Bitcoin is in a no-man’s land. At what levels will it indicate a resumption of the uptrend? Let’s analyze the charts.

Cryptocurrencies can benefit from wider adoption and many believe that with a user base of about two billion people, Facebook can speed up the process. Its Libra project has drawn sharp criticism from regulators, finance ministers and central banks around the world.

Previously, Bitcoin rallied along with risky assets, however, in the past few months, it has been acting similar to a safe haven, though it is not there yet, according to Nelson Minier, head of over-the-counter sales at cryptocurrency exchange Kraken. Minier said that the current state of the cryptocurrency industry, with all its innovation and trading, is similar to how Wall Street was when he was new to it.

Marcus Swanepoel, CEO of cryptocurrency exchange Luno, said that portfolio managers should have some exposure to cryptocurrencies because the astronomical returns far outweigh the risks. So, is it a good time to jump in? Let’s analyze the charts.

BTC/USD

Bitcoin (BTC) is trading inside a symmetrical triangle. Both moving averages have flattened out and the RSI is just below the midpoint, which points to a consolidation in the short term. A symmetrical triangle usually acts as a continuation pattern, hence, we have maintained a bullish bias and are looking for a good entry point. A breakout of the symmetrical triangle will be the first sign of a resumption of the uptrend. Therefore, traders can initiate long positions as proposed in the previous analysis.

However, there is nothing certain in trading because, at times, the symmetrical triangle acts as a reversal pattern. A breakdown below the triangle and $9,080 support can drag the BTC/USD pair to $7,451.63. Due to this uncertainty on the chart and price below both moving averages, we are not recommending traders to go long at current levels.

ETH/USD

Ether (ETH) is stuck between the 20-day EMA and $174.461. Both moving averages are sloping down and the RSI is in the negative zone, which suggests that bears are in command. Though the price broke down of the critical support at $192.945 on Aug. 14, bears have not been able to sink it to the next support at $150.

This shows some cherry-picking by investors at lower levels. When the price fails to follow through on the downside after breaking down of an important support, it tends to reverse direction and run in the opposite direction as short-term traders attempt to benefit from a counter-trend trade.

A breakout and close (UTC time) above the 20-day EMA can result in a quick rally to $235.70. Though there is a minor resistance at the 50-day SMA, we expect it to be crossed. Hence, aggressive traders can initiate long positions as suggested in our previous analysis. However, this is a risky trade because the trend is still down, hence, keep the position size at 50% of the usual.

XRP/USD

Though XRP reached the 20-day EMA, it could not break out of it. The cryptocurrency has not broken out of the 20-day EMA since breaking down of it on June 27. This shows that bears are aggressively defending the 20-day EMA.

However, the failure of bears to capitalize on the breakdown below $0.24508 shows that lower levels are attracting buyers. If bulls can push the price above the 20-day EMA, it will signal the end of the downtrend. Though there is a minor resistance at the 50-day SMA, we expect it to be crossed. The first target is $0.34229. Aggressive traders can initiate long positions as suggested in our previous analysis.

If the XRP/USD pair turns down from current levels and plummets below $0.24508, it will indicate the start of a new downtrend. The next level to watch on the downside is $0.19.

BCH/USD

The volatility in Bitcoin Cash (BCH) has shrunk and the price is stuck between the trendline of the channel and the 20-day EMA. A breakout of the moving averages can push the price to $360, which is a critical resistance. If this level is scaled, we expect momentum to pick up. Hence, we will propose long positions on a breakout and close (UTC time) above $360.

If the BCH/USD pair breaks down of the trendline of the ascending channel, it can drop to the neckline of the large head-and-shoulders pattern. A breakdown and close (UTC time) below the neckline will complete the bearish pattern, which will be a huge negative. The next level to watch on the downside is $166.98 and below it $105.

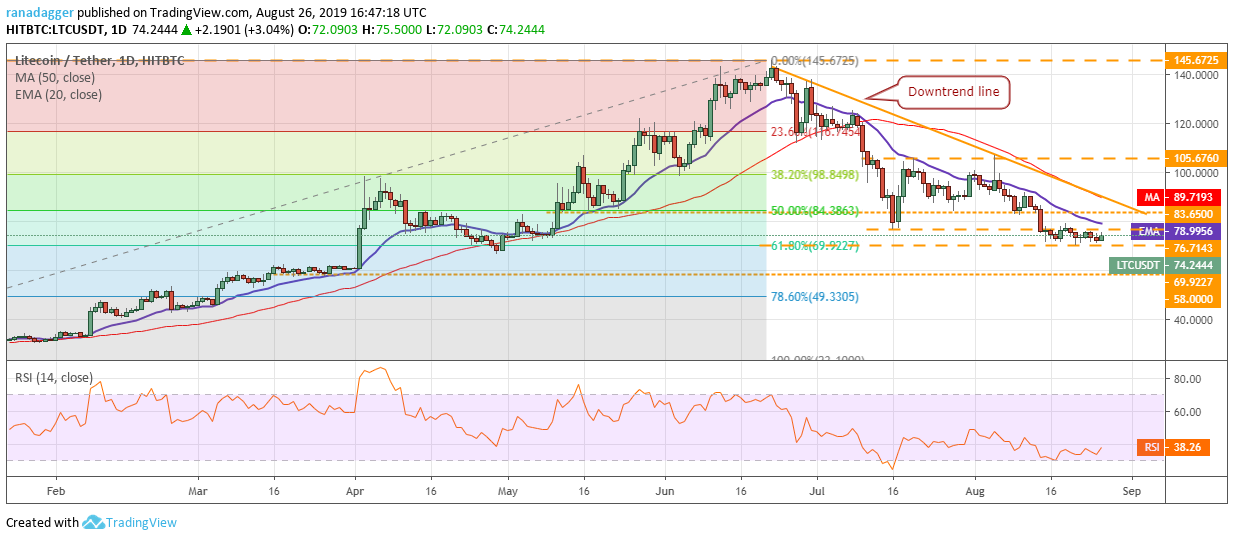

LTC/USD

Litecoin (LTC) has been holding above $69.9227 for the past few days but has not been able to achieve a strong bounce off it. This shows a balance between both buyers and sellers as neither party is showing any conviction.

The balance will tilt in favor of bears if the price slides below $69.9227. The next support on the downside is at $58. Conversely, a breakout of the 20-day EMA will be the first sign that investors are back in action.

However, as the LTC/USD pair has turned down twice from the downtrend line, we will wait for it to scale above it before turning positive. Above the downtrend line, the first target to watch is $105.676. A breakout of this resistance will signal resumption of the uptrend.

BNB/USD

Binance Coin (BNB) is struggling to hold onto the support at $26.202. This is a negative sign as it shows a lack of buying interest at current levels. If the price slides below $26.202, it can drop to $24.1709. This is an important level to watch out for because if it cracks, the cryptocurrency can turn negative and drop to $18.30.

Both moving averages are sloping down gradually and the RSI is below the midpoint, which suggests that bears have the upper hand.

Our negative view will be invalidated if the BNB/USD pair bounces off current levels or from $24.1709 and breaks out of the 50-day SMA. Such a move will signal the return of buyers. We will wait for the price to sustain above the 50-day SMA before turning positive. Until then, we remain neutral on the pair.

EOS/USD

EOS is currently range-bound with a negative bias. It has been trading below both moving averages that are sloping down and the RSI is in the negative zone, which shows that bears have the upper hand. The downtrend will resume on a breakdown of the critical support at $3.30. However, the bears have not been able to penetrate $3.30 since July 16, which shows that selling dries up at lower levels.

If bulls can push the price above the 20-day EMA, it might attract traders in anticipation of a change in trend. Above the 20-day EMA, there is a minor resistance at the 50-day SMA, above which the EOS/USD pair can move up to $4.8719. Aggressive traders can buy on a close (UTC time) above the 20-day EMA and keep a stop loss of $3.20. This is a trade in anticipation of a trend change, hence, keep the position size at 50% of the usual.

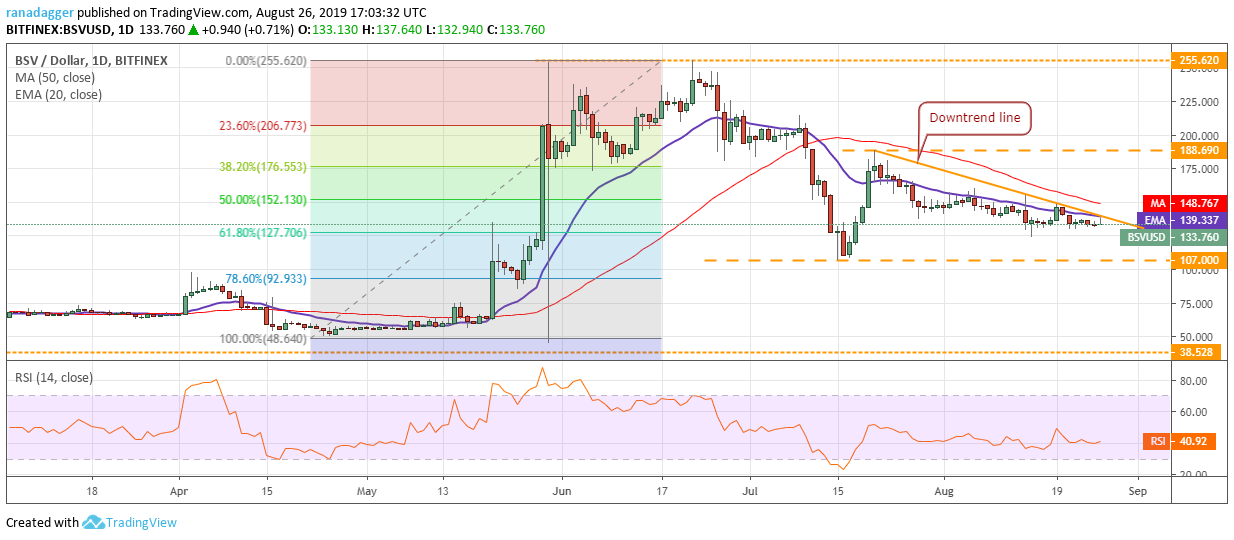

BSV/USD

Bitcoin SV (BSV) has been trading in a tight range for the past five days. A contraction in volatility is usually followed by an expansion, which can offer a quick short-term trading opportunity. We will wait for the price to make a decisive move to the upside by breaking out of both moving averages before recommending a trade in it. On scaling above the moving averages, a rally to $188.69 is probable.

Nonetheless, if the range resolves to the downside and the price breaks down of $123.67, a drop to the strong support of $107 is probable. A breakdown of this support will be a huge negative that can plummet the BSV/USD pair to $85.338. With both moving averages sloping down marginally and the RSI below 50, the advantage is with bears.

XMR/USD

Monero (XMR) is currently range-bound. If the price breaks out of the range, it will resume its up move, whereas a breakdown of the range will start a new downtrend. It is best to initiate a trade after the price makes a decisive move out of the range because the price action inside the range can be volatile.

A breakout of both moving averages will be the first indication that bulls are back in action. However, the XMR/USD pair will resume its uptrend on a breakout and close (UTC time) above $98.2939. Conversely, if bears sink the pair below $72, a drop to $60 is possible. Currently, bears have a marginal advantage and the chart is not offering a trade with a good risk-to-reward ratio, hence, we suggest traders remain on the sidelines.

XLM/USD

Stellar (XLM) is in a downtrend with price quoting below downsloping moving averages. This shows that bears have the upper hand. The bulls attempted to push the price above the 20-day EMA and the horizontal resistance of $0.072545 on Aug. 25, but failed.

One positive is that the price has not turned down sharply from the overhead resistance, which shows that sellers are exhausted. The bulls will make one more attempt to push the price above the overhead resistance. If successful, a move to the 50-day SMA and above it to $0.097795 is likely. Therefore, we retain the buy recommended in the previous analysis. This is a counter-trend trade, hence, it should be attempted only by aggressive traders.

Contrary to our assumption, if the XLM/USD pair fails to break out of the overhead resistance, it can drag the price back toward $0.065435. The pair will resume the downtrend if it falls to new yearly lows.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by the HitBTC exchange.