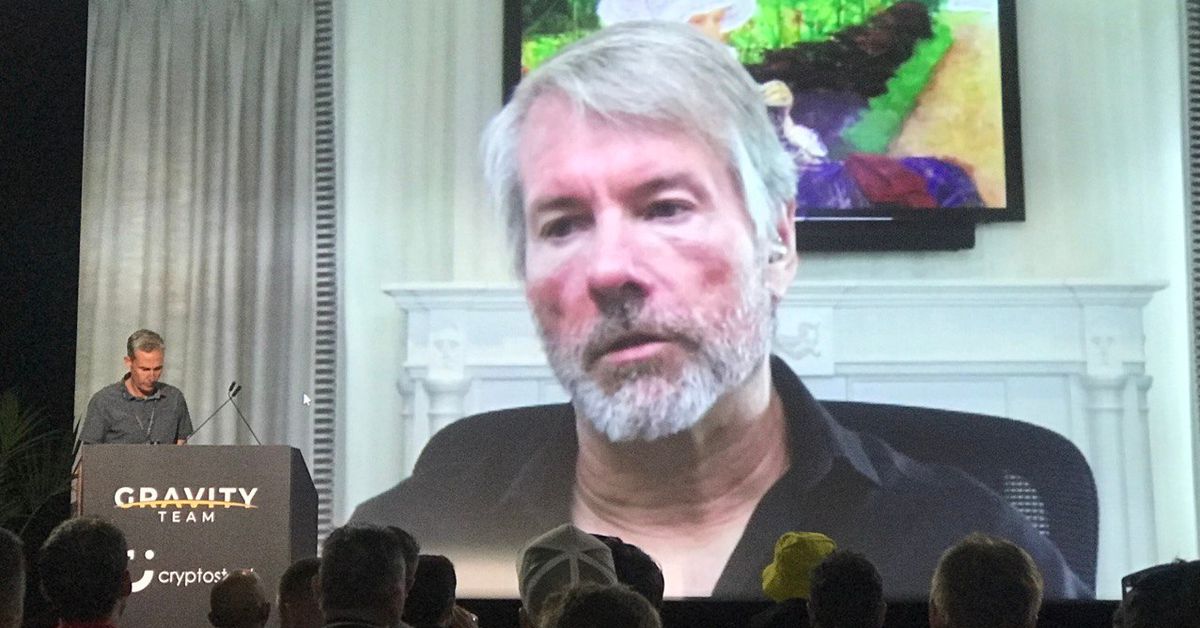

First Mover Asia: Asia Stocks Open Soft, Bitcoin Jumps Past $30K on MicroStrategy Filing and Despite Fitch Treasury Downgrade

PLUS: Bitcoin dominance sagged in July, absent a compelling BTC catalyst, and as altcoins seemed to benefit from a partial Ripple court victory. Source

Read More