Bullish bitcoin (BTC) options strategies are becoming popular again, stabilizing a crucial sentiment indicator that indicated panic early last week.

BTC has bounced to over $84,000 since probing lows under $75,000 last week. The recovery comes as the bond market chaos supposedly forced President Donald Trump to capitulate on tariffs just days after announcing sweeping import levies on several nations, including China.

Late Friday, The Trump administration issued new guidelines, sparing key tech products like smartphones from his 125% China tariff and baseline 10% global levy. Hours later, Trump refuted the news, suggesting no relief on tariffs.

Still, the price recovery saw emboldened traders chase upside in BTC through the Deribit-listed call options. A call gives the purchaser the right but not the obligation to buy the underlying asset at a predetermined price on or before a specific date. A call buyer is implicitly bullish on the market, looking to profit from an expected price rise. A put buyer is said to be bearish, looking to hedge or profit from price swoons.

“Trump’s bond-market-crisis fueled tariff-walkback flipped the vocal narrative from aggression to capitulation, and the markets from capitulation to aggressive bounce. Protective/Bear play BTC $75K-$78K [strike] Puts were dumped, and $85K-$100K [strike] Calls were lifted as BTC surged from $75K-$85K,” Deribit said in a market update.

The pivot to upside calls has normalized the options skew, which reflected strong put bias or downside fears early last week, according to data tracked by Amberdata. The skew measures the implied volatility (demand) for calls relative to puts and has been a reliable market sentiment indicator for years.

The 30-, 60-, and 90-day skews have rebounded to just above zero, up from deeply negative levels a week ago, indicating a decrease in market panic and a resurgence of upside interest. Although the seven-day gauge remains negative, it reflects a notably weaker put bias than a week ago when it dropped to -14%.

$100K is the most popular bet

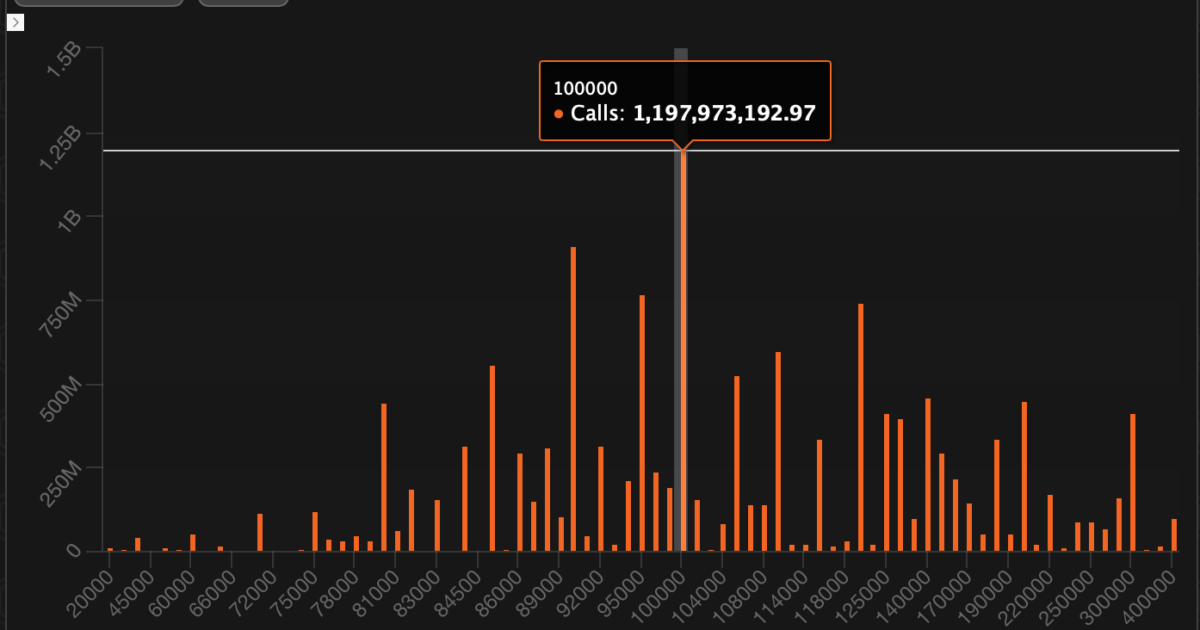

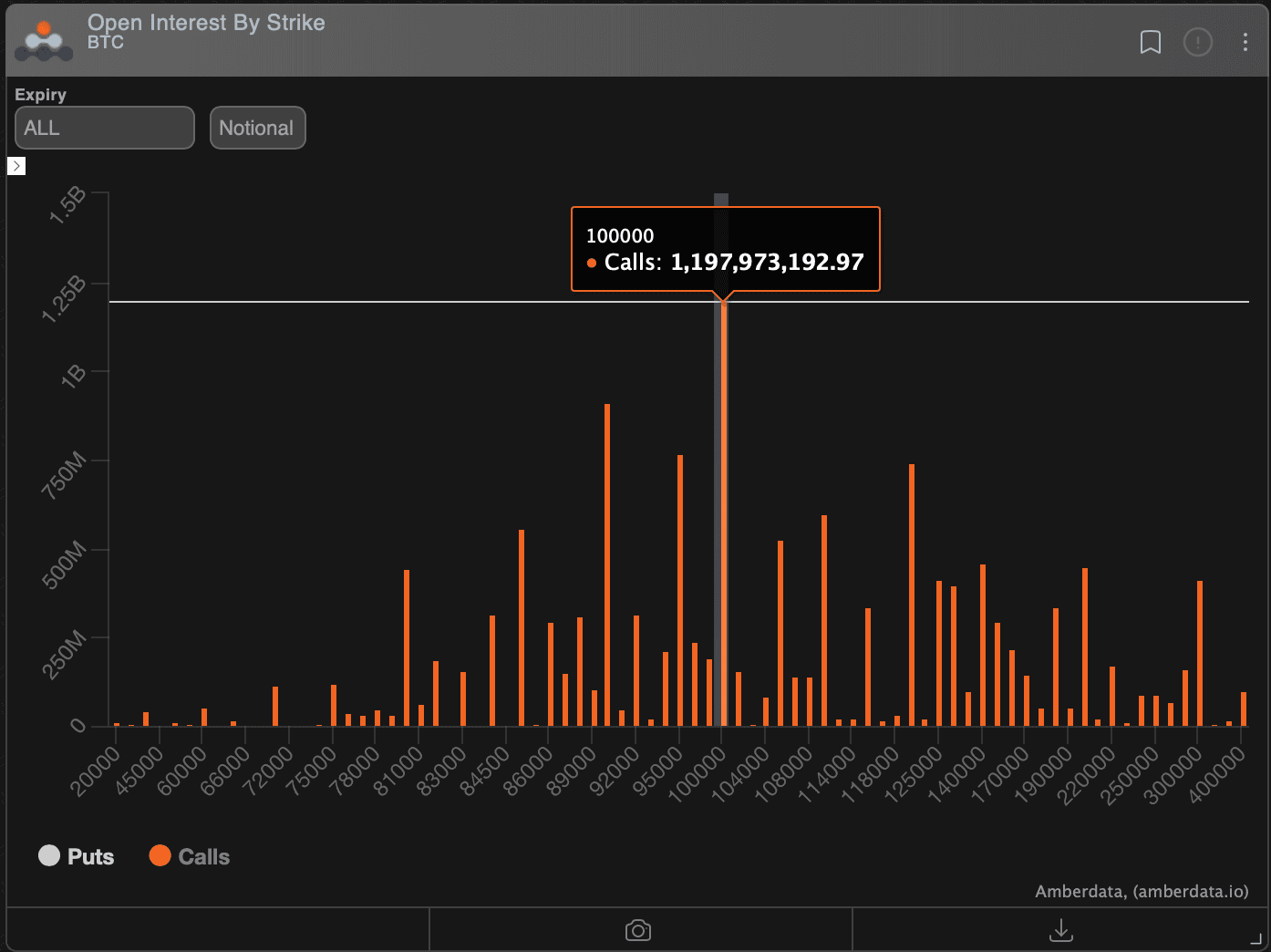

Another data point likely to energize the recently battered market participants is the distribution of open interest, highlighting the resurgence of the $100K call as the most favored options bet on Deribit, which accounts for over 75% of global options activity.

As of writing, the $100K call boasted a cumulative notional open interest of nearly $1.2 billion. The notional figure represents the U.S. dollar value of the number of active option contracts at a given time. Calls at $100K and $120K were popular early this year before the market swoon saw traders deploy money in the $80K put last month.

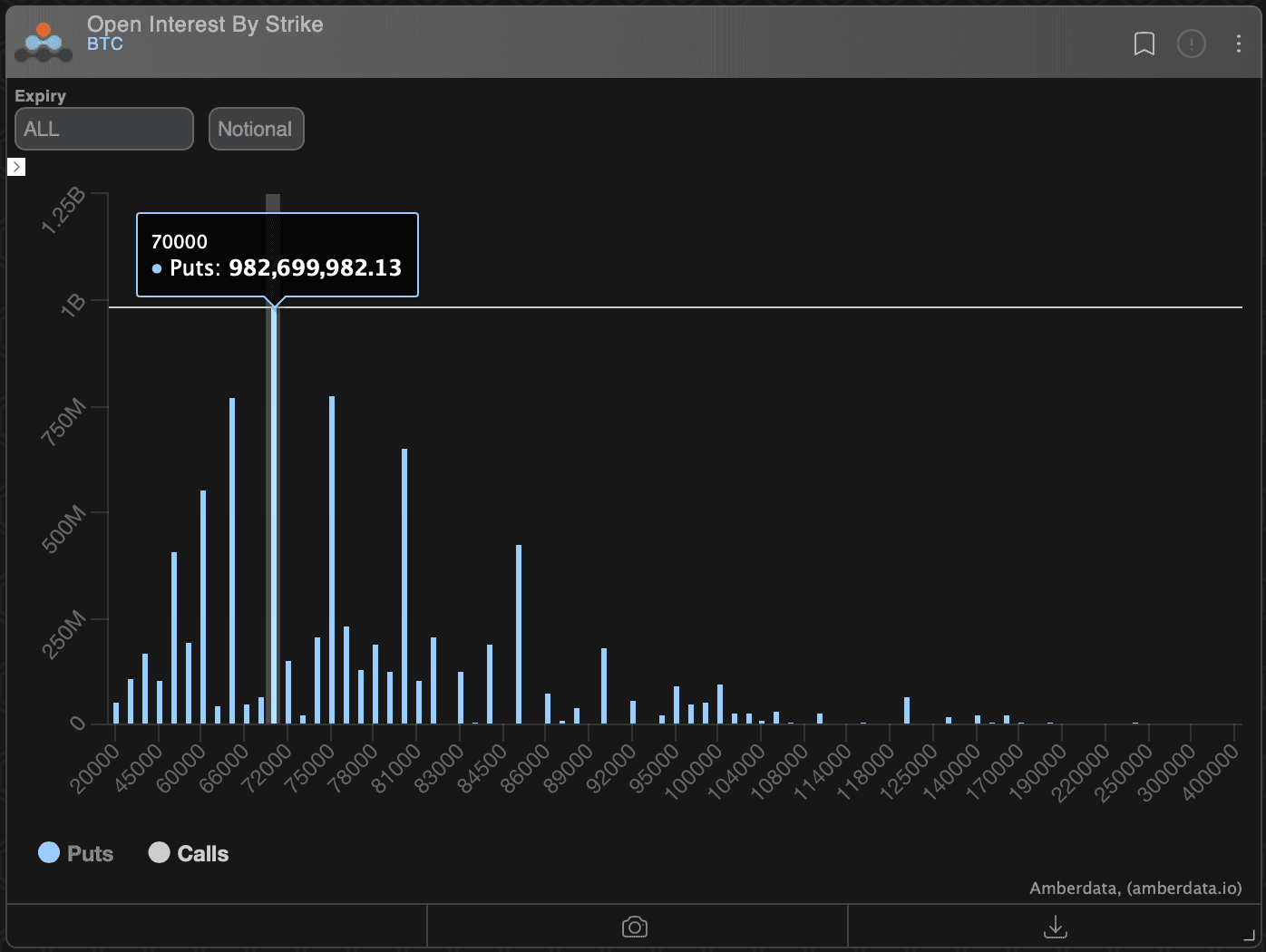

The chart shows the concentration of open interest in calls at strikes ranging from $95,000 to $120,000. Meanwhile, the $70K put is the second-most popular play with an open interest of $982 million.