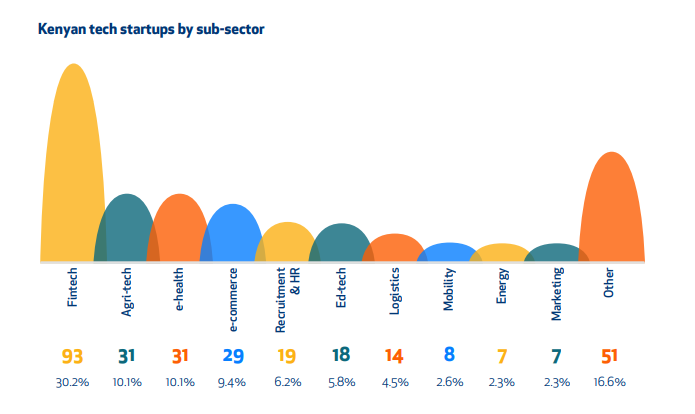

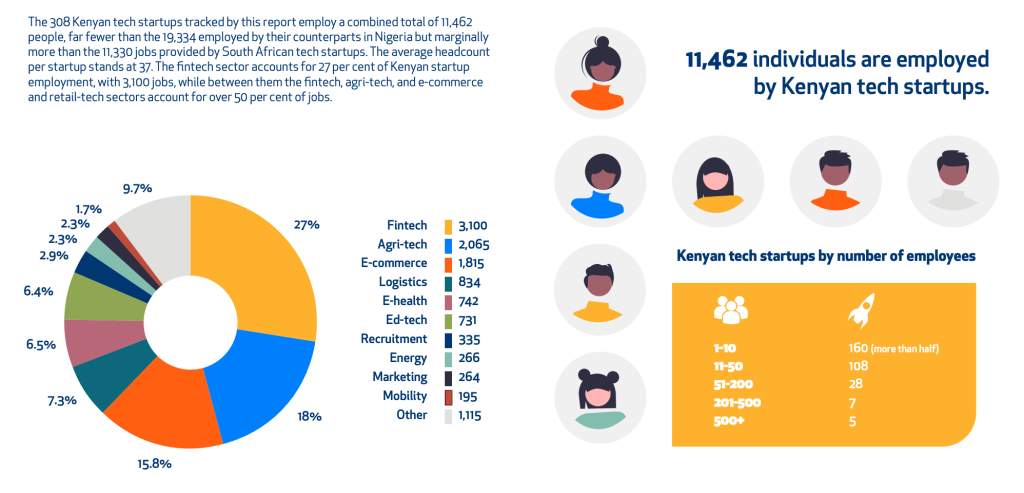

As of November 2022, Kenyan fintechs accounted for 30.2% or 93 out of the 308 tracked tech startups, a Disrupt Africa study recently found. In addition, the study findings show that the fintech sub-sector alone accounted for 3,100 or 27% of the 11,462 people that were employed by tech startups during the same period.

Fintechs Solving Fundamental Problems

According to the findings of a study on Kenya’s startup space, fintech ventures alone accounted for just over 30% or 93 out of the 308 tracked startups. This figure is almost three times more than that of the nearest challengers, namely agri-tech and e-health, which both accounted for 10.1% of Kenya’s tech startups that were tracked between January and November 2022.

However, as explained in Disrupt Africa’s study report on the Kenyan startup ecosystem, the dominance of fintechs is not unusual.

“Fintech takes the top spot in most African countries as it solves fundamental problems for the populace, is an area in which novel tech solutions tend to be well received and quickly adopted, as well as offering attractive returns for investors,” the report said.

Remittances and Lending More Popular Categories

Besides accounting for the largest share of tech startups, fintechs also employed more workers (3,100) than other sub-sectors. Agritech and e-commerce are the only other tech sub-sectors that employed more than a thousand workers.

Meanwhile, as shown by the study’s breakdown of the fintechs’ areas of focus, remittances (24%), as well as the lending and financing (21%) space, appear to be the more popular categories. According to the report, part of the reason for this is that “these areas cover many of the most fundamental financial services that are still lacking for much of the population.” The report added that such categories have been “the jumping-off point for fintech ecosystems continent-wide.”

Concerning the tech startups’ use of blockchain, the study found that 12 of the 30 blockchain-based ventures are fintechs. E-health (6) and agri-tech (5) are ranked second and third, respectively.

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.