- The number of active Ethereum addresses rose by 100 percent in 2020, according to data fetched by Messari.

- The volume picked momentum on signs of growth within the decentralized finance sector (DeFi).

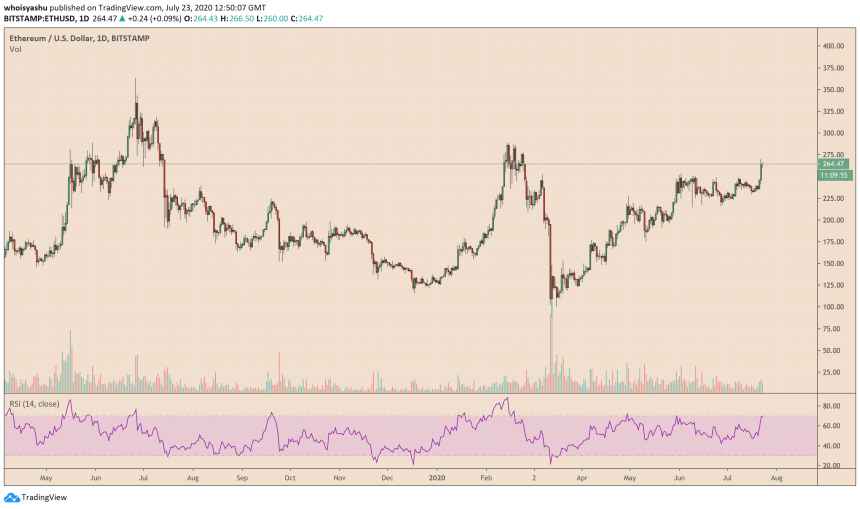

- Meanwhile, the ETH/USD exchange rate also grew higher, breaking above $250 for the first time since February 2020.

Ethereum addresses that either send or receive the token daily rose twofold in 2020, data on Messari revealed.

These active ETH wallets topped at around 573,000 last week, a level last seen during the notorious initial coin offering craze. Only this time, the hype within the Ethereum space shifted to Decentralized Finance, which represents a group of projects that offer staking, lending, oracle, as well as custodial services.

Ethereum active wallets. Source: Messari

DeFi Craze

Almost every token issued by the DeFi project surged by price and market capitalization while heading into the second financial quarter of 2020. Users rushed into these cryptocurrencies to extract maximum profits, primarily via an ongoing liquidity mining phenomenon.

As Ethereum powers a majority of these DeFi projects, an influx of users into it led to a higher number of ERC20 active addresses. The phenomenon also left Ethereum with rising transaction fees, which caused its active wallets to plunge sharply this week.

Messari noted that a rising gas cost points to high demand for Ethereum’s block space. It further adds to the blockchain network’s overall security. Nevertheless, an expensive system can also ward off potential users, especially those who transact in small ETH amounts.

Ethereum Price Hits $250

A growing craze for DeFi tokens does not necessarily serve as a bullish case for Ethereum. Unlike the ICO-era, whereby traders had to purchase ETH to invest in an emerging blockchain asset, DeFi projects can now attract capital using stablecoins.

That is one of the many reasons why the ETH/USD exchange rate was relatively stable during the DeFi boom – since June 1, 2020. The pair remained capped by a strict resistance level near $250. At the same time, it ensured a firm footing near $224 to maintain its short-term bullish bias.

But on Wednesday, ETH/USD broke above the $250-mark. The pair formed an intraday top near $270, a move that came as a part of a market-wide bullish action.

Ethereum price breaks above $250 for the first time since February 2020. Source: TradingView.com

There is no evidence that DeFi alone helped Ethereum to come out of its sideways trading range. But, as Messari stated, there are other catalysts, “such as Ethereum 2.0 or EIP-1559, that could have left “a positive impact” on ETH’s monetary value.

Meanwhile, other analysts see it as a technically-driven rally. Michaël van de Poppe, a crypto daytrader, suggested that the currency breakout attempt could lead the ETH price high towards $500 (as long as it holds above $215).

Ethereum Is Ready For $500!

Check it here:https://t.co/4iR2G734NC

Full TA analysis on $ETH and $LTC!

Enjoy and please subscribe!#ETHEREUM

— Crypto Michaël (@CryptoMichNL) July 23, 2020

Ethereum was trading at $263 at the time of this publication.