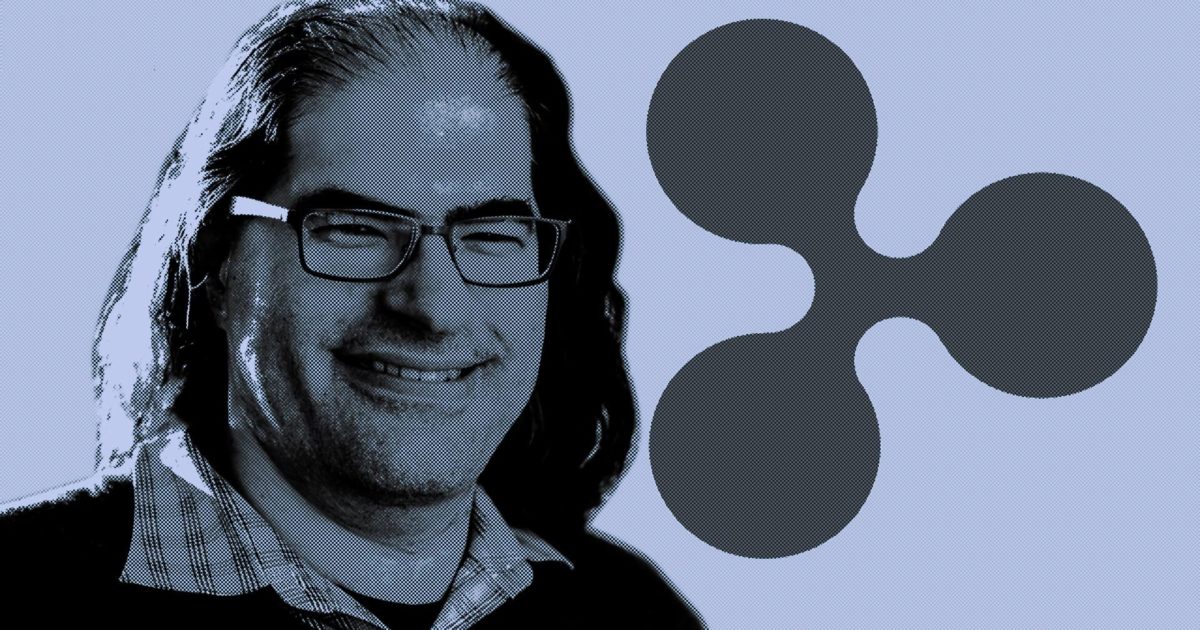

Ripple’s Chief Technology Officer (CTO), David Schwartz, has always been quick to come to the defense of the crypto firm and its technology. This time, he has defended Ripple developers implementing a newly proposed ‘Clawback’ feature on the XRP Ledger (XRPL).

Why The Clawback Feature Is Necessary

In a tweet shared on his X (formerly Twitter) platform, Schwartz mentioned that while initially having reservations about the feature as he felt it was “redundant,” he later realized its importance as it differed from the existing freeze feature.

The “clawback” amendment is now eligible for voting. This allowers issuers of new assets specifically created with this feature enabled to claw back a specified quantity of the asset from a holder.

Some thoughts: … https://t.co/OmrerirRQz

— David “JoelKatz” Schwartz (@JoelKatz) October 2, 2023

As the name suggests, the Clawback feature allows a token issuer to “claw back” tokens when there is fraudulent activity or for recovery purposes, like when a user loses access to their account.

Related Reading: Bitcoin Investment Strategy: Analyst Sets Hefty Exit Price

He noted that the clawback feature was primarily to be used to fulfill legal obligations, as in the case of a stablecoin issue fulfilling their redemption obligations or where a court order necessitates the need to use such a feature.

From this premise, he explained that this feature ensures that this event is represented on the ledger, unlike the freeze feature, which doesn’t highlight why an asset was frozen. As such, this latest feature allows for better accountability and makes audits less complex.

Furthermore, he mentioned that the freeze feature was more of a “nuclear” option, unlike the clawback feature, which does less damage and can seen as a viable and probably better alternative.

Schwartz reiterated that this clawback didn’t apply to XRP and suggested that it was an option for stablecoin issuers, noting that other “blockchains that have stablecoins on them have some version of this clawback feature” and how it helped solved an accountability problem.

Token price retains $0.52 support | Source: XRPUSD on Tradingview.com

XRP Ledger Feature Receives Cold Reception

Despite Schwartz’s justification of the feature, many still showed displeasure with it as it undermined the ethos of decentralization and users’ privacy. One X user (@bigcjat) explained that a clawback feature seemed more drastic, unlike the freeze feature, as the former stripped users of their tokens, unlike the latter, where the user still maintained control of his tokens.

He went on to quiz whether this token was simply proposed because of the ‘recent partnership’ considering that the feature was never proposed before now. He then suggested that the crypto firm and its blockchain may have been compromised as he stated, “Money taints, even decentralized ledgers.

In response, Schwartz stated that, to the best of his knowledge, the driving force behind this feature was to ensure accountability as it would reflect the legal obligation of an issuer. He is not aware of anyone stating that they will only partner with Ripple if the XRPL supports clawback.

Other users weighed in on the conversation, with some showing support for the feature, stating that stablecoin issuers needed to implement such a feature. On the other hand, others argued that the clawback feature wasn’t necessary, with a particular user stating that this risk is “akin to being SIM swapped.”

Another concern raised is that token issuers could use this feature maliciously, especially when experiencing financial difficulties. That particular user gave an example of FTX being able to claw back their FTT tokens or a stablecoin issuer like Tether clawing back their USDT tokens in the event of financial difficulty.

The X user @bigcjat once again came into the conversation and noted that Schwartz’s talks about “legal obligation” only undermine the essence of blockchain technology as there was no need for a ledger if the “actual value” and “rules” were off the ledger.

However, Schwartz noted “several benefits” to putting these transactions on the ledger. One of them is that a public blockchain ensures that “the total legal obligations of the issuer can be completely public in a verifiable way.”

The clawback feature will still need to be voted on by validators on the XRP Ledger before it becomes implemented. Once implemented, stablecoin issuers must decide to enable it before they can create their tokens on the network.

Featured image from Bitcoinist, chart from Tradingview.com