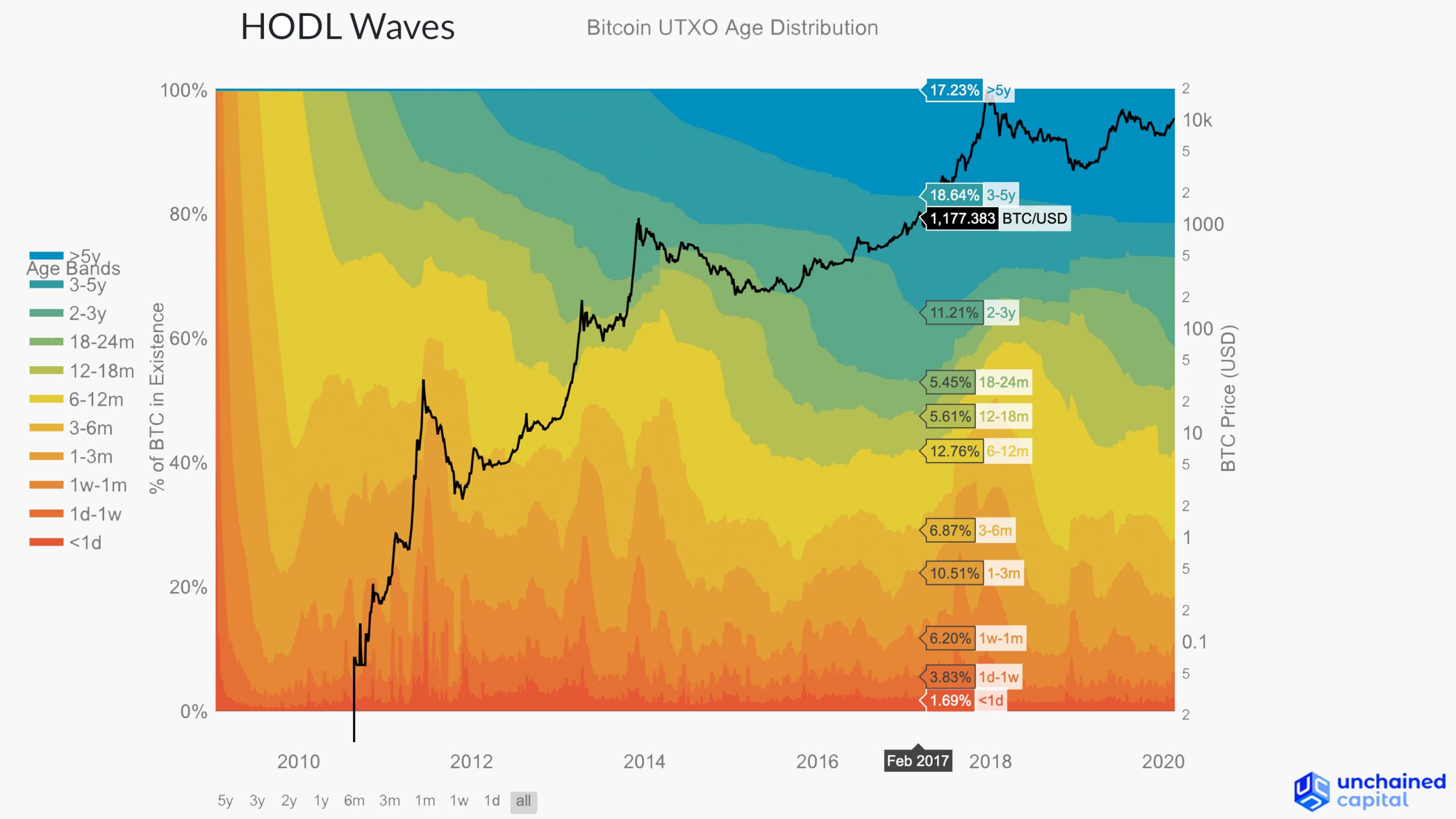

According to a report written by Coin Metrics analyst Jacob Franek, as of March 1, 2020, roughly 42% of all BTC has not moved onchain in more than two years. The metric is the largest number since June 2017 and the study notes that “HODL waves” have grown larger.

Also Read: Get Ready for the Bitcoin Halving – Here Are 9 Countdown Clocks You Can Monitor

42% of All the Bitcoin in Existence Has Not Moved in Two Years

On March 3, Coin Metrics published its “State of the Network” update which covers the BTC network by leveraging various perspectives and data sets. Within the report written by Jacob Franek, the researcher discusses unspent transaction output (UTXO) age analysis and HODL waves. News.Bitcoin.com first reported on the subject of HODL waves in April 2018, after Dhruv Bansal, the cofounder of Unchained Capital, published an in-depth report on the subject. Essentially, Bansal and his team described how they analyzed the BTC network’s UTXOs over the course of a few years and figured out how to measure distinct holding periods. A bitcoin UTXO represents the unspent funds stemming from bitcoin transactions and this data is recorded on the blockchain. When Coin Metrics analyst Franek discussed the subject in the latest update, he noted the earliest contribution to this field was when the term “Bitcoin days destroyed” was first defined.

Franek noted other contributions to the study of HODL waves in 2014 and the writer mentioned Bansal’s 2018 research as well. Unchained Capital’s post on the subject was “instrumental in introducing active supply to a broader audience,” Franek wrote. Two more studies were mentioned (Blummer 2018 and Hauge 2019) in Coin Metrics’ report, both of which research the behavior of bitcoin holders from different angles. When mentioning Franek’s study, fellow Coin Metrics researcher Nate Maddrey explained that 42% of all BTC hasn’t moved in two years. “As of March 1st, about 42% of all BTC has not been moved on-chain (i.e. transacted) for at least two years,” Maddrey tweeted. The analyst added:

The amount of BTC untouched in more than two years has not eclipsed 42% since July, 2017.

Unchained Capital has a live chart that shows all the bitcoins in existence and waves are defined by Bitcoin Age Days (BADs). Essentially, the colored coded chart calculates waves of age distribution within BTC’s identified UTXOs and their age distribution set back to the genesis block in 2009. “The colored bands show the relative fraction of Bitcoin in existence that was last transacted within the time window indicated in the legend,” the Unchained Capital HODL waves chart notes. “The bottom, warmer colors (reds, oranges) represent Bitcoin transacting very recently while the top, cooler colors (greens, blues) represent Bitcoin that hasn’t transacted in a long time.”

The ‘Iron Hands’ of Bitcoin Cash Holders and the Upcoming Reward Halvings

BTC holders are not the only crypto proponents storing their coins for long periods of time. A recent post on the Reddit forum r/btc called “Iron Hands” compares three different cryptocurrencies (BTC, ETH, and BCH) using Coinmarketcap.com’s new chain analysis feature. According to the screenshot and Coinmarketcap.com statistics, the holders’ composition by time held shows that BCH is around 92%, while BTC is 63% and ETH is 54%.

“Interesting that a higher percentage of BCH users are using [bitcoin cash] as a store of value than BTC users,” Bitcoin.com’s executive chairman Roger Ver wrote in response to the thread. “BCH isn’t just a store of value, it’s a great medium of exchange. And like any currency, financially responsible folks will spend some and save some,” explained another BCH proponent on Reddit. Data from charts.Bitcoin.com shows the UTXO Set Size for the BCH network is 68 million, while statistics from the BTC network’s UTXO Set Size are around the same.

The great hodling of BTC and BCH has been taking place just before both networks experience the block subsidy halvings. The BTC chain has 9,819 blocks left to go (at the time of writing) and 68 days left until the halving on or around May 11, 2020. The BCH chain has 5,001 blocks left to go and 34 days left until the halving on or around April 8, 2020.

What do you think about the recent study by Coin Metrics analyst Jacob Franek and the HODL waves research? What do you think about bitcoin cash holders composition by time held showing that BCH is being held for longer periods? Let us know what you think about this subject in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Price articles, halving updates and market reports are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader.

Image credits: Shutterstock, Unchained Capital, Coin Metrics, Reddit user u/TravisWash, bitcoincashblockhalf.com, bitcoinblockhalf.com, Fair Use, Coinmarketcap.com, Wiki Commons, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.