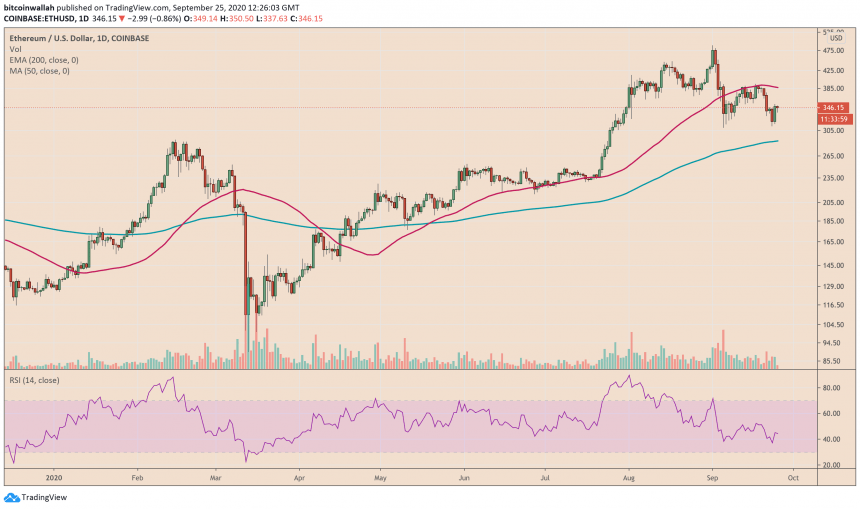

Avalanche started trading on Binance with a bang.

The latest Ethereum rival saw its native token, AVAX, rising by more than 1300 percent in its first hour of trading on September 22. A jump from $0.85 to $12.54 was enough for attracting profit-takers. Thereby, a strong sell-off ensured, and the price crashed.

But despite the bearish correction, AVAX/USD up by 450 percent from its exchange rate open. The pair is consolidating sideways, showing a minimal inclination to extend its move lower. On the other hand, it appears that the token is waiting for more buyers so it could sustain its uptrend.

AVAX/USD maintaining its gains despite a 65% downside move. Source: TradingView.com

The bullish cues come from what AVAX represents: a smart contract platform–another Ethereum killer in the making–that comes up with an exciting way to tackle its rival’s current shortcomings.

Avalanche Crash Course

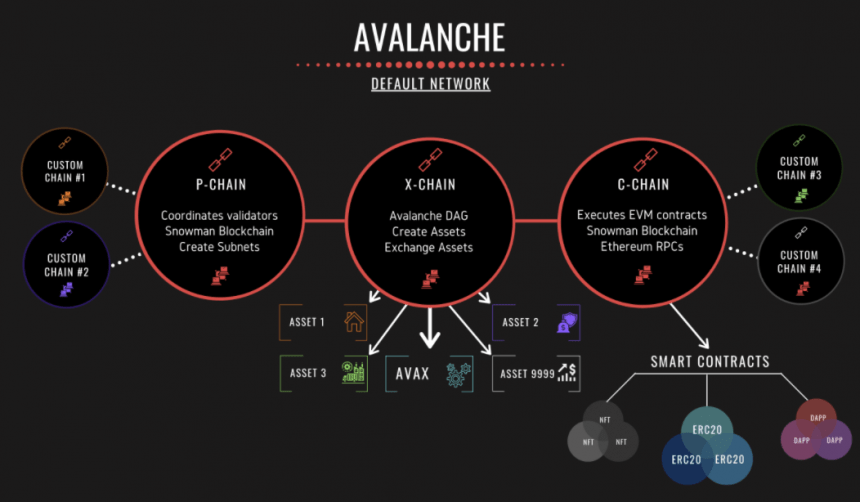

In retrospect, AVAX’s parent protocol, Avalanche, is a multi-blockchain network that consists of three base platforms, each having a critical role to play while protecting the core from a single point of failure.

The X-Chain, for instance, handles the creation of new digital tokens and their exchange between core blockchains and their respective subnets. The C-Chain, on the other hand, manages the design and launch of Solidity-based applications by using a so-called “consensus mechanism” to confirm transactions and make changes.

Avalanche's three platforms explained. Source: Messari

The third and the last in the line is P-Chain. It is a base staking platform that handles network validators – a kind of a decentralized finance protocol. Therefore, every validator must stake on the P-Chain to run the Avalanche’s “Primary Network.”

Meanwhile, the network allows validators to break off into small groups to manage one or more subnets.

From the first look, Avalanche’s idea of having a base network model appears to borrow heavily from decentralized finance projects, Polkadot and Cosmos. Nevertheless, the Ethereum rival comes by its own by tweaks, including a penalty-less staking environment, a hard cap of 720 million AVAX tokens, and a fees burning mechanism.

“The network burns any tokens used to pay transaction fees on its three core chains,” noted Messari researcher Wilson Withiam. “Based on monetary policy alone, Avalanche has a better claim on being a hard monetary asset than most competitors, including Ethereum pre EIP-1559 (ducks for cover).”

What’s Next for AVAX

AVAX expects to stand tall by the sides of Polkadot’s DOT and Cosmos’s ATOM by wearing a rigid monetary policy and a more comfortable validator experience. The token could further benefit should there be a departure from Ethereum over its higher transaction fees.

Avalanche has already enabled its C-Chain to allow Ethereum developers to port their projects onto its network via an EVM called Athereum – a so-called “friendly fork” of Ethereum. Its launch would enable all the ETH users to claim Athereum’s native token ATH.

“Ava Labs spent a good portion of the last few years in stealth mode and has placed marketing on the back burner in favor of pushing out its mainnet,” said Mr. Withiam. “Now is the time to flip the switch, especially with a functional ETH 2.0 so far from grasp.”