Bitcoin (BTC) begins a new week testing increasingly weak $9,000 support, but what factors could make or break price performance?

Cryptox Markets takes a look at the main things traders should focus on in Bitcoin for the coming five days.

Stocks recover led by China

Stock market futures showed a mixed but overall stronger mood going into Monday. Data, notably last week’s better-than-expected United States employment figures, helped to buoy the mood.

Stocks continue to rise, with Chinese stocks booming, despite the rapidly increasing spread of coronavirus. China’s FTSE A50 index hit all-time highs on the day.

Weighing that issue against economic data is a key balancing act for the market, and its volatility is set to reflect in Bitcoin’s own moves.

“As a proxy for risk sentiment in China, this could bode well for crypto,” crypto lender Amber Group forecast.

At press time, BTC/USD had just hit $9,200, a level not seen since July 2, having dipped below $9,000 late Sunday.

Bitcoin vs. S&P 500 three-month chart. Source: Skew

As Cryptox reported, Bitcoin’s correlation with macro may yet yield more pain than gain for investors. The curious “recovery” of stocks comes amid mass interventions in the markets by central banks.

Last week, charts showing market performance denominated in Bitcoin and gold highlighted just how unstable current conditions really are.

…While China stomps on financial privacy

Staying on economic factors, Monday’s finance news was dominated by China imposing checks on large transactions.

As Bloomberg reported, the pilot program will ultimately affect 70 million people, who will all be required to pre-report transactions worth over 500,000 yuan ($71,000), be they retail or business clients.

The issue is bad debt, which has surged in China in the wake of coronavirus and is now causing major headaches for smaller domestic banks.

Chinese residents are officially banned from trading Bitcoin, but over-the-counter (OTC) activities remain, with the true size of the underground market a matter of debate.

Recently, one mining pool located in China saw its second-biggest outflow in history, leading to suggestions that the BTC may end up in an OTC sell-off.

Meanwhile, the debacle over Hong Kong and its new security law has so far failed to impact Bitcoin in the way that last year’s riots did. At the time, Bitcoin as a safe haven narrative took center stage as cash supplies dwindled and the Hong Kong dollar fell precipitously amid the unrest.

Bitcoin fundamentals shoot higher

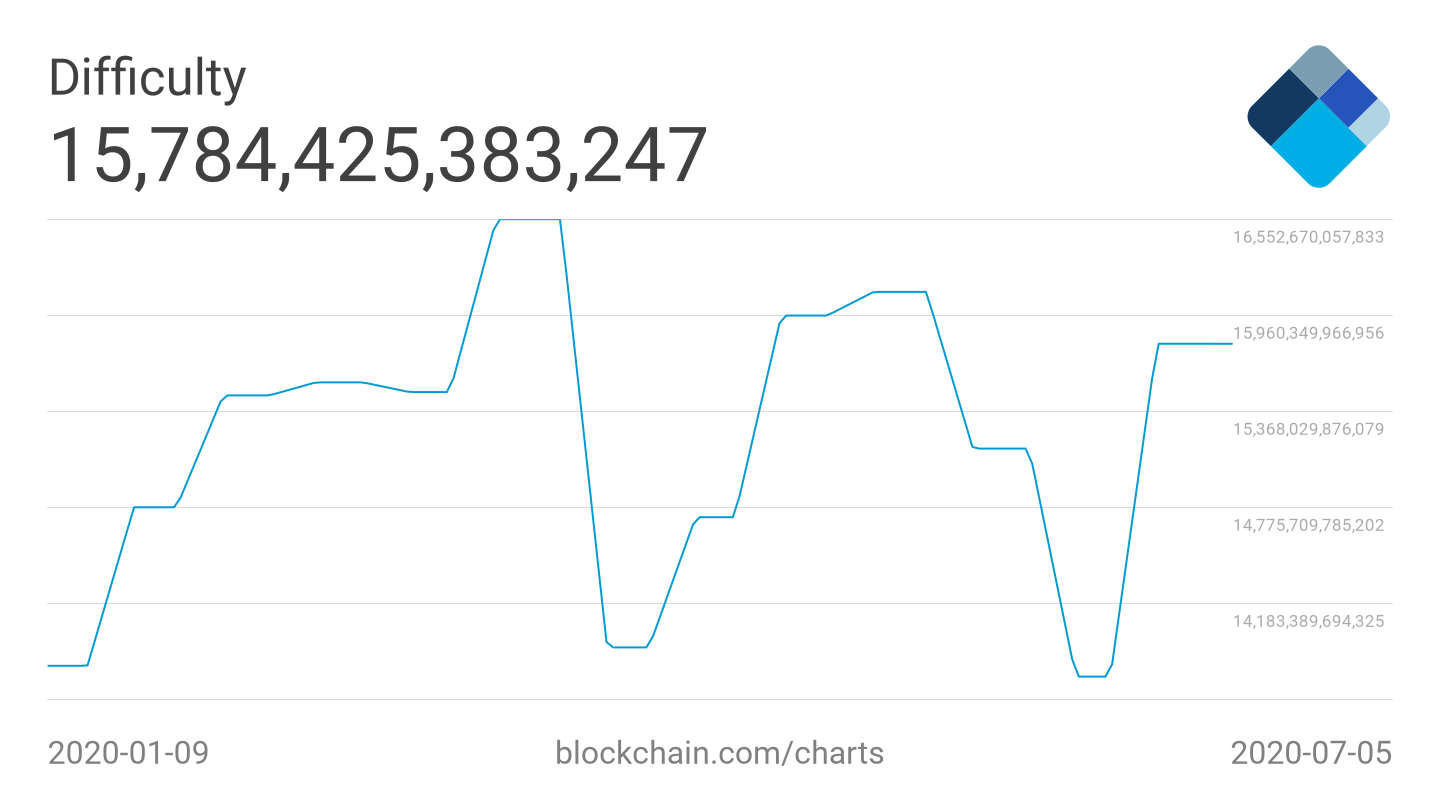

Having stayed completely static at the last adjustment, Bitcoin network difficulty is once again set for a healthy uptick next week.

The difficulty, non-technically, is a representation of miner participation in the Bitcoin network. Its value goes up and down due to factors impacting their activity, including price.

Adjustments, which occur every two weeks, are a vital part of Bitcoin’s ability to regulate itself as a system — regardless of price action or otherwise.

In around seven days’ time, the difficulty will increase by an estimated 6%, implying demand is in place to make processing Bitcoin transactions more intensive in terms of computing power.

The previous adjustment was 0%, a rare occurrence, while before that, difficulty jumped by 15%, its highest single upward move in over two years.

Bitcoin 7-day average difficulty six-month chart. Source: Blockchain

Meanwhile, hash rate — an estimate of the computing power already devoted to mining — hit highs of over 120 EH/s this weekend, data from Blockchain suggests. Hash rate has increased by 10% in the past two weeks.

Futures “mini gap” provides little inspiration

Those hoping that a gap in Bitcoin futures markets might drive price performance to a certain level will be disappointed this week.

Low volatility over the weekend means that the difference between last week’s trading close and this week’s open is almost nonexistent — just $20.

Bitcoin has a tendency to “fill” gaps left in futures quickly. As Cryptox reported, it was only a matter of days before even a giant $1,000 void was canceled out by gains earlier this year.

For the coming week, however, the $20 gap at $9,100 is already filled.

CME Bitcoin futures 30-minute chart with gaps. Source: TradingView

Overall, however, derivatives markets form an increasingly important focus for Bitcoin analysts, given that they are responsible for the lion’s share of the trading volume. Last week, Cryptox discussed what time of day traders are most active.

The volume will dictate “heavy” Bitcoin breakout or breakdown

For the short term, Cryptox Markets analysts believe that the most important thing for Bitcoin is to hold not even $9,000, but lower.

In a summary late last week, Michaël van de Poppe explained that $8,600 was the target to protect, and failure to do so would trigger a “heavy breakdown.”

Similarly, there is potential for a breakout above $10,500, itself a key resistance level. It all depends on volume, says Van de Poppe.

“During the range-bound period of 2019, the volume drained away over time. The actual climax of the volume came with the breakout, which meant that breakout traders hit their limit buys and shorters hit their stop/loss,” he wrote, comparing the 2019 bull run and current conditions.

“This chain reaction triggered a sudden $1,000 candle.”

Volume dips have accompanied the return of lower exchange reserves as traders appear primed to hold and not sell for the near term.