Ethena price has been in a strong freefall this week as a sense of fear spread in the crypto industry.

ENA has recorded losses for eight consecutive days, marking its longest losing streak on record. It plummeted to a low of $0.07400 on Tuesday, reaching its lowest point since May 20th. It has lost over half of its value from its highest level this year.

Crypto fear and greed index slips

Ethena has joined other cryptocurrencies that have crashed hard in the past few days. Bitcoin, the biggest crypto in the world, has dropped from this month’s high of near $72,000 to $67,000. Ethereum has also slipped to $3,500 while the market cap of all digital coins has slipped to $2.4 trillion.

This retreat has contributed to a decline in the crypto fear and greed index, which has fallen from this week’s high of 64 to the greed zone of 60.

There has been no direct catalyst for this sell-off since Bitcoin ETFs have continued to accumulate assets in the past few weeks. Therefore, investors are likely anticipating a hawkish Federal Reserve when it concludes its meeting on Wednesday.

Ethena price has dropped even as its ecosystem remains steady. According to DeFi Llama, the total value locked in the ecosystem has jumped to a record high of over $3.38 billion as demand for the Ethena USDe stablecoin jumped.

USDe has now grown to become the fourth-biggest stablecoin in the industry after Tether, USD Coin, and Dai. Its holders have jumped to over 212k as they chase its 27.5% yield. That is a bigger yield than Terra Luna used to offer in its prime.

There are a few concerns about USDe. First, a US legislation proposed by Cynthia Lummis would ban algorithmic stablecoins in the country. Second, there is a risk that the stablecoin will lose its peg in case of substantial volatility in the crypto industry.

Third, unlike stablecoins like Tether and USDC, USDe is not backed by fiat currency. Instead, the developers have described its mechanism as a “delta-neutral synthetic dollar backed by assets outside the banking system.” It achieves its stability by hedging the spot assets’ delta during the minting process.

Ethena price forecast

Ethena’s hourly chart

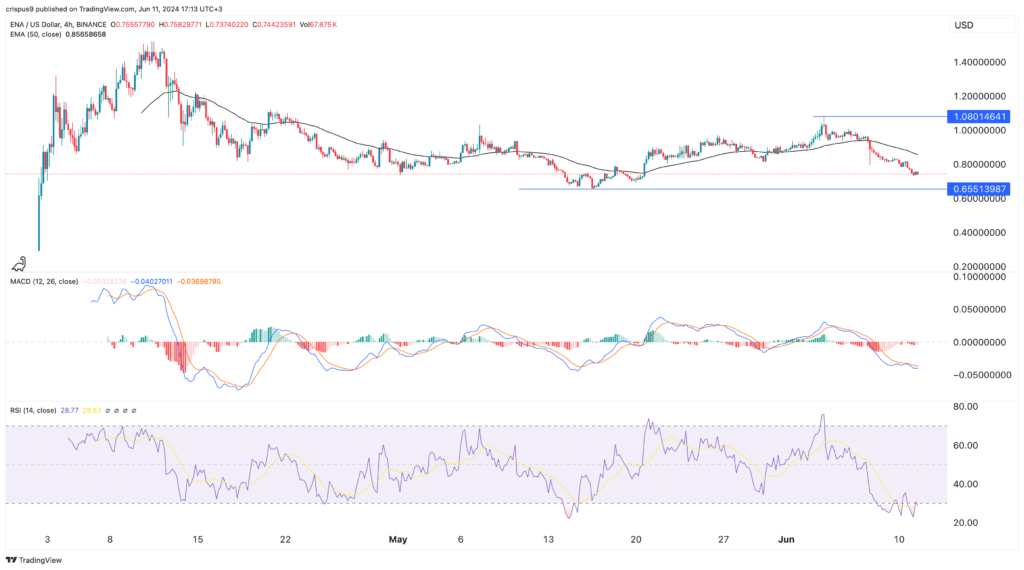

The 4H chart shows that the Ethena token price has been in a strong bearish trend after peaking at $1.0800 last week. It has now slipped below the 50-period moving average while the MACD indicator has dropped below the neutral level.

The Relative Strength Index (RSI) has also moved from the overbought level of 75 to the current 30. Therefore, the path of the least resistance for the token is bearish, with the next point to watch being at $0.6550, its lowest swing on March 16th.