Shares of Canaan Creative, one of the few publicly traded crypto miner manufacturers, plummeted below $2, their lowest after going public in November.

The Nasdaq-listed stock has been steadily falling since the bitcoin halving on May 11, according to data from Yahoo Finance. It closed at $1.98 at the end of the trading session Monday, down 3.88%.

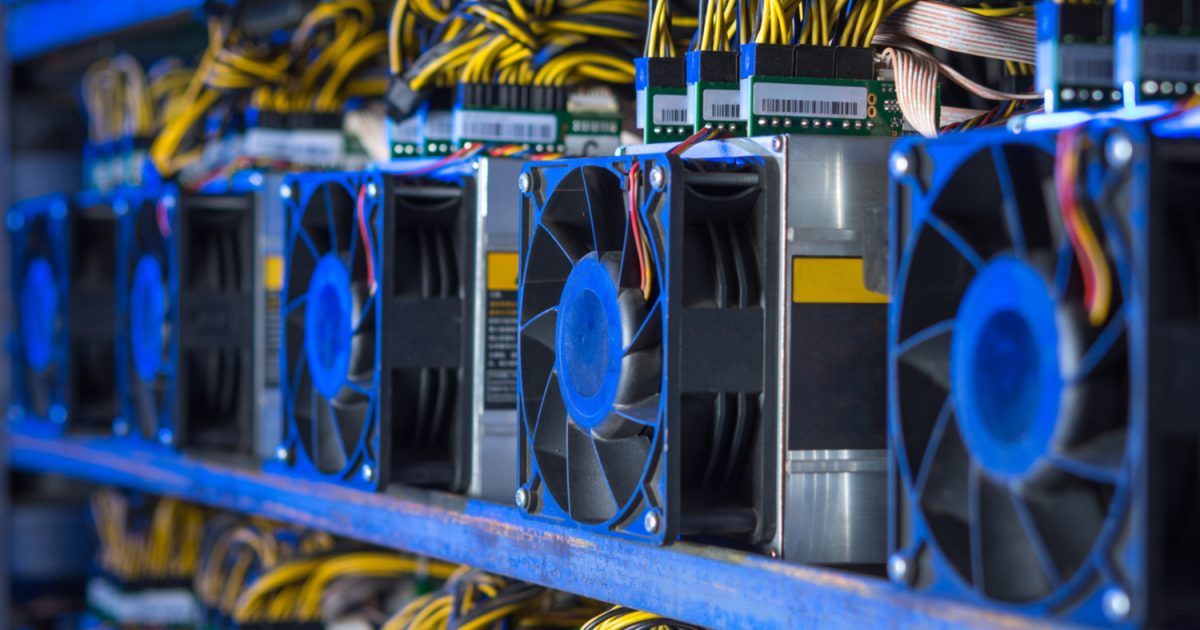

The China-based crypto miner maker is trying to make a comeback after the halving damped demand for its machines and logistics disruptions caused by coronavirus hurt first-quarter sales.

Demand for crypto mining machines from some Chinese miners may have begun to soften a few months before the halving in May, Aries Wang, co-founder of crypto exchange Bibox, said.

“Some of the earliest Chinese miners started to raise funding from institutional investors and buy new models and phase out old machines so that they would be prepared for the halving last July,” said Wang, whose company has invested in crypto mining businesses. “Many had already completed the update on infrastructure such as mining sites and miners before the end of February.”

Canaan tried to spur sales by cutting the price for its mining hardware sold in the first quarter by more than half compared to the average price in 2019. However, it still suffered a $5.6 million net loss for the period, according to its latest quarterly report.

Q1 sales were also affected by the coronavirus outbreak in China, according to the report. Logistics in mainland China had stopped around the Chinese new year on Feb 10. The firm couldn’t deliver machines to customers even if there were higher demand due to the bitcoin price rallies at the time, Nangeng Zhang, CEO and chairman of Canaan, said on its first-quarter earnings call.

The firm enjoyed a rebound in April after China declared it had contained the spread of coronavirus and freed up the domestic logistics. Its stock price reached $5.99 per share on May 13, two days after the halving, and has tumbled since then.

The halving, a preprogrammed event that cuts a mining machine’s production by half every four years, was considered a bullish development for miner makers before it happened. However, demand for newer machines weakened as many mining firms had already replaced most of their old models with newer ones in anticipation of the more competitive post-halving environment.

The Chinese crypto miner manufacturer’s Nov. 20 initial public offering (IPO) priced the stock $9 per share, but the price was nearly cut in half one month later. It was briefly back above $8 on Feb. 12 after a surge of more than 80% from $4.40 from the previous day. The price started to fall again as China rolled out coronavirus quarantine measures.

Canaan’s cash and cash equivalents on hand decreased by 47.9% for the first quarter, down from $71 million as of the end of last year. The firm said the drop was partly due to $24.5 million in short-term investments including its partnership with Semiconductor Manufacturing International Corporation (SMIC), one of the largest computer chip makers from mainland China.

The leader in blockchain news, CryptoX is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CryptoX is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.