Key points:

-

Bitcoin is witnessing a tussle between buy and sell volume as BTC/USD hits its highest levels since the start of March.

-

BTC price action is making traders increasingly wary due to the pace of recent gains.

-

$100,000 is likely to remain out of reach for the short term, multiple commentators say.

Bitcoin (BTC) headed into key resistance after the April 25 Wall Street open as doubts over the BTC price breakout persisted.

Bitcoin sellers and buyers battle for control

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting new seven-week highs above $95,000.

Having preserved its yearly open at $93,500 as intraday support, Bitcoin went on to liquidate leveraged shorts as $100,000 came closer.

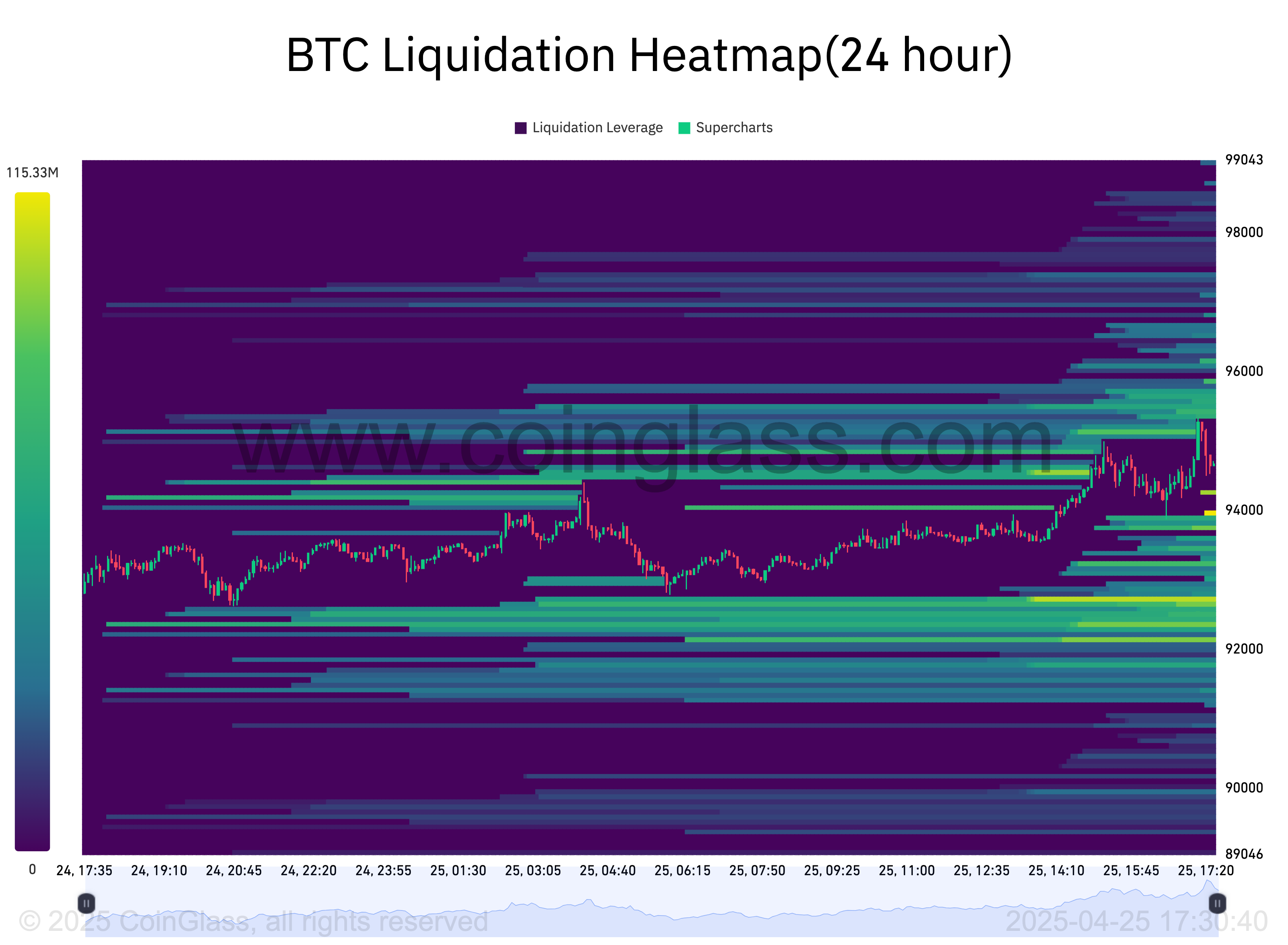

The latest data from monitoring resource CoinGlass shows progress in taking upside liquidity across exchange order books.

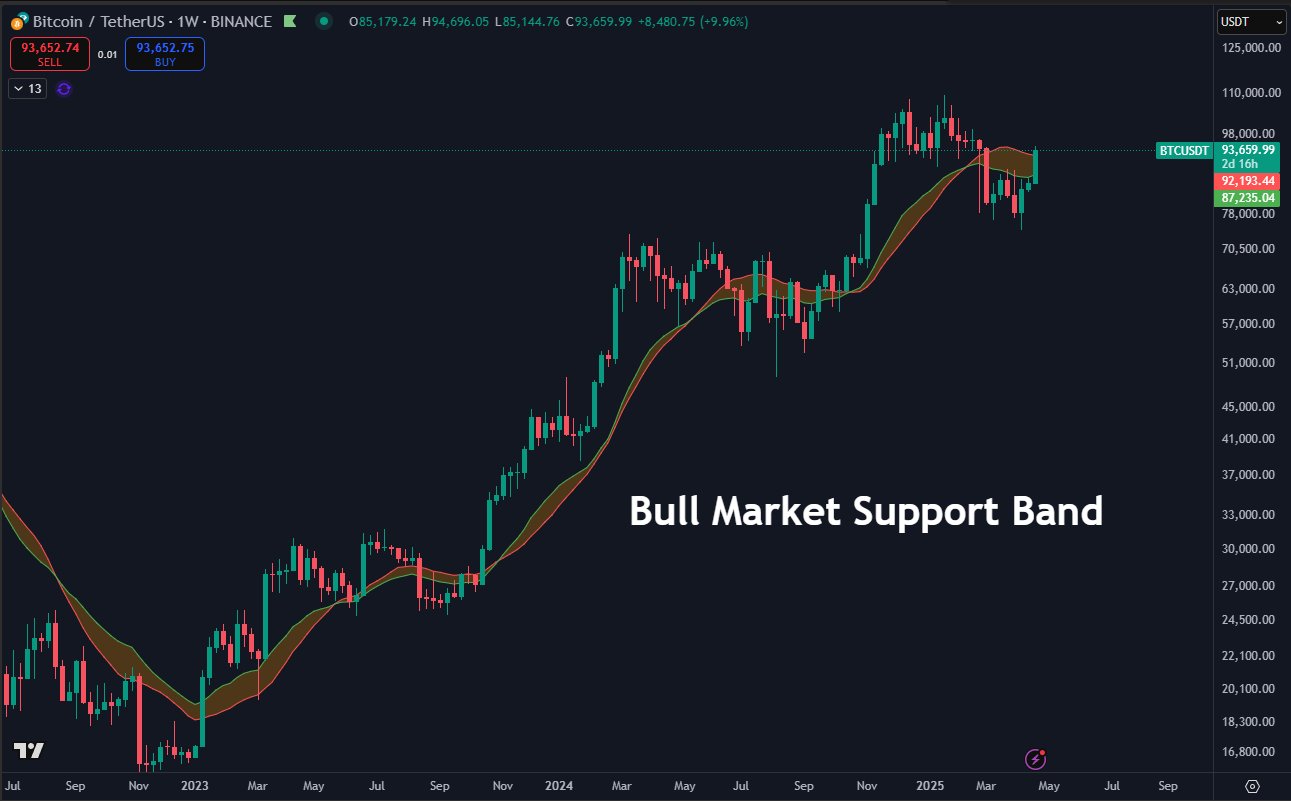

Reacting, popular trader Daan Crypto Trades underscored the importance of the current price range in the context of the Bitcoin bull market.

“Trading back above the Bull Market Support band as we speak,” he wrote in an X post, referring to a cluster of moving averages lost as support earlier in 2025.

“A weekly close above this level would be a good look for the larger timeframe and I’d expect new highs at some point as long as it holds above.”

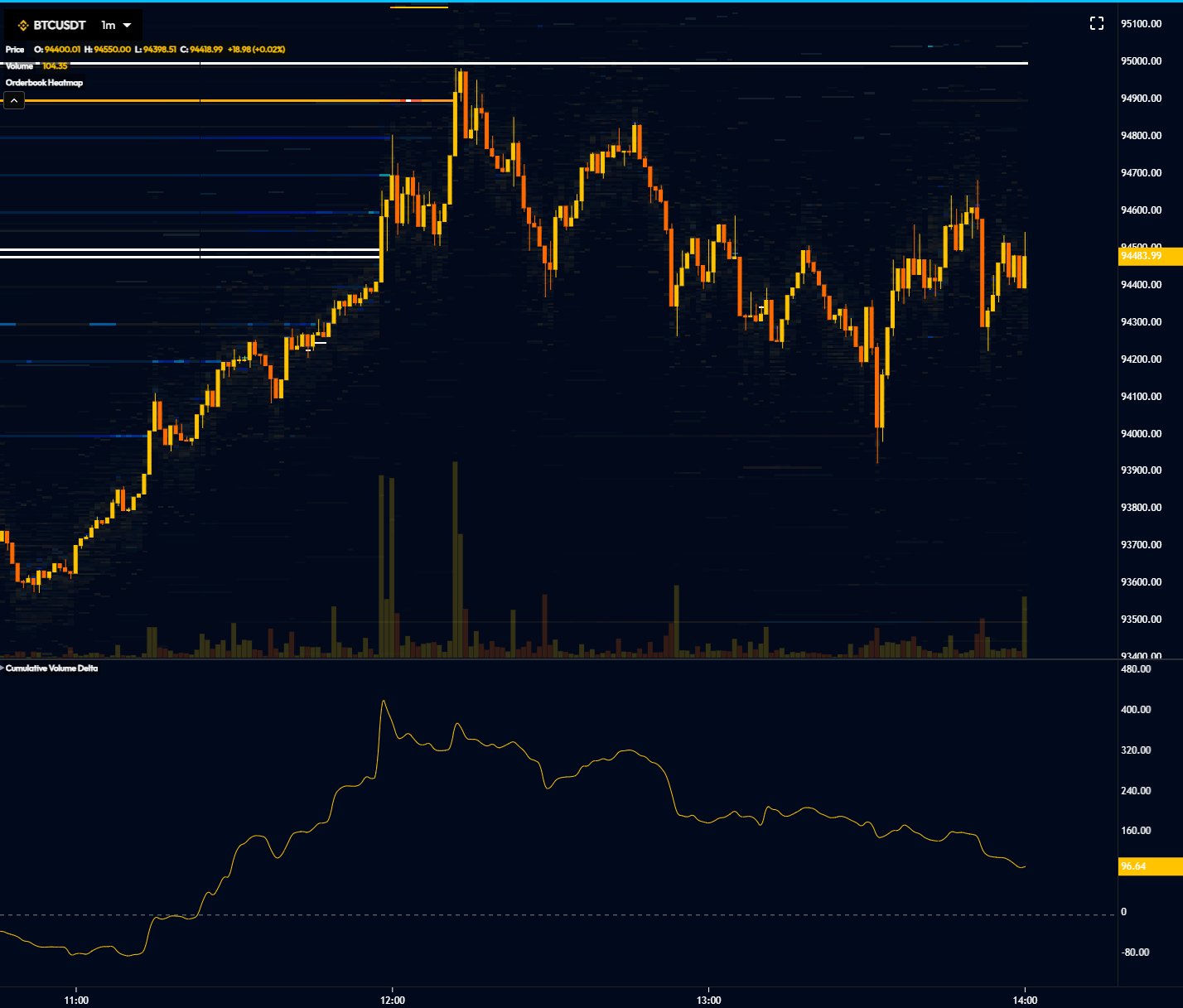

Others were cautious, with fellow trader Skew revealing a tug-of-war between a large-volume buyer and seller.

“Price would be a lot lower than it is now without the passive buyer matching this market selling,” he warned alongside an order book print.

“Eventually one will throw in the towel & volatility will follow through.”

Waiting on a $100,000 BTC price “catalyst”

Continuing, Keith Alan, cofounder of trading resource Material Indicators, likewise doubted whether BTC/USD could sustain a trip above $95,000.

Related: Bitcoin exchange outflows mimic 2023 as whales buy retail ‘panic’

Alan noted declining volume as price moved higher, repeated wicks below the yearly open and a “down” signal on one of Material Indicators’ proprietary trading tools.

“For me, a pump above $95k would invalidate the new signal, but I’d probably consider such a move to be a short squeeze unless we have a catalyst with some substance behind it,” he summarized.

Macroeconomic perspectives also favored a period of consolidation before BTC/USD returned to six figures.

In its latest bulletin to Telegram channel subscribers, trading firm QCP Capital argued that Bitcoin lacked a $100,000 “catalyst.”

“Given the pace of the recent rally, we remain tactically cautious,” it wrote.

“Positioning has become more crowded, which could lead to sharper reactions around key levels. Market participants appear to be watching closely for signs of continuation or exhaustion.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.