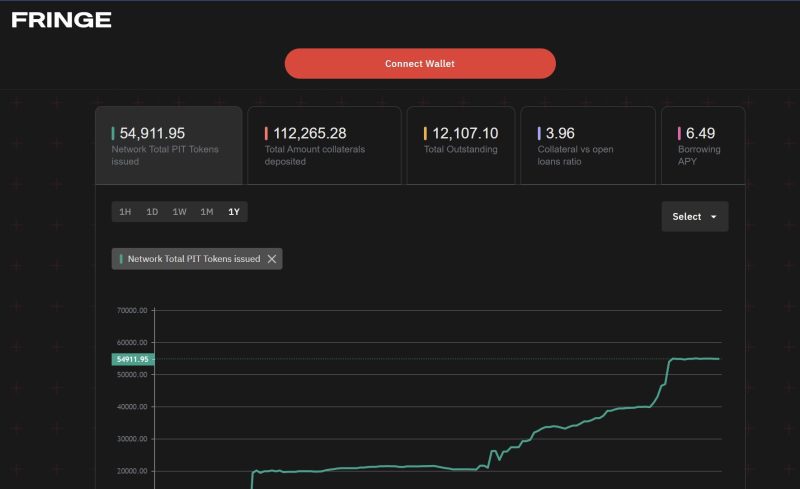

Fringe Finance, an all-new and inclusive DeFi lending platform, saw the integration of $LDO as a collateral type into its Primary Lending Platform (PLP). With Fringe’s PLP, borrowers can take out $USDC loans against their altcoins. Now $LDO holders will get access to stablecoin loans and will be able to unlock part of the value of their positions without selling their tokens.

Below, we’ve prepared a short tutorial on borrowing $USDC with LDO tokens.

How do $USDC Loans work?

Through Fringe Finance, you can take out instant $USDC overcollateralized loans against IoTeX, Matic (Polygon), BNT (Bancor), Ren, Link (Chainlink), SHIB (Shiba Inu), APE (ApeCoin), LDO (Lido DAO), OGN (Origin Protocol), and TOMOE (TomoChain) tokens.

Here’s how it works:

On the Primary Lending Platform, you can deposit altcoins into your personal collateral safes. Your wallet is the only key to moving the assets on your collateral safes. You, and only you, maintain full control of your assets throughout the duration of your loans. Fringe’s PLP has been doubly audited by HashEx and CyberUnit, thus, it the highest standard of security in crypto. Still, we encourage users to always do their own research before dropping assets to a smart contract.

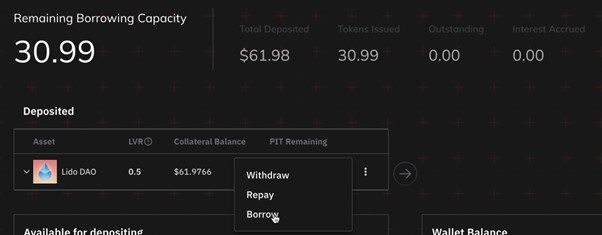

Once assets have been deposited into the platform, you may take out loans against your holdings. The amount a user can borrow depends on the total value deposited in the collateral safe, the asset’s maximum borrowing capacity, and the asset’s loan-to-value ratio (LVR). $LDO’s current LVR in Fringe’s PLP is 50% — depositing $1000 worth of $LDO allows a user to borrow up to 500 $USDC.

Outstanding loans accrue interest continually. This interest, however, does not increase proportionally as your $LDO increases in value. This means that any gains from your $LDO position are entirely yours. If your $LDO drastically depreciates, your position may become undercollateralized and subject to liquidation. In other words, the platform will be allowed to sell an equivalent amount of your deposited $LDO plus a liquidation fee to settle your loan.

What is Lido DAO?

Lido is a staking solution for ETH, SOL, Kusama, and Polygon backed by industry-leading staking providers. Lido lets users stake their tokens — without locking assets or maintaining infrastructure — while participating in on-chain activities, e.g., lending.

This way, the project aims to solve the problems associated with initial ETH 2.0 staking — illiquidity, immovability, and accessibility — making staked tokens more liquid and usable across the growing DeFi ecosystems.

LDO is an Ethereum-based token granting governance rights across the Lido DAO. The Lido DAO features a set of liquid staking protocols, decides on key parameters (e.g., fees), and executes protocol upgrades to ensure efficiency and stability.

How to borrow USDC with LDO on Fringe Finance

You can get an instant $USDC loan with $LDO in five easy steps.

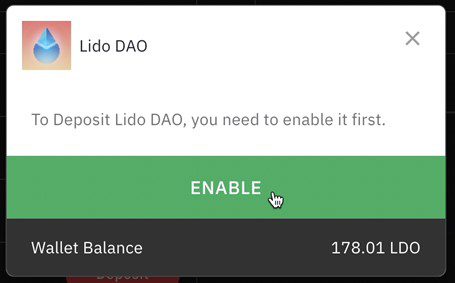

1. Go to Fringe Finance’s PLP and open the Borrow tab. Click the Deposit button on the right of Lido DAO and press Enable. Metamask will prompt you to confirm a transaction enabling the deposit of $LDO into Fringe’s PLP.

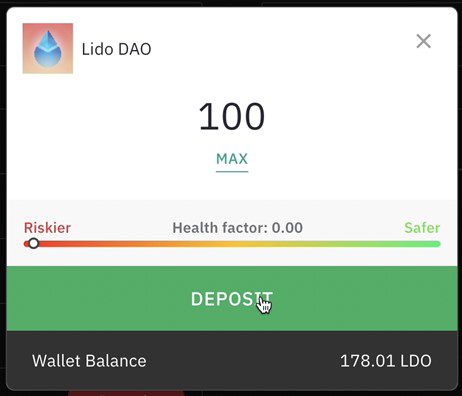

2. First, enter the amount of LDO tokens you would like to deposit. Click Deposit and confirm the operation via your MetaMask wallet.

3. Click Lido DAO’s “ ⋮ ” button to

open the drop-down menu, and then click Borrow.

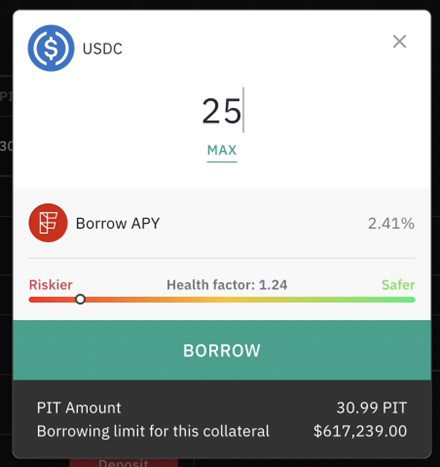

4. Enter the amount of $USDC you want to borrow, taking care to keep the Health Factor as far from 1 as reasonable to avoid being liquidated. Click Borrow and confirm the operation via your MetaMask wallet.

5. That’s it! Your borrowed $USDC will be available in your wallet automatically.

Learn more about Crypto Borrowing and Lending

LDO is one of the top altcoins that can be used as collateral to get an instant loan on Fringe Finance. You can check other accepted altcoins on our Primary Lending Platform, alongside the $USDC lending functionality that allows you to effortlessly earn interest on your $USDC.