The open interest on Bitcoin (BTC) options contracts has reached a new all-time high at $2.9 billion. Interestingly, this feat happened only five days after the October expiry, which liquidated $400 million worth of options.

Over the past six months, the options market has grown three-fold, causing investors to grow more curious about the potential impact upcoming expiries will have on Bitcoin price.

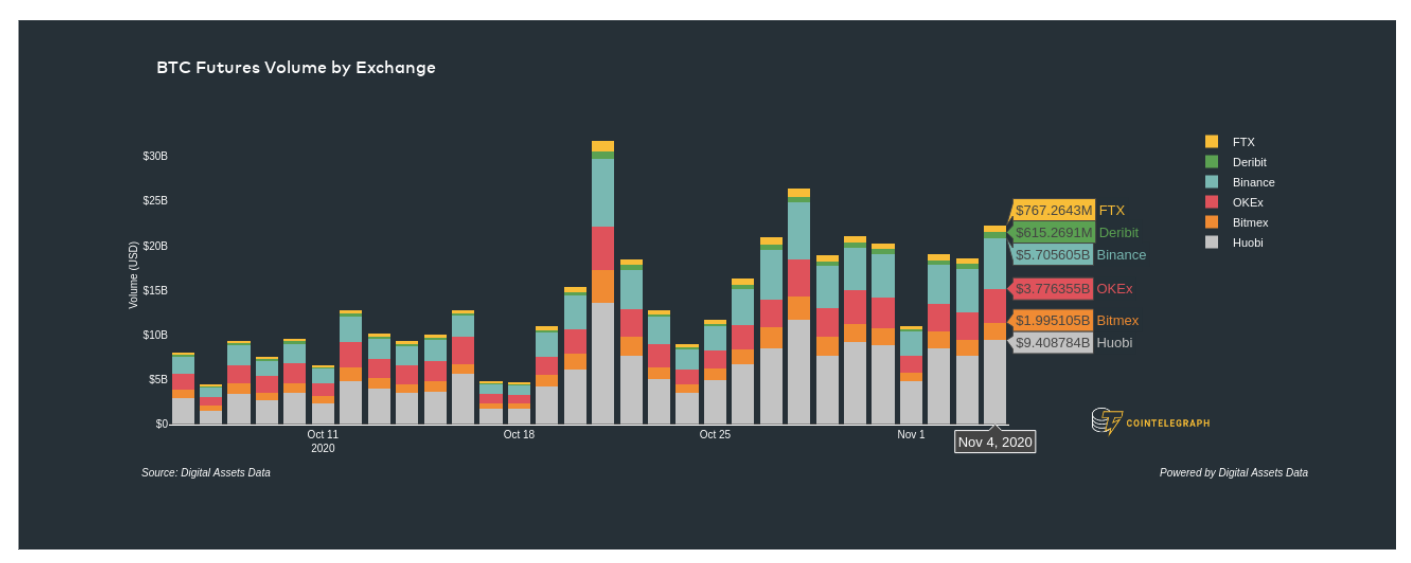

Data from Cryptox and Digital Assets Data also show that monthly Bitcoin transaction volume and BTC futures volume has been on the rise since the end of October.

When analyzing options, the 25% delta skew is the single most relevant gauge. This indicator compares similar call (buy) and put (sell) options side-by-side.

It will turn negative when the put options premium is higher than similar-risk call options. A negative skew translates to a higher cost of downside protection, indicating bullishness.

The opposite holds when market makers are bearish, causing the 25% delta skew indicator to gain positive ground.

Oscillations between -10% (slightly bullish) and +10% (slightly bearish) are considered normal. This hasn’t been the case since Oct. 19, when Bitcoin broke the $11,600 level and never looked back.

This indicator is the most substantial evidence a trader interested in derivatives needs to recognize Bitcoin options’ current sentiment.

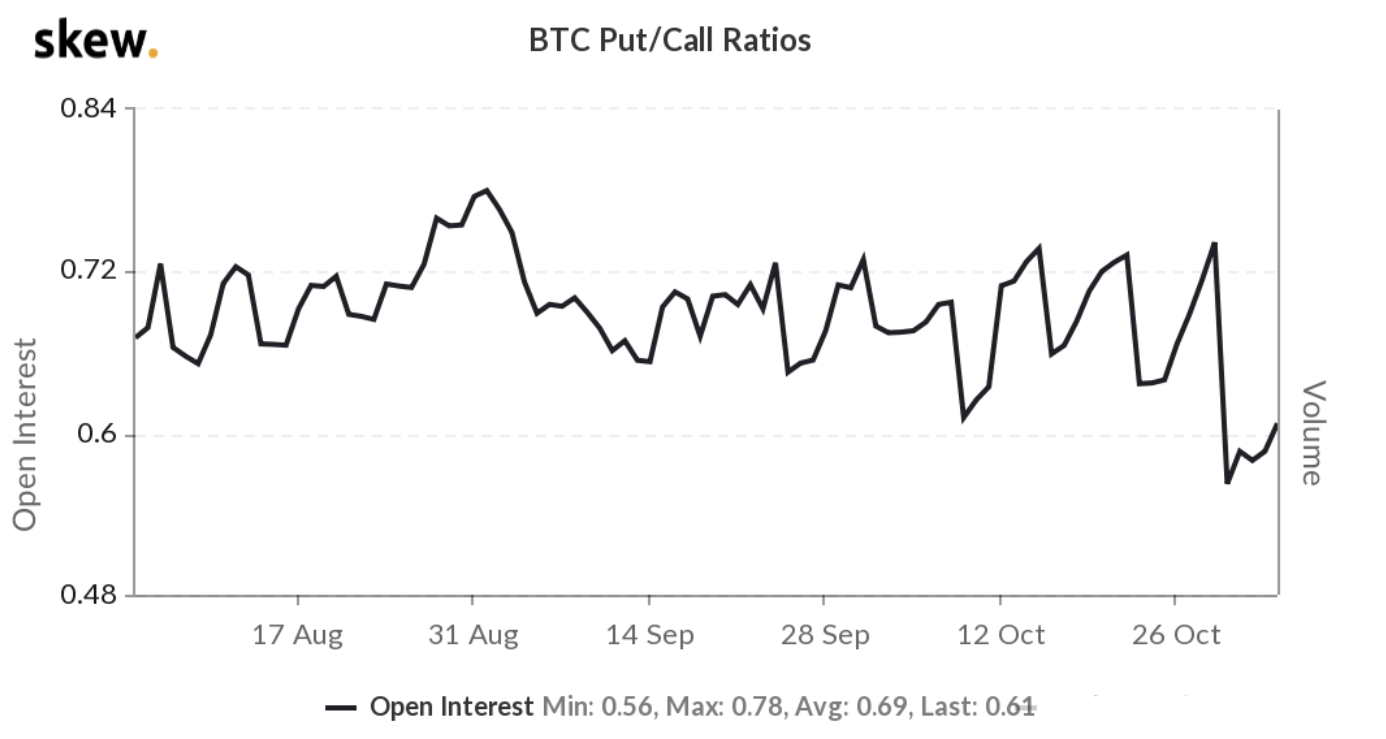

Observe the put-call ratio for additional confirmation

To further investigate how those instruments are being used in traders’ strategies, one must dive into the put-to-call ratio. Call (buy) options are generally used on neutral and bullish strategies, while put (sell) options the opposite.

By analyzing the open interest ratio between put and call options, one can broadly estimate how bearish or bullish traders are.

Put options open interest have been lagging the more bullish call options by 30%. After the October expiry, this difference increased as the indicator reached its lowest level in 3 months.

Based on the current conditions shown by the skew indicator and put-to-call ratio, there is little reason to worry about the growing options open interest.

The market has been signaling bullish intentions, and the liquid derivatives markets are allowing larger players to hedge and enter the spot market.

From the BTC options perspective, everything is clear for the current bull run to continue.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.