Some Bitcoin indicators show similarities between the post-ATH price action and current trend, implying that there will be one last push up before a bigger drop.

Indicators Might Show Today’s Price Action Is Similar To That After $64.5k ATH

As explained by a CryptoQuant analyst, there seem to be many similarities between the Bitcoin indicators of the post all-time-high (ATH) period and that of present day.

There are three main metrics of relevance here. The first is the exchange reserve, which shows the amount of BTC currently being held on centralized exchange wallets.

Here is how this indicator’s value has changed during the past year:

The BTC exchange reserve after the ATH vs today

Looking at the above graph, there does seem to be a similarity between the two periods. Both had declining prices as well as declining exchange reserves.

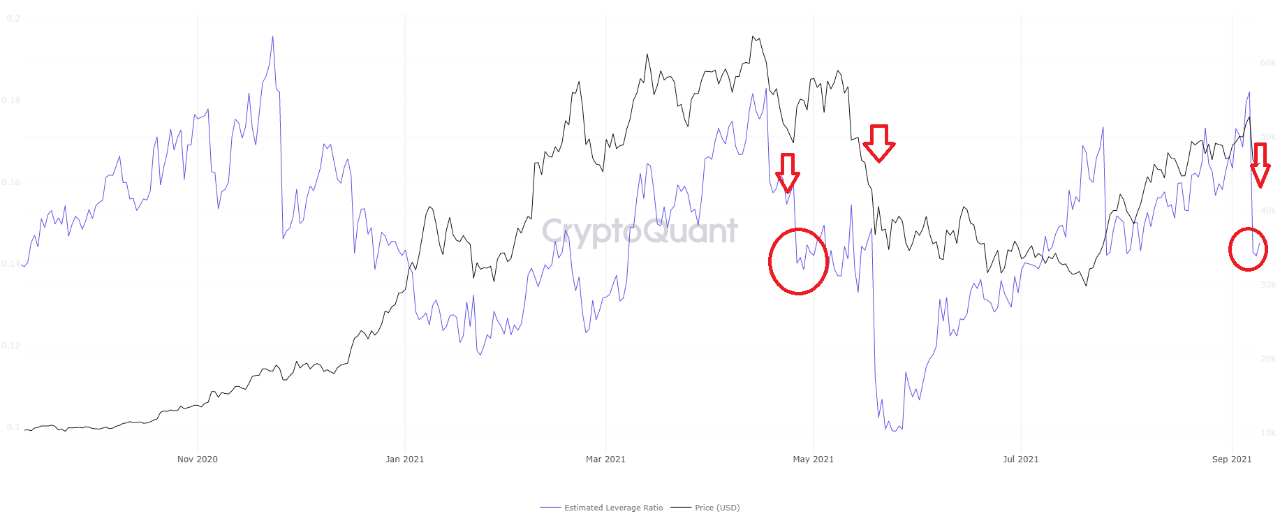

Next is the estimated leverage ratio, an indicator that shows how much leverage is used by traders on average. It’s calculated by taking the open interest divided by the exchange reserve.

The leverage ratio seems to be plunging down

Here too a similarity can be seen as the indicator seems to have sharply dropped down during both present day and the post-ATH period.

Related Reading | Why This Investor Fled His Bitcoin Position, Should You Do The Same?

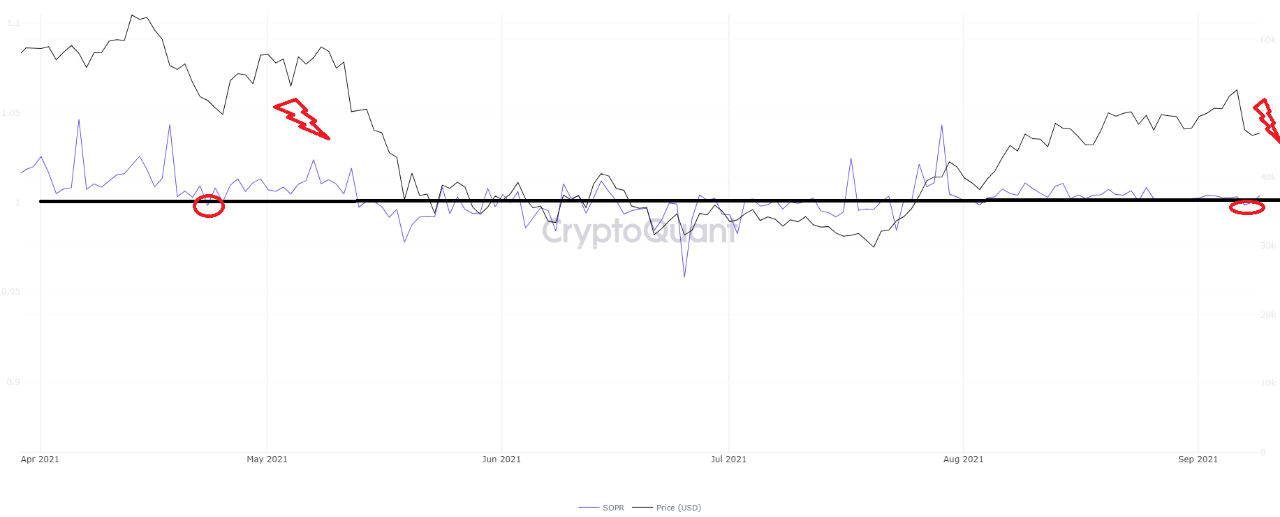

Finally, there is the Spent Output Profit Ratio (SOPR), which is calculated by taking the ratio of realized value (in USD) to the value of creation of a spent output.

In simpler terms, the indicator shows whether Bitcoin wallets are selling their coins at a profit or a loss. The below chart shows the trends for this metric.

The BTC SOPR over the past six months

Looks like the value of the SOPR dropped down below 1 during both these periods. Such a value indicates that investors have been selling BTC at a loss (while values above 1 would imply the opposite).

Related Reading | Bitcoin Price “Pitchfork Channel” Could Pin-Point The Last Dip Ever

If the current trend really is similar to the post-ATH one as these indicators would seem to imply, then it means BTC’s price might move up soon and make a local peak. And just like last time, a big drop could happen after that which takes the price to lower levels. So that this uptrend could turn out to be the last move up for a while.

BTC Price

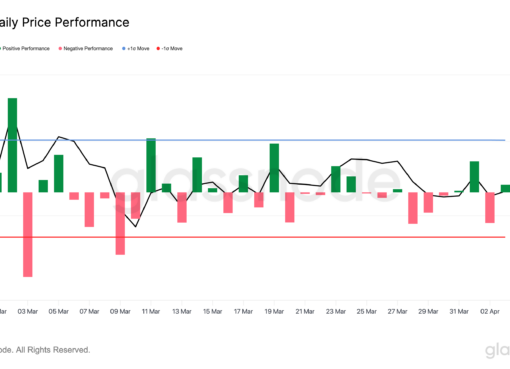

At the time of writing, Bitcoin’s price floats around $45.7k, down 10% in the last 7 days. Over the past month, the cryptocurrency has dropped 1% in value.

Here is a chart showing the trend in the price of the coin over the last three months:

Bitcoin's price moves sideways after a big plunge downwards | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant