Key takeaways:

-

Bitcoin spot demand has flipped positive, signaling a potential bullish reversal.

-

Increasing spot volume suggests higher speculative activity.

-

BTC price must reclaim $110,000 as support to secure the recovery.

Demand for Bitcoin (BTC) has shown signs of recovery in November, signaling a possible bullish reversal. However, traders say momentum will increase once the BTC/USD pair breaks above $110,000.

Bitcoin apparent demand hits a four-month high

Bitcoin’s apparent demand has shifted to a positive outlook after rising to its highest level since July, as traders and investors adopt a risk-on approach due to improving macroeconomic conditions.

Capriole Investment’s Bitcoin Apparent Demand metric is a commodity metric that gauges demand, measuring production (mining issuance) minus inventory (supply inactive for over 1 year).

This demand has increased sharply to 5,251 BTC on Nov. 11, levels last seen on July 31.

Related: Bitcoin’s next move could shock traders if BTC price breaks above $112K

Bitcoin’s apparent demand has been negative since Oct. 8, bottoming around -3,930 BTC on Oct. 21, before reversing sharply as shown in the chart below.

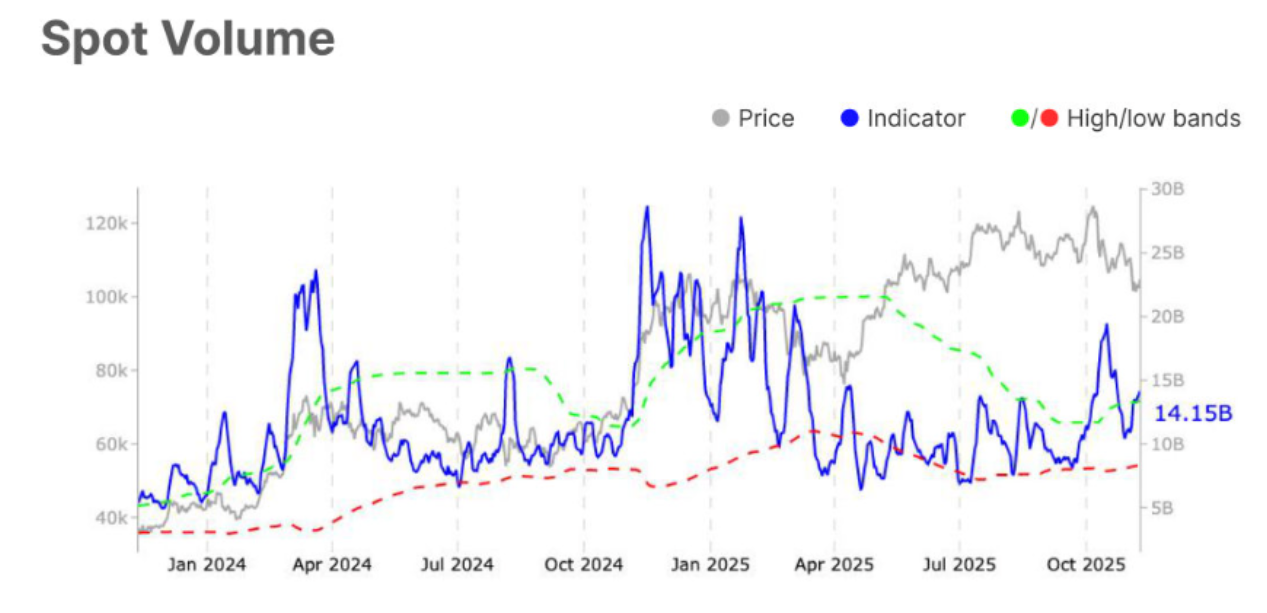

Meanwhile, spot trading volume has increased by 23% to $14.1 billion from $11.5 billion over the last week, suggesting increased speculative activity.

The increase suggests that Bitcoin’s recent recovery to $106,000 was “an early sign of buyer re-engagement,” Glassnode wrote in its latest Weekly Market Impulse report, adding:

“The rise in spot volume suggests stronger investor participation and a potential for a breakout move.”

Optimism around the end of the US government shutdown and Trump’s promise of $2,000 tariff dividend payments, coupled with the Fed’s expected December rate cut and upcoming quantitative easing, are causing investors to scale back into risk assets.

Bitcoin price must reclaim $110,000

Bitcoin’s bullish weekly close above the 50-week simple moving average has convinced traders of its ability to move higher from current levels.

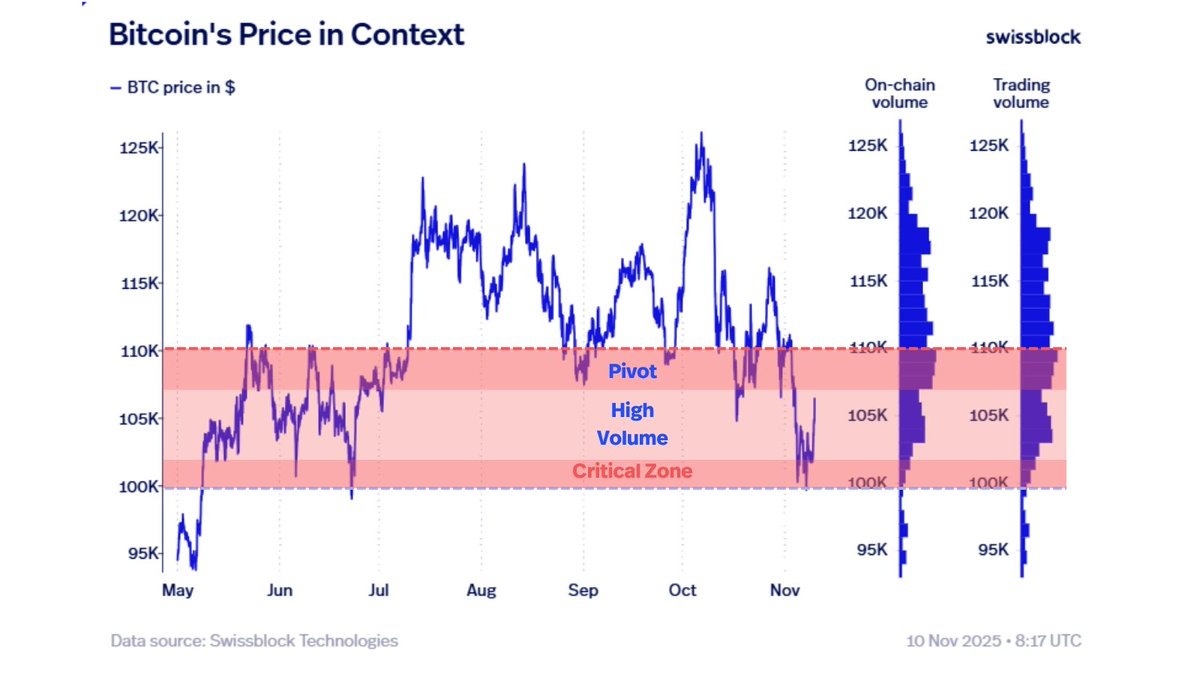

Bitcoin’s bullish case now hinges on bulls reclaiming $110,000 as support, according to Swissblock.

“After defending the critical zone, BTC’s next move is all about consolidation and confirmation,” the private wealth manager said in a Monday X post.

Swissblock explained that since the price is still holding the macro structure, momentum will start igniting once bulls “reclaim $108K–$110K pivot zone,” adding:

“Selling pressure is easing, and $BTC is giving early signals of a bullish reversal.”

MN Capital founder Michael van de Poppe said Bitcoin will likely rally toward its all-time high of $126,000 if it breaks through $110,000.

Crucial resistance coming up for #Bitcoin.

The government shutdown is nearly over, which would be an ideal signal for the markets to turn back into bull mode.

To be honest, if $BTC breaks through $110K, we’ll likely see a rally towards the ATH.

I do expect #Altcoins to… pic.twitter.com/5j0UEAkq3S

— Michaël van de Poppe (@CryptoMichNL) November 10, 2025

Fellow analyst Jelle said reclaiming the $110,000 support level is “very important as rejecting here would be a clear sign of further weakness in the market.”

As Cryptox reported, Bitcoin’s double bottom pattern may boost bullish momentum toward $110,000, but the BTC/USD pair could first see a short-term retracement to fill the CME gap near $104,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.