Bitcoin Long-Term Holders Stay Strong Despite $20K Drop From Last Month’s High

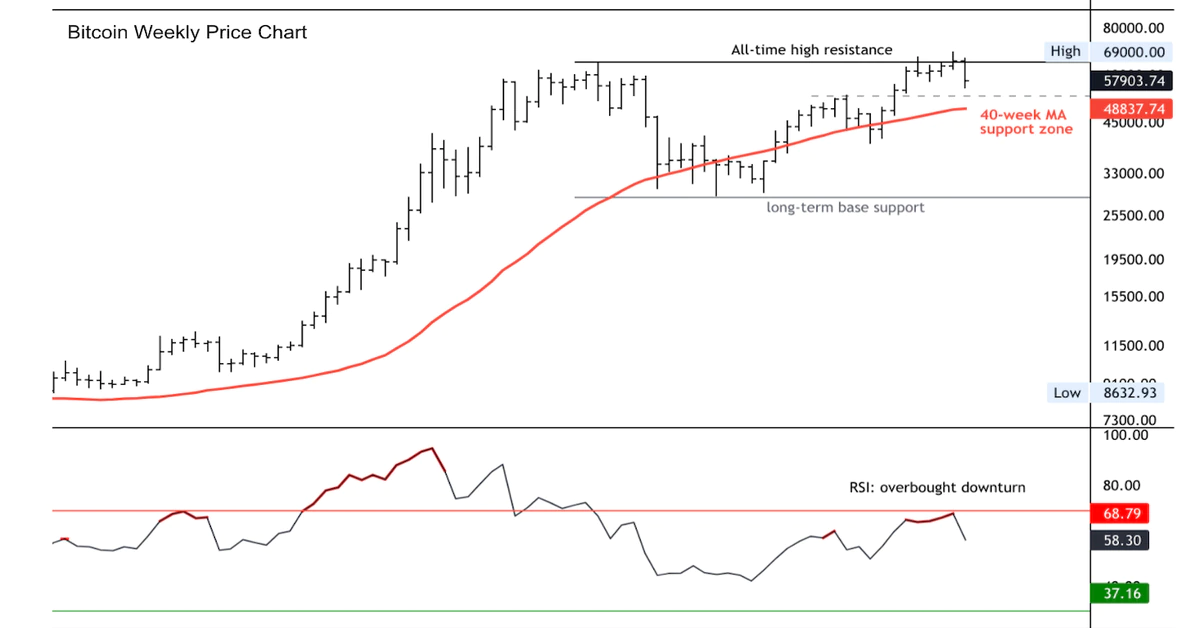

Meanwhile, the Relative Strength Index (RSI), a price-chart indicator, for bitcoin slid to favorable levels in European trading hours on Tuesday after reaching overbought conditions last Friday. The tool calculates market momentum for assets, and an overbought level implies prices are overvalued and may be primed for a trend reversal

Read More