The introduction of the consultation paper, which is open until March 31, is the next major show of good faith for the regulator, and industry experts are keeping a close eye on the events moving forward.

The Hong Kong Securities and Futures Commission (SFC) has released a consultation paper that shows it is making good on its promise to return the city to its once glorious era as a crypto hub. According to reports, the SFC is looking to permit the trading of large crypto coins for all retail traders but with significant safeguards.

While the harsh stance of the Hong Kong SFC on crypto has been generally milder than that of Mainland China, the regulator has been quite strict in permitting active crypto trading platforms on its shores. As of now, only two platforms including HashKey Group and BC Technology Group’s OSL bourse, and trading is only allowed for traders whose portfolio is at least HK$8 million (US$1 million).

Per the new position of the regulator, the limit will be removed and more exchanges will be permitted to trade digital assets that it termed big enough. The regulator was notably silent on which exchanges it will permit to trade as well as the exact digital currencies.

However, the SFC said the eligible crypto must be accepted in at least 2 investable indexes from independent providers. Per the regulator, one of the two index providers must have experience in the traditional financial sector.

The definition of index providers is also not clear as to whether they must operate on or off-shore. With the open-ended possibility in this regard, permitted trading platforms will be required to make the unique discretion of which of the coins to list or not.

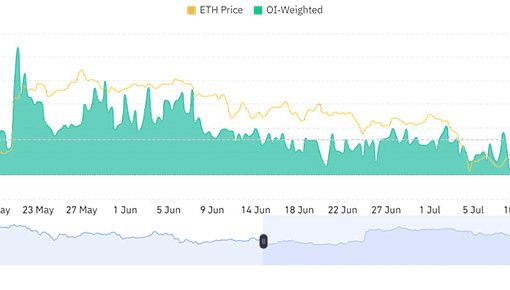

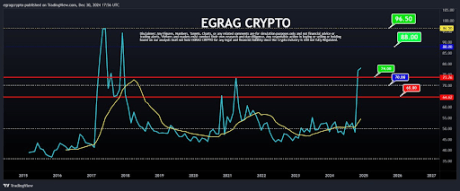

At this time, Bitcoin (BTC) and Ethereum (ETH), the two largest digital currencies in the world are the obvious favorites to be listed for trading in Hong Kong. Except for the conditions changes, these two assets will form the basis for which other cryptocurrencies’ eligibility will be based.

Hong Kong and its Crypto Rebalancing

While it may not yet be visible, the rebalancing of the crypto ecosystem in Hong Kong may take more than just the sweet promises made thus far. The industry has faced a lot of significant headwinds over the past year with the bankruptcies of Three Arrows Capital (3AC), Celsius Network, Zipmex, and more recently FTX Derivatives Exchange as the key dealbreakers to become more strict with the nascent industry.

While the SFC will choose to be more lenient with its crypto regulations, market participants will also proceed with caution as many investors have lost money to these platforms whose collapse has wiped away billions of dollars from the industry.

The SFC will have to make a distinction between the permissible crypto laws and what is extreme in a bid to foster market growth and protect investors as well. The introduction of the consultation paper, which is open until March 31, is the next major show of good faith for the regulator, and industry experts are keeping a close eye on the events moving forward.

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.