Solana (SOL), the self-proclaimed “world’s fastest blockchain,” has been grabbing headlines for its blazing transaction speeds and surging token price. But is it all sunshine and rainbows in Solana land, or are there cracks in the seemingly smooth road?

Related Reading

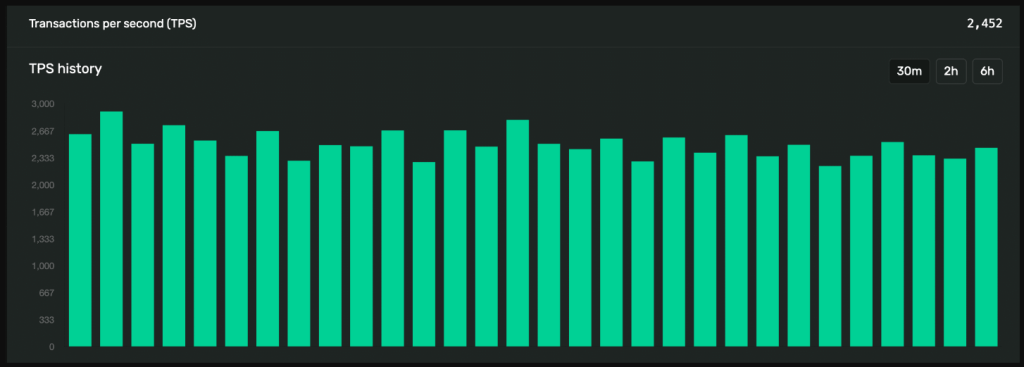

Solana Takes The TPS Crown

According to CoinGecko data, Solana blew past competitors like Polygon and Ethereum in transactions per second (TPS). This translates to faster transaction processing times, a key factor for scalability and mass adoption in the blockchain world.

However, a closer look reveals a more nuanced picture. While daily active addresses, which represent unique users interacting with the network, have indeed increased, the daily transaction count hasn’t kept pace.

This suggests a scenario where more users are entering the Solana ecosystem, but they aren’t necessarily conducting a high volume of transactions. Is this a case of casual crypto tourists dipping their toes in, or is there something else at play?

Fees Take A Tumble, But Is It A Sustainable Slide?

Another interesting wrinkle is the decline in transaction fees on Solana. This might seem like good news for users, but it could be a double-edged sword. Lower fees could indicate that the transactions being processed are less complex and require lower charges.

This could potentially limit Solana’s revenue generation in the long run. Additionally, a drop in fees could signal a decrease in network congestion, which might explain the stagnant daily transaction count.

DeFi Keeps The Party Going, But Caution Flickers

A bright spot for Solana is the continued growth in its Decentralized Finance (DeFi) Total Value Locked (TVL). DeFi refers to a suite of financial services built on blockchains, and TVL represents the total value of crypto assets deposited in DeFi protocols.

Solana’s rising TVL indicates its growing adoption within the DeFi space, where users can lock up their crypto to earn interest or participate in other financial activities. This is a positive sign for the overall health of the Solana ecosystem.

Related Reading

However, a note of caution emerges from technical indicators like the Money Flow Index (MFI). This indicator suggests a potential price correction for SOL, hinting that the current uptrend might not be entirely sustainable.

Combine this with the mixed signals on network activity and the declining fee structure, and investors are left with a question mark hanging over Solana’s long-term prospects.

A Blockchain In High Gear, But the Destination Is Unclear

Solana’s impressive transaction speeds and strong DeFi presence are undeniable strengths. However, the network’s overall activity and tokenomics raise questions about its long-term viability.

Meanwhile, at the time of writing, SOL was trading at $185, up 7.1% and 26.0% in the daily and weekly timeframes, data from Coingecko shows. This price surge, coupled with the network’s breakneck transaction speeds, paints a picture of a project with immense potential.

However, for Solana to truly become a dominant force, it will need to address the questions surrounding its network activity and long-term sustainability, not to mention add more fuel to its price.

Featured image from F1, chart from TradingView