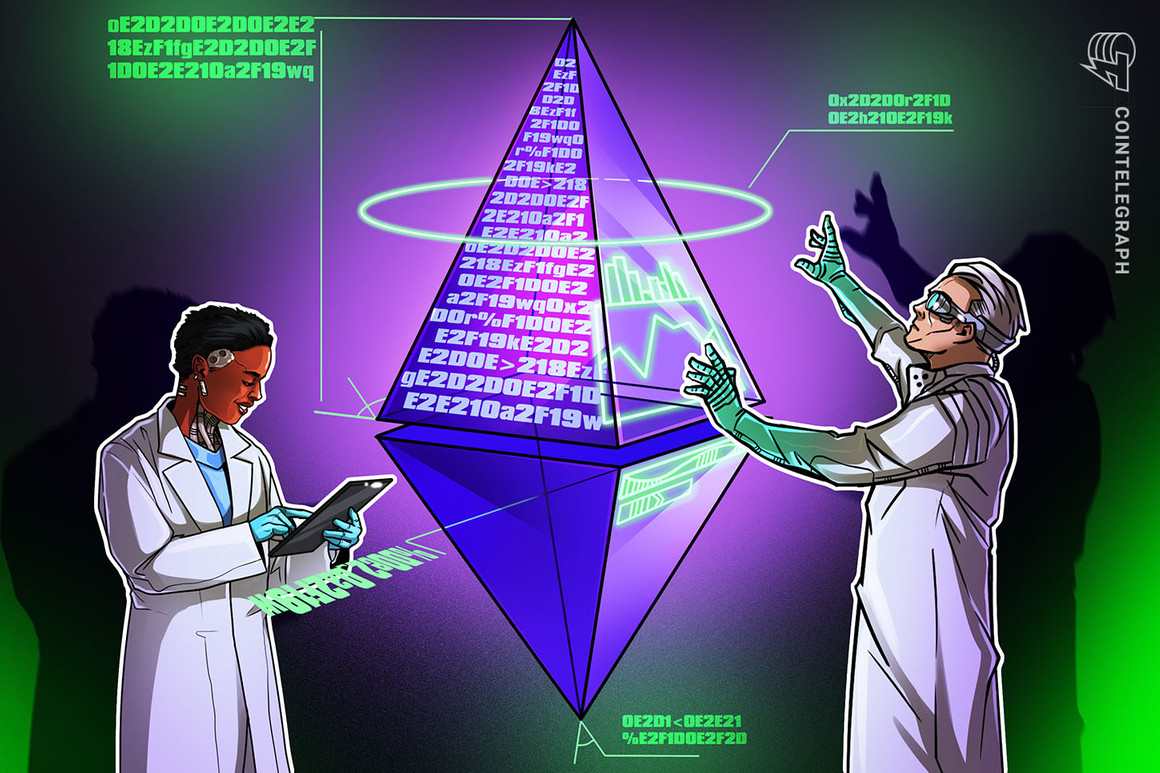

The floppening? Ethereum price weakens post-Merge, risking 55% drop against Bitcoin

Ethereum's native token Ether (ETH) has been forming an inverse-cup-and-handle pattern since May 2021 on the weekly chart, which hints at a potential decline against Bitcoin (BTC). ETH/BTC weekly price chart featuring inverse cup-and-handle breakdown setup. Source: TradingViewAn inverse cup-and-handle is a bearish reversal pattern, accompanied by lower trading volume. It typically

Read More