Coinspeaker

Bitcoin Stares at Death Cross Eyeing Sub $50K Levels, Funding Rate Flashes Warning

Following the release of the US CPI inflation data, Bitcoin (BTC) price has come under some selling pressure tanking all the way under $57,000 earlier today. However, it has bounced back to the $58,000 level today as of press time.

This price volatility has led to strong liquidations in the market with the BTC long and short liquidations standing at $76.06 million. On the four-hour timeframe, Material Indicators has flagged a death cross pattern appearing on the Bitcoin chart, an event that could help the market establish long-term support. “The good news is, one way or another this has the potential to help the market validate a bottom for Bitcoin…or possibly create a new one,” it noted.

Besides, other market analysts are saying that there’s the potential for much correction from the current levels and falling all the way to $45,000 before it resumes the uptrend. This would take the market to a six-month low and to a rising trendline at around $45,000.

Photo: Keith Allan

Bitcoin Funding Rate Flashes Warning Signs

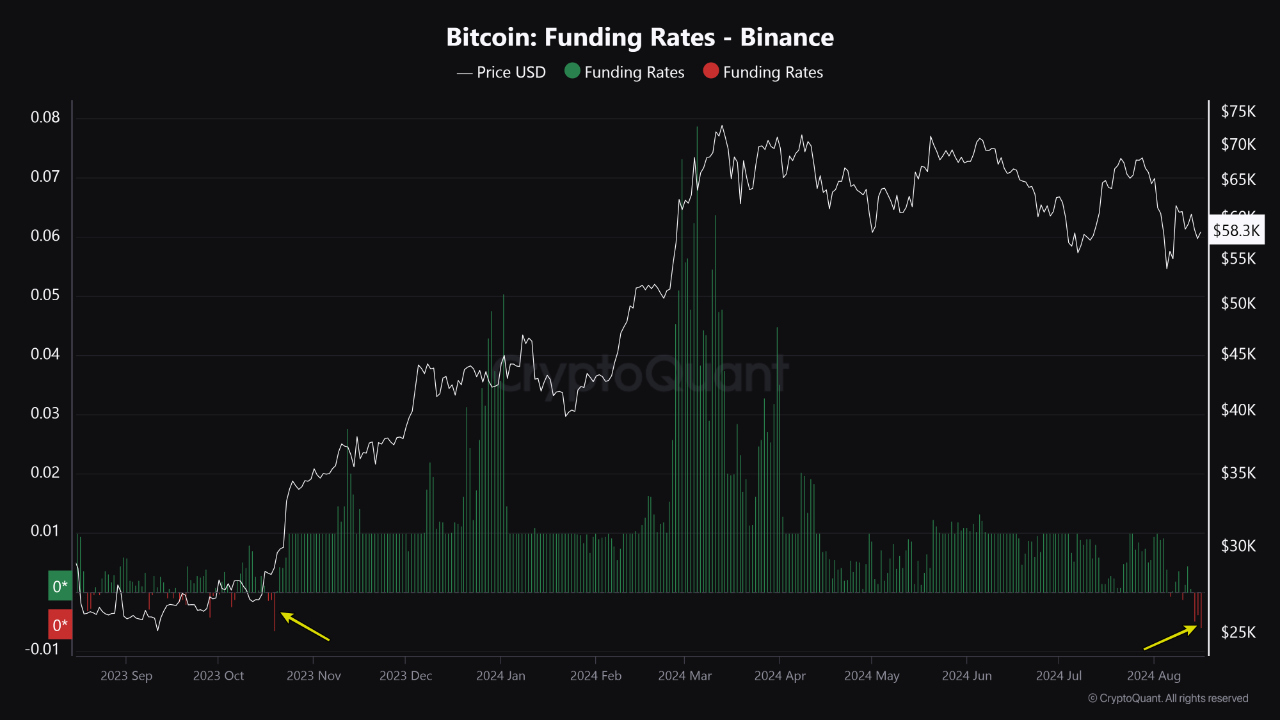

One major on-chain indicator to watch is the Bitcoin funding rate which has turned negative for the third consecutive day at levels not seen since October 2023. In its recent post, CryptoQuant noted:

“The average Bitcoin funding rate indicator that counts the funding rates on all exchanges is now also negative. This means that short positions are now dominating the perpetual market. Taking this into consideration, and as Binance has the largest share of open interest (OI), this could indicate a bearish market sentiment for the short term.”

Photo: CryptoQuant

Liquidation platform Coinglass also reported that the open interest (OI) for the Bitcoin futures has reached $29 billion as of August 16, and has been rising throughout the week. On the other hand, the spot BTC price has plummeted 5% over the last two days. Open Interest suggests the total number of Bitcoin futures that have yet to settle or expire.

Photo: Coinglass

The rising Open Interest shows huge leverage in the market that can amplify movements in either direction. “An increase in open interest means that both long and short positions are increasing,” said the firm.

Bitcoin Stares at Death Cross Eyeing Sub $50K Levels, Funding Rate Flashes Warning