Coinspeaker

BlackRock Records Zero Inflow for First Time Amid $121M Outflows

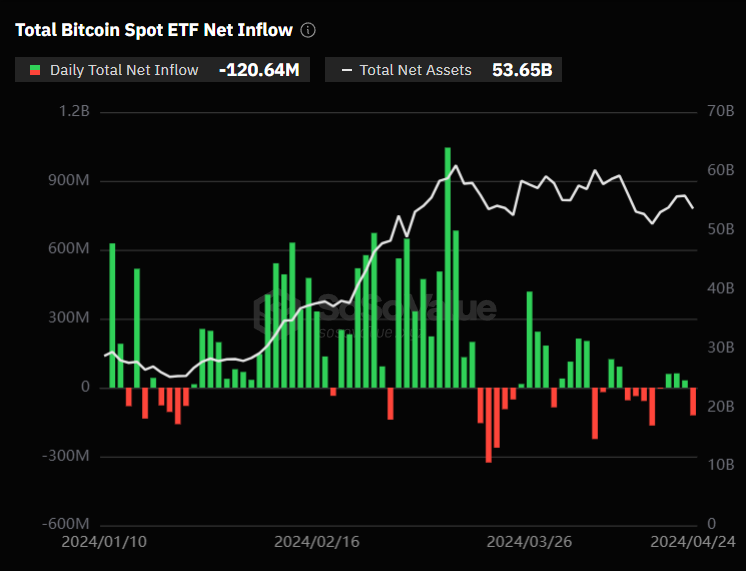

The Bitcoin spot exchange-traded fund (ETF) market witnessed significant outflow on Wednesday, April 24. According to the SoSoValue, the total net outflow reached $121 million, while Grayscale Bitcoin Trust ETF (GBTC) experienced a substantial net outflow of $130 million as usual. This added to GBTC’s historical net outflow, which now totals $16.963 billion.

Photo: SoSoValue

However, Fidelity’s Bitcoin ETF (FBTC) denied this trend and saw an increase of $5.61 million, contributing to its impressive historical total net inflow of $8.186 billion. Ark 21Shares Bitcoin ETF (ARKB) closely followed, with a net inflow of $4.172 million, bringing its historical total net inflow to $2.272 billion.

The data from SoSoValue shows a stark difference between the funds offered by Fidelity and Ark Invest, which collectively attracted around $10 million in inflows and the remaining eight funds on Wednesday. These eight funds, including BlackRock iShares Bitcoin Trust ETF (IBIT) and Bitwise Bitcoin ETF (BITB), did not record any net inflows.

BlackRock Ends Historic 71-Day Inflow Streak

BlackRock’s IBIT’s 71-day streak of positive inflows finally ended on Wednesday. BlackRock has attracted substantial interest since its launch on January 11, consistently drawing in millions of dollars daily, amassing nearly $15.5 billion in inflows. However, April 24 marked the first-day IBIT experienced zero inflows, concluding its remarkable streak of positive trend.

BlackRock Bitcoin ETF’s impressive 71-day inflow streak marks a significant milestone. However, it is still behind popular options like JPMorgan’s Equity Premium Income ETF (JEPI) and Pacer’s US Cash Cows 100 ETF (COWZ) in terms of performance.

However, industry experts caution against overreacting to zero-flow days’ impact. BTC Markets crypto analyst Rachael Lucas explained to The Block that such instances are normal and not a sign of failure. She cited market performance, geopolitical tensions, and factors beyond ETF flows as contributors to these occurrences.

“Days with zero inflows are typical and not indicative of product failure, […] “It also coincides with market performance and geopolitical tensions, highlighting complexities beyond ETF flows,” said Rachael Lucas.

Joe Caselin, institutional marketing lead at the BIT crypto exchange, shared similar views. Despite zero flows potentially signaling waning initial excitement, Caselin stressed Bitcoin ETFs’ long-term promise. He explained that merging traditional finance with crypto takes time, and fresh inflows will likely arise as traditional finance keeps adopting cryptocurrencies.

Morgan Stanley Prepares Brokers for Bitcoin ETFs

Adding a layer of intrigue, a report from AdvisorHub on Thursday suggests Morgan Stanley may allow its 15,000 brokers to recommend spot Bitcoin ETFs to clients. Citing two senior executive sources familiar with the company’s plans, the report indicates Morgan Stanley is preparing for solicited purchases.

These purchases would likely come with stipulations, including requirements for risk tolerance and limitations on allocation and trading frequency. While the timeframe for this policy change remains unclear, it suggests a growing comfort level with Bitcoin ETFs among major financial institutions.

While recent outflows from Bitcoin spot ETFs raise questions, analysts remain optimistic about the long-term prospects. The combined inflows from Fidelity and Ark Invest’s ETFs demonstrate continued investor interest and the potential entry of a major player like Morgan Stanley could provide a significant boost. As the crypto market navigates external factors and traditional finance embraces this new asset class, the future of Bitcoin spot ETFs appears full of potential.

BlackRock Records Zero Inflow for First Time Amid $121M Outflows