This week Ether (ETH) price finally broke through the $2,000 level as aggressive institutional inflow through Grayscale Investments products and declining exchange reserves signaled that buying pressure was increasing.

While many traders are skilled at using perpetual futures and the basic margin investing tools available on most exchanges, they may be unaware of additional instruments that can be used to maximize their gains. One simple way, albeit expensive, is buying Ether call option contracts.

For example, a March 26 call option with a $1,760 strike trades at $340. In the current situation, the holder would only profit if Ether trades above $2,180 in 39 days, a 21% gain from the current $1,800. If Ether remains flat at $1,800, this trader will lose $300. This is certainly not an excellent risk-reward profile.

By using call (buy) options and puts (sell), a trader can create strategies to reduce this cost and improve the potential gains. They can be used in bullish and bearish circumstances and most exchanges offer easily accessible options platforms now.

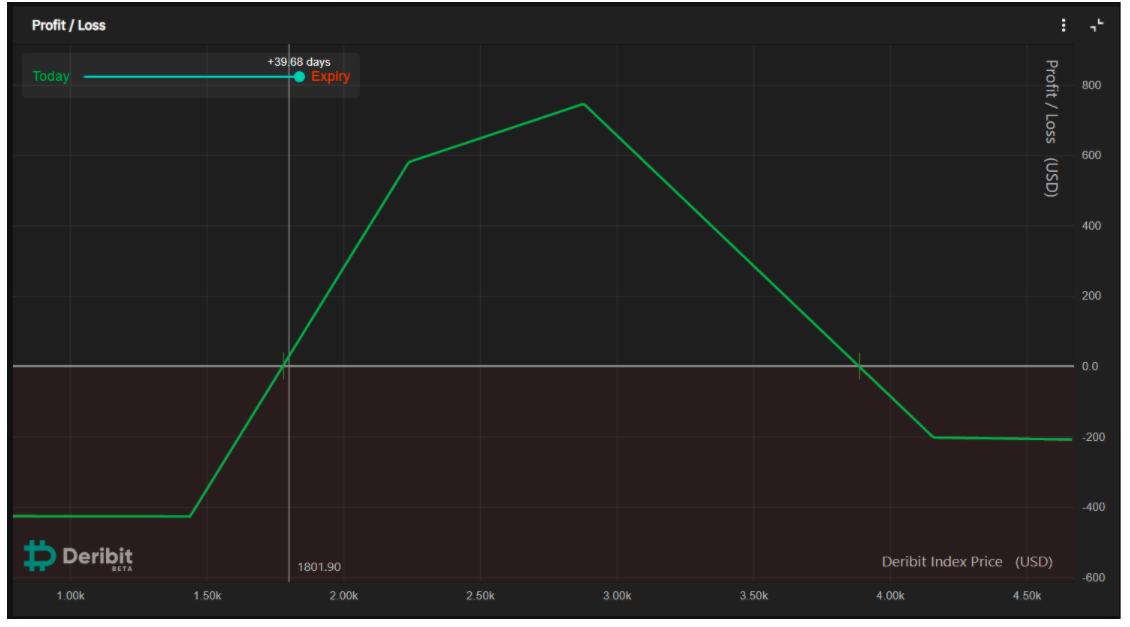

The suggested bullish strategy consists of selling a $2,240 put to create positive exposure to Ether while simultaneously selling a $2,880 call to reduce gains above that level. These trades were modelled from Ether price at $1,800.

Two out-of-the-money (small odds) positions are needed to protect from the possible price crashes below 20% or Ether gains above 130%. Those additional trades will give the trader peace of mind while also reducing the margin (collateral) requirements.

The above trade consists of selling 1 Ether contract of the March 26 put option with a $2,240 strike while selling another 1 Ether contract of the $2,880 strike. The additional trades also avoid the unexpected scenarios for the same expiry date.

The trader needs to buy 0.73 Ether contracts of the $4,160 call in order to avoid excessive upside losses. Similarly, buying 1.26 Ether contracts of $1,440 puts will protect against more significant negative price moves.

As the estimate above shows, any outcome between $1,780 and $3,885 is positive. For example, a 20% price increase to $2,160 results in a $478 net gain. Meanwhile, this strategy’s maximum loss is $425 if Ether trades at $1,440 or lower on March 26.

On the other hand, this strategy can net a positive $580 or higher gain from $2,240 to $3,100 at expiry. Overall it yields a much better risk-reward from leveraged futures trading, for example. Using 3x leverage would incur a $425 loss as soon as Ether drops 8%.

This multiple options strategy trade provides a better risk-reward for those seeking exposure to Ether’s price increase. Moreover, there is zero upfront funds involved for the strategy, except from the margin or collateral deposit requirements.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.