Coinspeaker

Number of Bitcoin Wallets Holding 10+ Coins Hits All-Time High

Bitcoin has reached a significant milestone: wallets with over 10 BTC now hold a record 16.17 million BTC. This strong accumulation indicates a high level of confidence among major Bitcoin investors, despite recent price fluctuations.

Recent data from Santiment shows that while Bitcoin’s price has dipped below $61,000, dropping 3% in the last 24 hours, large Bitcoin holders continue to accumulate. This suggests optimism about Bitcoin’s long-term value.

Stablecoins and Market Sentiment

The future movement of Bitcoin price largely depends on stablecoin holders, especially those using USDT and USDC. According to Santiment, if these holders increase their buying, it could help push Bitcoin’s price higher.

The Fear and Greed Index has recently shifted from “greed” to “fear”, and is now hovering around the “neutral” zone. Indicators like the Relative Strength Index (RSI) and the Market Value to Realized Value (MVRV) ratio suggest a balanced market sentiment and potential buying opportunities.

Is the Bitcoin Bull Run Over?

While Bitcoin’s whale accumulation is on the rise, certain metrics still don’t favor a significant short-term price surge. Bitcoin has seen a 15% decrease from its peak in mid-March when it surpassed $73,500.

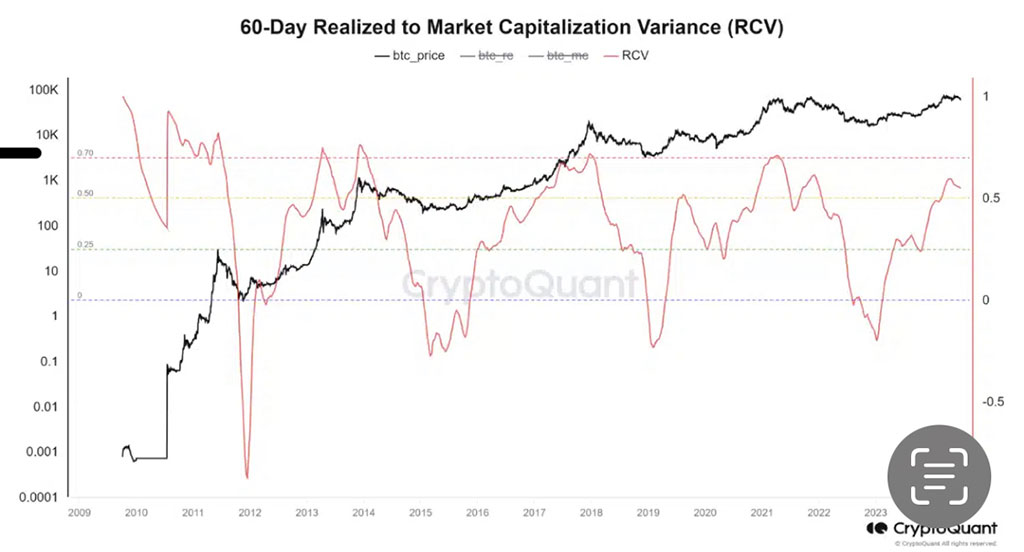

This decline has raised questions about the sustainability of the current upward trend in Bitcoin’s price. As per CryptoQuant’s analysis, Bitcoin has now entered a risk zone based on the 60-day Realized to Market Capitalization Variance (RCV), suggesting a potential shift in market dynamics.

Photo: CryptoQuant

This metric evaluates the two-month change in Bitcoin’s realized capitalization relative to its present market value, providing insights useful for long-term investment strategies like Dollar Cost Averaging (DCA).

Despite this, there remains potential for growth, with readings near 0.70 indicating possible higher market valuations for Bitcoin. Analysts caution that a surge in demand around the 0.50 level could mimic past market trends observed in 2017, potentially establishing new long-term highs for Bitcoin.

Events Determining Price Trajectory

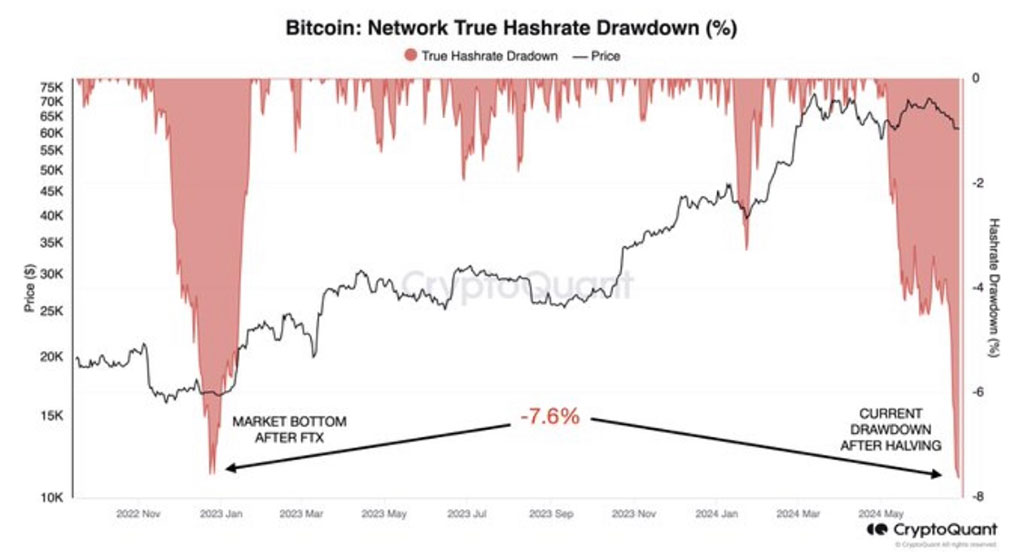

Recent developments in Bitcoin mining have significantly influenced the cryptocurrency’s market dynamics. CryptoQuant reports a 7.6% drop in Bitcoin’s hash rate last month, reminiscent of levels last seen post-FTX exchange collapse. This decline follows Bitcoin’s recent halving, reducing miner rewards to 3.125 BTC per block.

Photo: CryptoQuant

Miners are facing reduced revenues from alternative sources amid declining network activity. Initially benefiting from high transaction fees post-halving, earnings have since declined as network activity slowed. This decline in profitability has led to miner capitulation, where miners sell Bitcoin to cover costs, adding to recent downward pressure on Bitcoin’s price.

In addition, the looming Mt. Gox repayment process has drawn significant attention from cryptocurrency investors. Mt. Gox, once the largest Bitcoin exchange, recently transferred about 150,000 BTC to several wallets, sparking rumors of creditors potentially receiving long-awaited repayments. Many analysts predict further selling pressure in the coming months.

Number of Bitcoin Wallets Holding 10+ Coins Hits All-Time High