Data shows the Bitcoin market sentiment has taken to extreme fear again as the asset’s price has seen a retrace to the $59,000 mark.

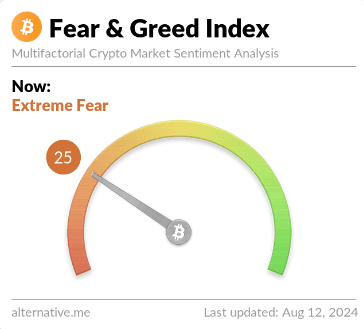

Bitcoin Fear & Greed Index Suggests Market Now Extremely Fearful

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment that’s currently present in the Bitcoin and wider cryptocurrency markets.

The index uses the following five factors to determine the sentiment: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends. It then represents this estimation using a scale that runs from 0-100

Related Reading

All values of the indicator beyond the 53 mark imply that investors are showing greed, while those below 47 suggest the presence of fear in the market. The region between these two cutoffs naturally corresponds to a neutral mentality.

Besides these three territories, there are also two special sentiments called the extreme fear and the extreme greed. The former of these occurs at 25 and below, while the latter at 75 and above.

Now, here is what the latest value of the Bitcoin Fear & Greed Index looks like:

As is visible above, the indicator has a value of 25 at the moment, meaning that the market is just inside the extreme fear zone. This is a pretty significant change from how the metric was just yesterday.

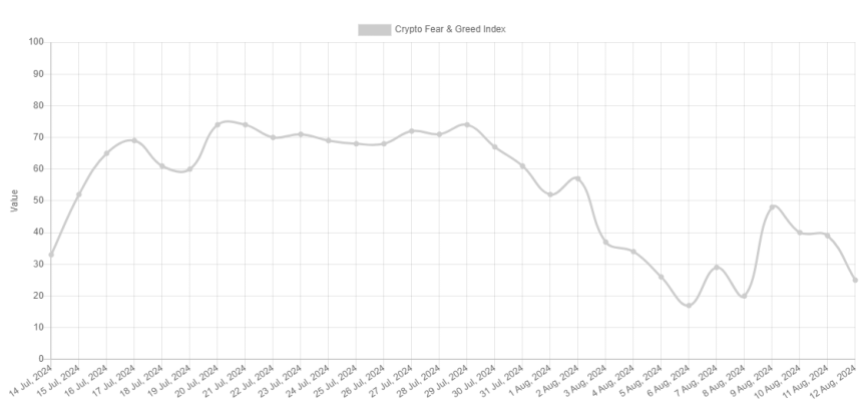

The below chart shows the trend in the Bitcoin Fear & Greed Index over the past month.

From the graph, it’s apparent that the Fear & Greed Index had been at a high level near the end of July, but during the bearish momentum that had followed in the BTC price, the metric’s value had also gone through a notable drop.

On the 29th, the index was at a value of 74, meaning it was right on the edge of extreme greed, but by the 6th of this month, it had gone into the extreme fear zone with a value of 17.

The asset’s recent recovery did lead to an improvement to the sentiment, with the index traveling back up to 48. It would appear, though, that this growth couldn’t last, as the sentiment has again declined into extreme fear, as the BTC price has seen a retrace.

Related Reading

The fact that the sentiment has worsened, however, may not actually be a bad sign for the cryptocurrency. Historically, Bitcoin has tended to move against the expectations of the majority, and the extreme regions are where this expectation is perhaps the strongest.

As such, tops and bottoms have tended to form whenever the market has been inside these zones. With the Fear & Greed Index now back inside extreme fear, It’s possible that a bottom could be likely to take place. It now remains to be seen if the asset’s decline ends with this drop, or if there is more to come.

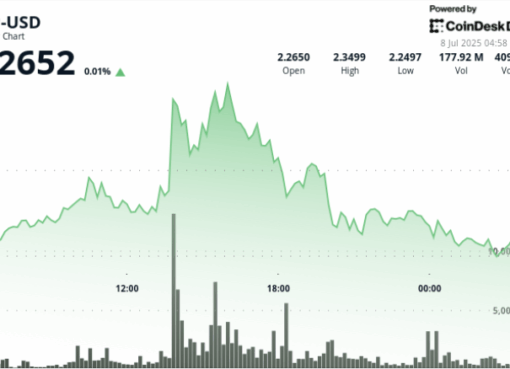

BTC Price

Bitcoin appears to already be showing signs of a rebound as its price has climbed back up to $59,700 from its low of under $58,000 earlier in the day.

Featured image from Dall-E, Alternative.me, chart from TradingView.com