Lightning fast, like most things in Bitcoin and the crypto space, general sentiment in the market seems to have changed. The bears have taken over. BTC’s price has been bleeding and this time suggests further downside.

Many “bought the dip” when it BTC was below $50,000 expecting a bounce-back during the weekend towards the familiar $58,000 area. The bounce is yet to happen and, as some experts have pointed out, BTC could see more blood before it experiences a recovery.

At the time of writing, BTC stands at $42,692 with a 9.4% loss in the daily chart and a 30% correction in the monthly chart. Lower timeframes are moving sideways with a 10% loss in the daily chart as BTC’s price broke below 3 critical support levels at $47,000, $45,000, and $43,000.

As Bitcoin expert Preston Pysh claimed via Twitter, Bitcoin has seen similar corrections in the past. The expert has called recent price action “business as usual” and a consequence of BTC’s compound annual growth rate (CAGR) of 200%.

As depicted below, during 2016 and 2017 bull-fun, BTC’s price saw at least 6 corrections from its yearly low towards, at the time, a new all-time high of $20,000. The corrections varied from 38% and 29%.

The Bears Put Relentless Selling Pressure On Bitcoin

After losing 3 critical support levels, Bitcoin needs to reclaim the area above $44,000 for a potential bounce to finally kick in. However, as trader “lowstrife” has shown, the market is facing relentless selling pressure. A whale on Bitfinex has been selling 100 BTC every minute with a 4,000 BTC short margin. The trader said:

This person has single handedly moved bitfinex -100bp, currently trading ~$180 discount to spot (…). 7091 btc have been taken out from the lending market in large blocks. Looks like this guy takes out a chunk rather than letting the system nibble out like his orders are. We’re talking ~$300m in exposure if these all get added on. Serious player playing serious games.

This person has single handedly moved bitfinex -100bp, currently trading ~$180 discount to spot pic.twitter.com/AwgfuxQ2Jh

— lowstrife (@lowstrife) May 17, 2021

In the last hour, the entity selling BTC on Bitfinex has increased the selling pressure to 200 BTC every minute before taking a pause.

CryptoQuant’s CEO Ki-Young Ju has recorded an increase in BTC inflows for the past days and classified the activity as “unusual”. Although Young Ju said most of the funds have gone towards the derivative sector in Binance, he warned caution:

I don’t usually trade when a bunch of inflow alerts rings off. I’m going to wait until the inflow signal cools off.

Data from Glassnode suggest the selling pressure might be coming from addresses with 1,000 BTC. This metric is at its lowest point in 10 months dropping from 2,500 to 2,150, at the time of writing.

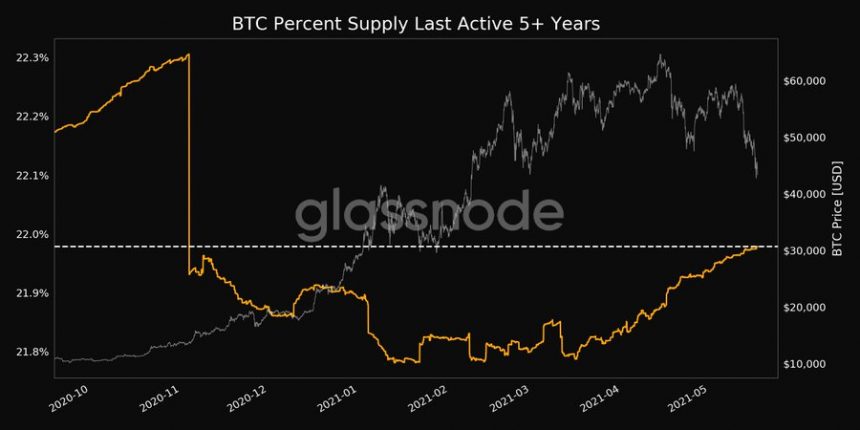

Additional data indicates that inactive coins for the past 5 years could have reentered the market. The metric reached a 6-month high with 21.9% of this supply on the move.