Bitcoin (BTC) never saw a bear market in 2019 — and the evidence is easy to find on the blockchain, according to some prominent figures.

Data covering various metrics shows that despite recent price volatility, Bitcoin has held strong throughout its eleventh anniversary year.

Investors echo that resolve — as the numbers confirm, so-called “hodlers” are more attached to their stash than ever before.

One BTC price is in a perpetual bull market

BTC/USD has dipped significantly several times since September. The pair’s rapid rise and fall triggered predictable warnings from critics and concerns from traders.

Zoom out, however, and the picture changes completely. As noted by PlanB, creator of the Bitcoin price forecasting tool Stock-to-Flow, Bitcoin’s 200-week moving average (200WMA) has never gone down.

Uploading a chart to Twitter on Dec. 28, the analyst revealed that short-term price action has failed to turn the 200WMA negative at any point in Bitcoin’s existence. Current growth is 3% per month, or around $150, he added.

Bitcoin price versus Bitcoin price 200WMA. Source: PlanB, Twitter

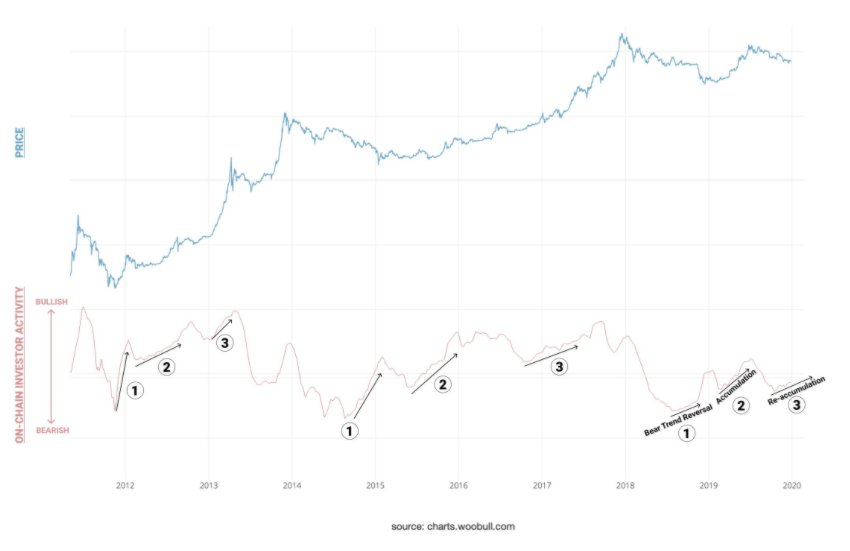

Market displaying “bullish reaccumulation”

Bitcoin’s recent trip to $6,400 has also failed to convince statistician Willy Woo that conditions are worse than they should be.

In a tweet on Saturday, Woo likewise took recent events within the context of Bitcoin’s entire history. According to him, that places price movements now in an accumulation bracket, and not a bear market. He summarized:

“Are we in a $BTC bear market? No, we are in the re-accumulation phase of a bull market.”

Bitcoin investor activity in various price phases. Source: Willy Woo, Woobull.com, Twitter

Woo also shed light on Bitcoin’s December 2018 lows of $3,100. That phase, which some have since compared to this month, was the result of “inorganic” behavior:

“In 2018 $6k was held with buy walls inorganically, smart money exited, the walls were let go and we overshot to the low side.”

Hodlers are hodling longer

As CryptoX previously reported, trends in investor behavior began changing even before Bitcoin’s April 2019 bull run took hold. Despite a run-up from $3,100 to almost $14,000, very little of the available BTC supply actually left the wallet it was in over that period.

As entrepreneur Alistair Milne noted over the weekend, 70% of the supply has remained static over the past six months.

The behavior, he says, mimics that leading up to Bitcoin’s previous block reward halving in 2016. Then, as with the next halving in May 2020, the event was considered a potential catalyst for Bitcoin price.

The impact of the halving was felt only a year later, however, and opinions are mixed as to its potential market moving power this time around.

Last week, CryptoX reported on other metrics pointing to its increasing underlying strength.