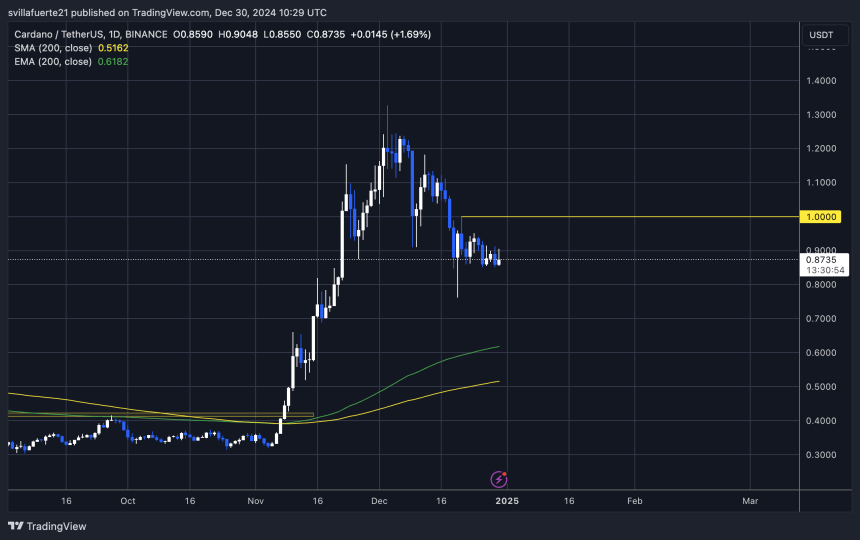

Cardano (ADA) has faced a challenging period, experiencing a sharp 42% correction since reaching a multi-year high of $1.32 in early December. This significant decline reflects the broader market uncertainty, with increased selling pressure and cautious investor sentiment weighing heavily on ADA’s price. Despite this, on-chain data suggests a shift in dynamics, hinting at a potential recovery for the embattled cryptocurrency.

Related Reading

Top analyst Ali Martinez has highlighted key metrics indicating whale accumulation in recent weeks, adding a layer of optimism to ADA’s outlook. According to Martinez, Cardano’s most significant support zone lies between $0.77 and $0.68, a range that has been consistently respected by the market. This support has proven crucial in stabilizing ADA’s price, providing a base from which a recovery could materialize.

The sustained interest from large holders signals confidence in ADA’s long-term potential, even amid short-term volatility. As Cardano continues to defend critical support levels, market participants are watching closely for signs of a breakout. With whale activity increasing and technical indicators aligning, Cardano’s next moves could redefine its trajectory, offering a glimmer of hope in an otherwise challenging environment.

Cardano Setting The Stage For A Move

Cardano has faced a sharp downturn following its explosive rally in November, entering a phase of deep correction that rattled investor confidence. Despite the recent pullback, ADA appears to be finding stability as it consolidates above critical support levels, sparking renewed optimism for a potential rebound.

Prominent analyst Ali Martinez recently shared a technical analysis on X, identifying Cardano’s most significant support zone between $0.77 and $0.68. According to Martinez, ADA’s price action has closely respected this range, reinforcing its importance in preventing further declines. Should ADA continue to hold above this level for a few more days, the groundwork for a strong recovery could be laid, potentially reversing the bearish trend.

Adding to the positive outlook is the behavior of large market participants. On-chain data reveals significant whale activity during this consolidation phase, suggesting that major investors are taking advantage of the lower prices to accumulate ADA. This pattern of accumulation often signals growing confidence in a project’s long-term potential, even in the face of short-term price volatility.

Related Reading

As ADA holds its ground above the crucial support zone, market participants eagerly await a breakout. If a sustained rebound occurs, it could position Cardano for a powerful rally, reclaiming recent losses and potentially testing new highs.

Price Action: Key Supply To Test

Cardano is currently trading at $0.87, grappling with increased selling pressure that has kept its price subdued. Despite the challenges, ADA has demonstrated resilience by holding above key support levels, indicating that buyers are still active in the market. However, the next few days will be crucial for determining its direction.

A significant price milestone lies at the $1 mark, which has acted as a psychological resistance level in recent weeks. If ADA can successfully reclaim $1 with strong volume and momentum, it could pave the way for a massive rally. Such a breakout would likely see ADA targeting its yearly high of $1.32, a level last reached during its impressive November rally. Clearing this resistance would signal renewed bullish sentiment and potentially attract additional buying interest.

Related Reading

On the downside, the risk of a deeper retracement remains if selling pressure intensifies. ADA could test lower demand zones around $0.75, which aligns with historical support levels. This scenario would likely lead to a period of further consolidation as the market seeks equilibrium. For now, ADA remains at a crossroads, with both opportunities for recovery and risks of further downside in play.

Featured image from Dall-E, chart from TradingView