Although the Coronavirus pandemic has led many brick and mortar industries to close operations, cryptocurrency exchanges seem to have had their best month in a long time.

According to an exchange report released by CryptoCompare, Bitcoin (BTC) trading volume saw record-breaking numbers throughout the month.

Cryptocurrency market daily view. Source: Coin360

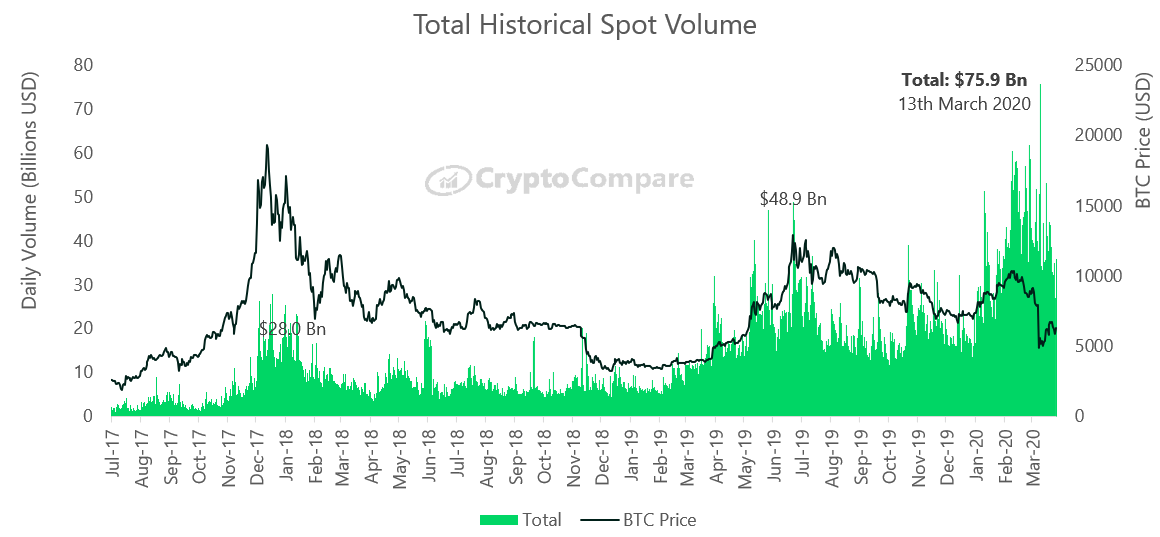

The March 13 market crash that brought the Bitcoin price from $8,000 to a low of $3,800 in 24 hours registered the biggest day for crypto in terms of trading volumes registered at Bitcoin spot markets. On March 13 alone, total daily volumes hit an all-time high of $75.9 billion.

Total Historical BTC Spot Volume. Source: CryptoCompare

Bitcoin selloff propelled by a dash for cash

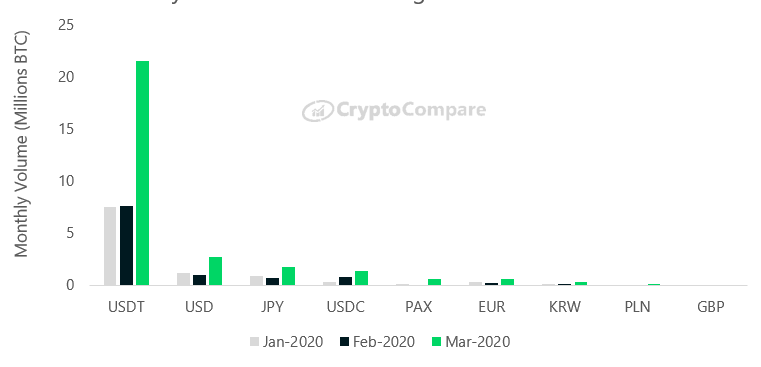

Not only did Bitcoin see its biggest spike in spot trading volumes during the crash to $3,750, but fiat volumes also increased substantially as traders sought liquidity amidst the Coronavirus panic. This also triggered similar selloffs in global equities and commodities markets.

Bitcoin to fiat volumes also reveal a possible interest in acquiring the cryptocurrency as a hedge against the COVID-19 economic fallout. USD to BTC trading volumes increased by 170% in March. The JPY pair also increased substantially, going up by 130%.

According to CryptoCompare, March 13 held record numbers for the BTC/USD pair and other fiat/Bitcoin pairs. Crypto traders also took shelter in stablecoins as Tether’s USDT saw its monthly volume triple during the month of March.

Monthly Bitcoin Volume Trading into Fiat or Stablecoin. Source: CryptoCompare

Retail demand spikes after Bitcoin selloff

As shown by the total historical BTC spot volume chart, Bitcoin spot volumes reached an all-time high on March 13 and they have remained noticeably elevated throughout March as the price continued to recover. While trading volume could signal both sell and buy pressure, there are multiple factors pointing to a higher interest in buying the cryptocurrency.

A recent Coinbase report explained that the 48 hours after the crash brought record-breaking numbers for the company compared to their yearly averages. Purchasing pressure in their retail brokerage increased by 7% from the typical 12-month average of 60%. Coinbase also reported an increase in cash and crypto deposits, new signups, as well as higher trading volumes.

Another factor pointing towards buy pressure or at least a lack of sell pressure is the BTC exchange net inflow, derived from the number of coins leaving and entering exchanges, which has dropped sharply after a spike in the Bitcoin selloff during mid-March.

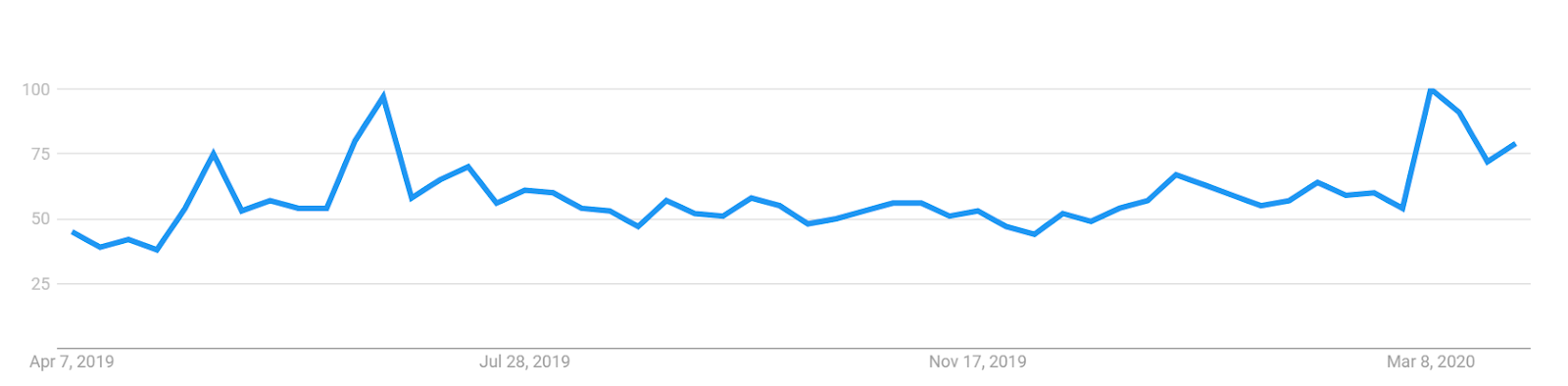

Google trends see uptick in Bitcoin interest

The interest in buying Bitcoin can also be observed in Google search trends. After the price crash, queries for the term “Buy Bitcoin” reached the highest level seen since July 23, 2019. Interest had previously spiked as the Bitcoin price surged to a 2019 yearly high of $11,280.

“Buy Bitcoin” interest over time. Source: Google Search Trends

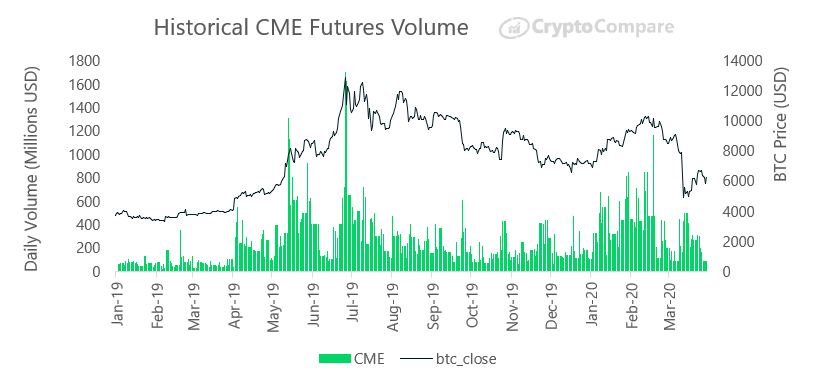

CME Bitcoin data shows institutions pulled out

In the Bitcoin derivatives market, volumes hit an all-time high triggered by the price volatility experienced during the March 13 Bitcoin price drop, with a reported $600 billion in monthly volume. Despite this, regulated derivatives exchange, CME, saw its trading volume for Bitcoin futures decrease by a whopping 44% since February following the BTC price crash.

Historical CME Futures Volume. Source: CryptoCompare

The growing disinterest among institutional investors may be explained by the lack of safeguards against crises like the current Coronavirus pandemic. The quantitative easing program launched by the U.S. Federal Reserve brought a small degree of trust back to the stock markets for institutional investors. The same cannot be said for Bitcoin.

Will retail demand drive the market higher in 2020?

It’s hard to say if retail demand for Bitcoin will continue to grow as potential buyers could be pushed towards more traditional safe havens like gold or silver. However, it’s clear to see that institutional interest in Bitcoin has been severely diminished by the current pandemic and the associated economic fallout.

Nevertheless, many believe that the Bitcoin price will surge after the halving, which will be Bitcoin’s stock to flow value increase, a bullish sign for investors as production is cut in half.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.